If you’ve missed the DeFi Summer of 2020, you may be wondering what all the fuss is about Aave and why it became one of the biggest protocols.

In this article, we'll introduce you to Aave and its aTokens, the interest-bearing tokens. We'll show you how to lend and borrow, explaining what terms like LTV and the health factor mean. So, read on for a crash course on Aave!

What is AAVE?

Founded by Stani Kulechov, Aave is a decentralized non-custodial liquidity protocol where anybody can lend crypto assets and take out loans. The protocol is governed by holders of AAVE tokens, i.e. the community.

Put simply, Aave is like a bank but without the middlemen. Instead, the protocol's smart contracts match lenders and borrowers.

When you deposit funds into Aave, you become a lender. Borrowers can take out loans as long as they have enough collateral.

Aave lending

Here’s how to lend on Aave:

- Connect your non-custodial wallet like Zerion Wallet

- Select the pool into which you want to supply the cryptocurrency

- Sign a transaction, approving your asset to be used by Aave (pay the gas fees)

- Sign a transaction to have your cryptocurrency transferred into the pool (more gas fees)

- That’s it! You’ll see your dashboard updated and you’ll earn interest

The interest rate (APY) depends on supply and demand. The rate you see will likely change.

As a lender, you get interest payments through aTokens, the Aave interest-bearing tokens that grow in your account.

aTokens: Aave tokens with interest payments

When you put some token into an Aave pool, its smart contract mints you aTokens at the 1-to-1 rate.

aTokens represent your deposit. Like other ERC-20s, they are tradeable and transferable. The aToken balance increases with every block — that’s how aToken holders earn interest. You can get back the principal and interest by claiming the tokens from Aave or selling the aTokens.

