How to Import Zero Network Transactions Into Crypto Tax Calculator

Step-by-step guide to adding your ZERO Network to Crypto Tax Calculator to compute gains and generate compliant tax reports.

You may not be paying any gas fees on ZERO Network transactions, but that doesn’t mean those transactions are tax-free. You’re still responsible for reporting your crypto activity to the relevant tax authorities.

That’s where Crypto Tax Calculator comes in. The platform integrates directly with Zerion and the ZERO Network, making it easy to import your transactions, figure out your gains, and get tax-compliant reports in minutes.

What is Crypto Tax Calculator?

Crypto Tax Calculator is a crypto tax platform designed for a range of crypto investors – from beginners to pros. As one of the simplest tax calculators on the market, it automatically imports your transactions and quickly figures out how much tax you owe.

We’ve partnered with the team at Crypto Tax Calculator to put this article together. As part of the collaboration, they're offering Zerion users 15% off for their first year, making it easy to do your taxes in just a few clicks.

How are ZERO Network transactions taxed?

It depends on where you’re based, but typically you have to pay either capital gains tax or income tax on the transactions you make on the ZERO network. Here’s some common transaction events and how they might be categorized:

- Capital gains tax: Selling crypto, crypto-to-crypto swaps, and selling NFTs

- Income tax: Providing liquidity to DeFi pools, receiving airdrops, rewards from staking, or yield farming

How to import ZERO transactions into Crypto Tax Calculator?

Importing your Zero transactions into Crypto Tax Calculator can be done in 6 easy steps:

Step 1. Sign up or log in to Crypto Tax Calculator.

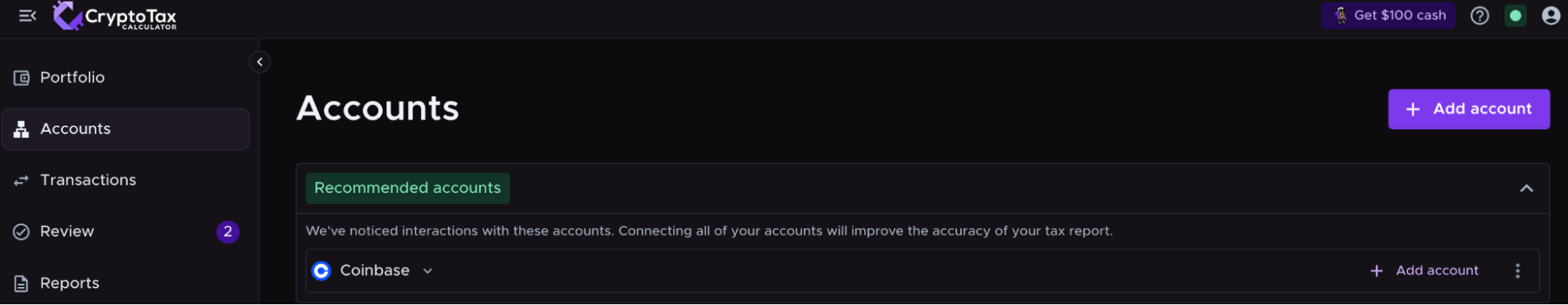

Step 2. Click “Add Account.”