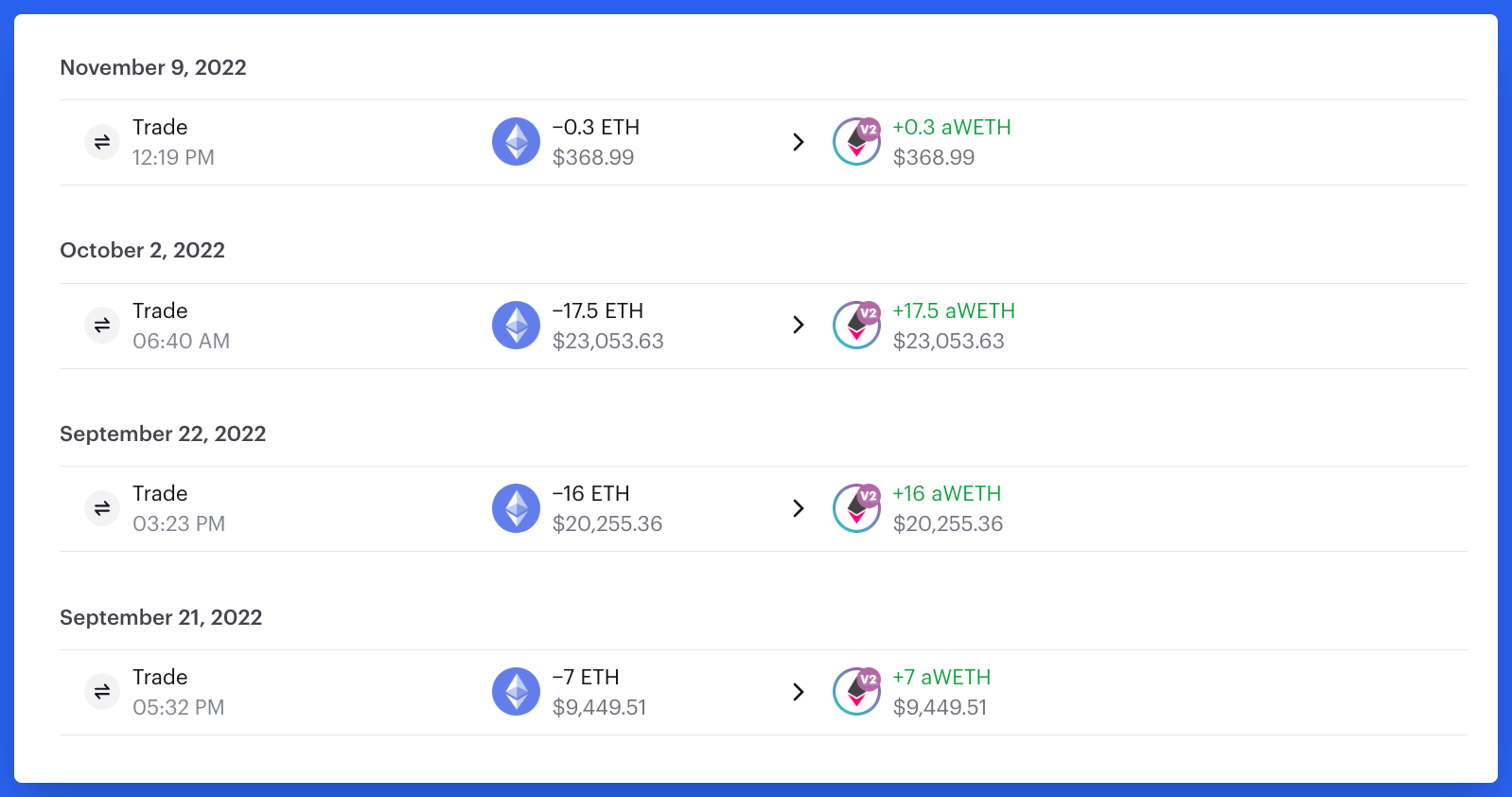

Here’s how it looks in an actual address. In transaction history on Zerion, you can see that they deposited 7 + 16 + 17.5 + 0.3 = 40.8 WETH, getting the same amount of aWETH or Aave interest-bearing WETH.

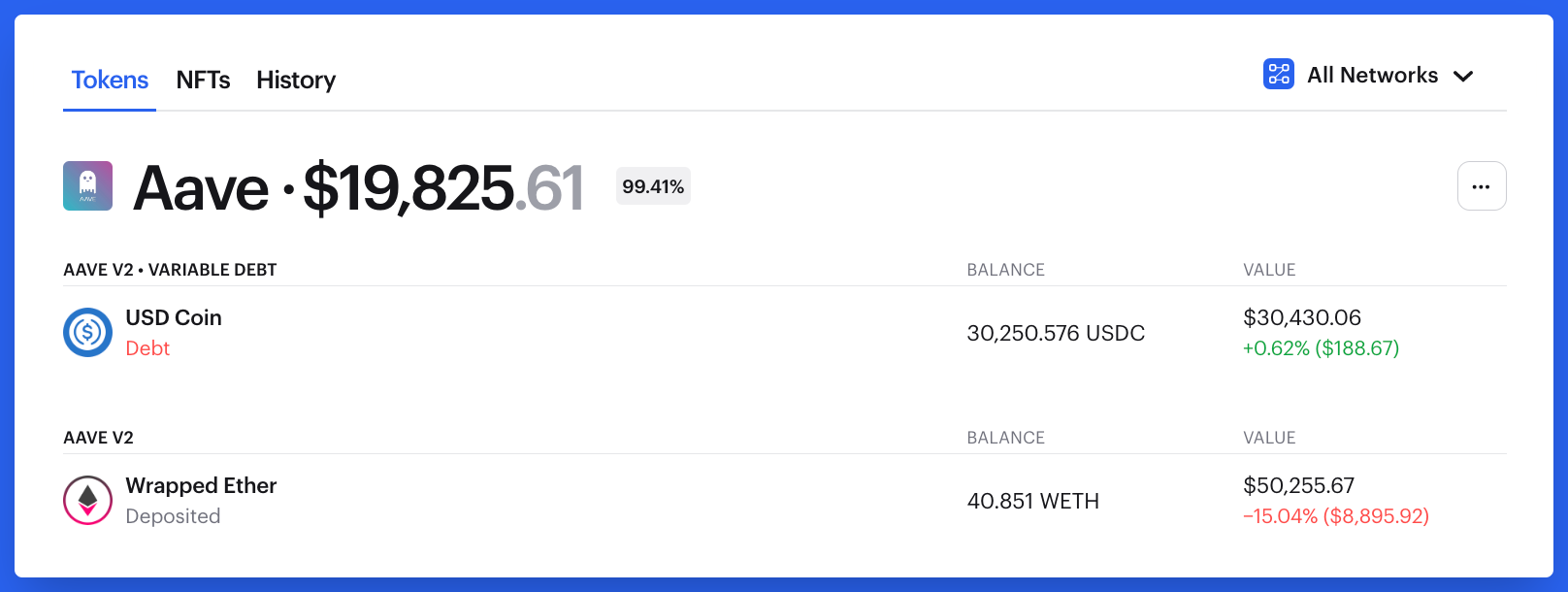

As of November 9, Aave deposit balance was 40.817 WETH. That 0.017 WETH is the interest. Some wallets display these along with other ERC-20 tokens but Zerion shows them as ‘deposited’ tokens. Because that’s what they are!

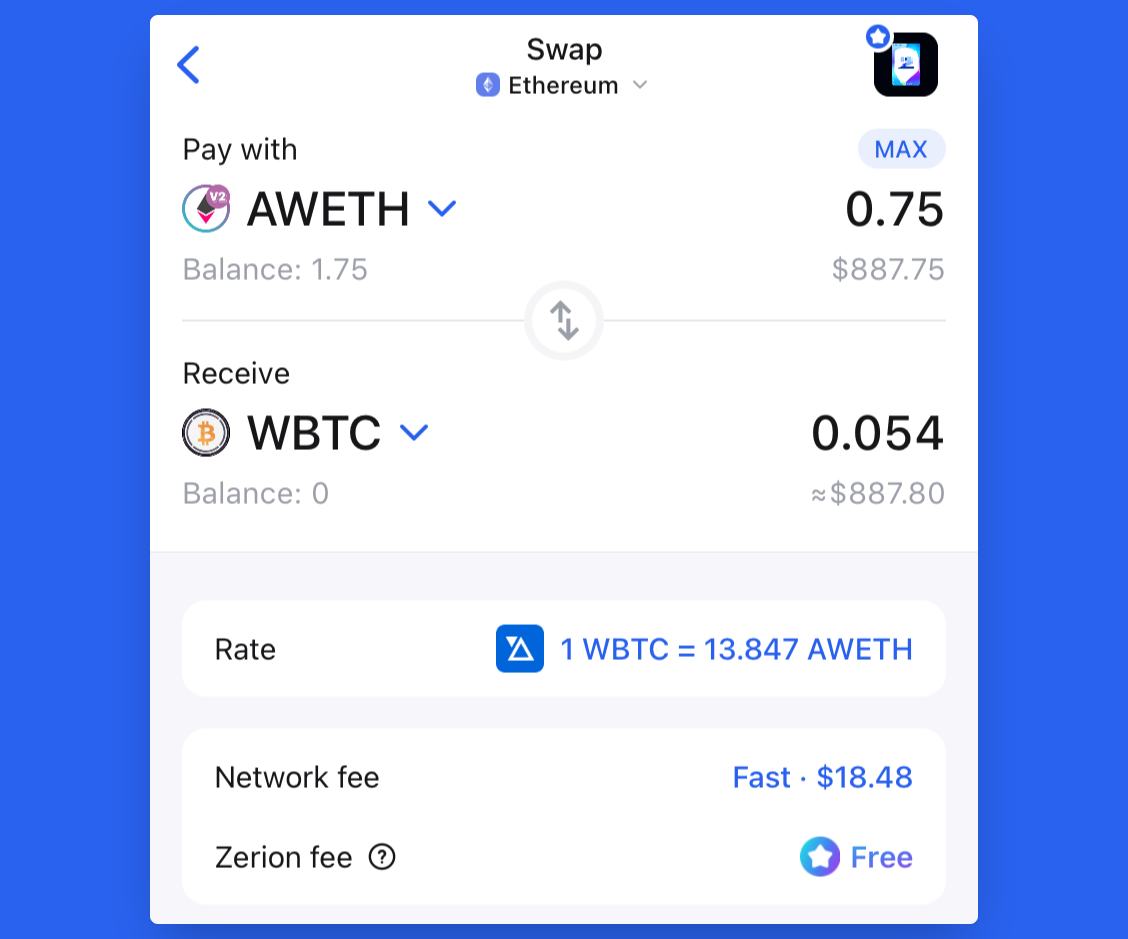

With Zerion Wallet, you can swap Aave interest-bearing tokens just like any other ERC-20 token.

This is useful if you want to not only withdraw from Aave but also want to trade those tokens. Instead of two transactions (e.g. withdraw from Aave and swap on a DEX) you do everything in the same transaction (a Zerion swap).

With Zerion, you can swap Aave interest-bearing WETH right into WBTC at the best rate:

Swapping Aave interest-bearing tokens with Zerion can also help you save on gas fees. Just withdrawing from Aave would cost more gas. And then you still need to swap on a DEX.

You can save even more on gas if you buy interest-bearing liquid staked tokens like stETH. Instead of first staking with Lido and then depositing the token to Aave, you can just buy the interest-bearing token in one transaction.

Another way to save on gas fees with Aave is to go beyond Ethereum and use it on other Layer-1 or Layer-2 networks. It’s helpful to understand more about different versions of the Aave protocol.

Aave Version 2 vs Version 3

Aave users can select between two versions of the Aave protocol: Version 2 and Version 3

Aave V2

Launched on the Ethereum mainnet in December 2020, Aave V2 is the legacy version.

Version 2 introduced tokenization of deposited funds with aTokens as well as loans with Debt Tokens. That unlocked the true power of decentralized finance: you can use tokens from one DeFi protocol in other dapps — and all without anyone’s permission.

Besides Ethereum, Aave V2 is also available on Polygon and Avalanche.

Other networks were rolled out with the launch of Aave V3.

Aave V3 for multichain liquidity

Launched in March 2022, Aave V3 is a new set of smart contracts built specifically for Layer 1 and Layer 2 networks with low gas fees.

The main innovation in V3 is the High-Efficiency Mode (E-Mode), which increases the ability to borrow a token that is similar to the collateral. E.g. if you deposit DAI, you can borrow more USDT in E-Mode. That’s because the prices of both assets are stablecoins.

| Aave V2 | Aave V3 | |

|---|---|---|

| Supported networks | Ethereum, Polygon, Avalanche | Arbitrum, Avalanche, Fantom, Harmony, Optimism, Polygon |

| Supported assets | 35+ | 8-19, depending on the network |

| Maximum loan | ~75% | 98% with E-Mode |

How to borrow on Aave

All loans on Aave are overcollateralized.

This means that you can borrow less than the value of your deposit, which will be used as collateral. Think of it as similar to a mortgage: the bank typically won’t give you a loan that’s bigger than the value of the house.

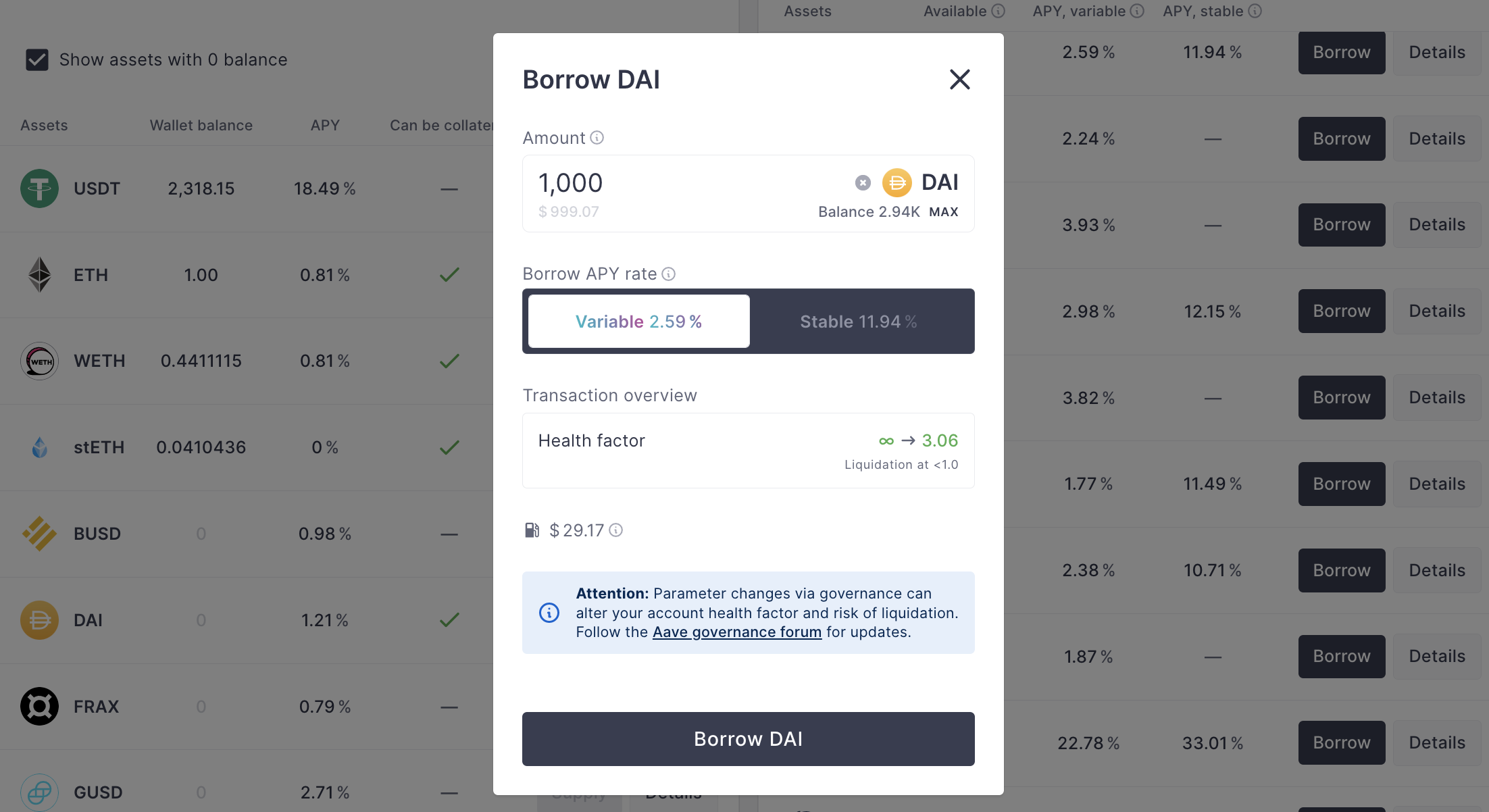

You have two options for interest rates: variable and stable.

The variable interest rate depends on supply and demand, fluctuating frequently. The stable interest rate is not fixed and can also change in the long term but it gives a better idea of how much you will need to pay.

Here are the steps to borrow on Aave:

- Select the token you want to borrow

- Select the amount you want to borrow, paying attention to the Health Factor

- If it’s available for your asset, select the Variable or Stable APY rate

- Pay attention to the AAVE Health Factor, making sure it stays green to minimize the risk of liquidation

- Sign in your wallet

To repay a loan you will need the same cryptocurrency that you borrowed.

If you don’t repay when the price of your underlying asset falls, you can get liquidated. Liquidation happens when the value of the collateral falls and/or the value of the token you owe surges, bringing the health factor to under 1.

Aave liquidation example

- A user deposits 1 ETH to borrow 0.5 ETH worth of USDC.

- The price of ETH crases and the health factor of the loan drops below 1, making it eligible for liquidation.

- A liquidator (usually a bot) can repay up to 50% of what you borrowed or 0.25 ETH in USDC.

- For that, the liquidator gets the collateral with a discount on the market price (aka the liquidation penalty).

During big market moves, liquidation bots can drive up gas prices by competing for the most lucrative liquidations and making it hard to repay your loan.

Zerion Wallet can help you to keep track of all your Aave positions.

In the ‘Tokens’ tab of your Zerion Wallet, you’ll find your Aave pools and debts, arranged by different versions of the protocol.

AAVE Health Factor, LTV, and other important Aave terms

If you venture into borrowing on Aave, you need to know several terms.

- Aave health factor: That’s a number that shows the safety of your total loans and deposits. The higher the health factor is, the safer your loans are. The health factor is not constant and rises and falls with cryptocurrency prices. If it drops to 1, some of your deposits will be liquidated.

- Max LTV: This ratio shows your borrowing power. If you deposited 1 ETH worth of some token with a max LTV of 50%, you can get up to 0.5 ETH.

- Aave Liquidation Threshold: The LTV at which a specific cryptocurrency will be liquidated.

- Liquidation penalty: That’s the liquidators’ reward for repaying undercollateralized loans. It’s the difference between the market price and the price at which you're liquidated. The penalty is lower for highly liquid digital assets like WETH or USDC.

- Utilization Rate: The share of the total liquidity used in loans. The more loans there are and the greater the utilization rate is, the higher the APR for borrowers.

- Aave reserve factor: That’s the share of the interest payments that go to the protocol’s “collector contract”, which is controlled by Aave governance.

Try Zerion Wallet

And mint Zerion DNA, a free evolving NFT!

FAQ

How to lend stablecoins on AAVE?

To lend stablecoins on AAVE, follow these steps:

- Connect your wallet – Go to AAVE’s app and connect your Zerion Wallet or another Ethereum-compatible wallet.

- Select a stablecoin – Choose the stablecoin you want to deposit, such as USDC, USDT, or DAI.

- Deposit funds – Enter the amount you want to lend and confirm the transaction.

- Earn interest – Once deposited, you will receive aTokens (e.g., aUSDC) that automatically accrue interest in your wallet.

What stablecoins does AAVE support?

AAVE supports multiple stablecoins, including:

- USDC (USD Coin)

- USDT (Tether USD)

- DAI (Dai Stablecoin)

- GHO (AAVE’s native stablecoin)

- TUSD (TrueUSD)

- FRAX (Frax Finance’s stablecoin)

The availability of stablecoins may vary depending on the AAVE market (Ethereum, Polygon, Avalanche, etc.).

How do I borrow money on AAVE?

To borrow from AAVE:

- Supply collateral – Deposit supported assets into AAVE to enable borrowing. All loans on AAVE are overcollaterolized, which means you cannot borrow without first making a deposit that is larger than the amount you want to borrow.

- Choose a borrowable asset – Select the cryptocurrency you want to borrow.

- Confirm the transaction – Borrow funds, which will be sent to your wallet instantly.

- Manage your loan – Keep your collateral above the liquidation threshold to avoid liquidation.

Which cryptocurrencies can I borrow on AAVE?

Aave allows borrowing of various cryptocurrencies, including:

- Stablecoins: USDC, USDT, DAI, GHO, etc.

- Blue-chip assets: ETH, WBTC, MATIC, LINK, etc.

- DeFi tokens: AAVE, UNI, CRV, etc.

The exact list depends on the AAVE market and chain you are using. Cryptocurrencies available for borrowing are not fixed and are selected by the community based on several factors.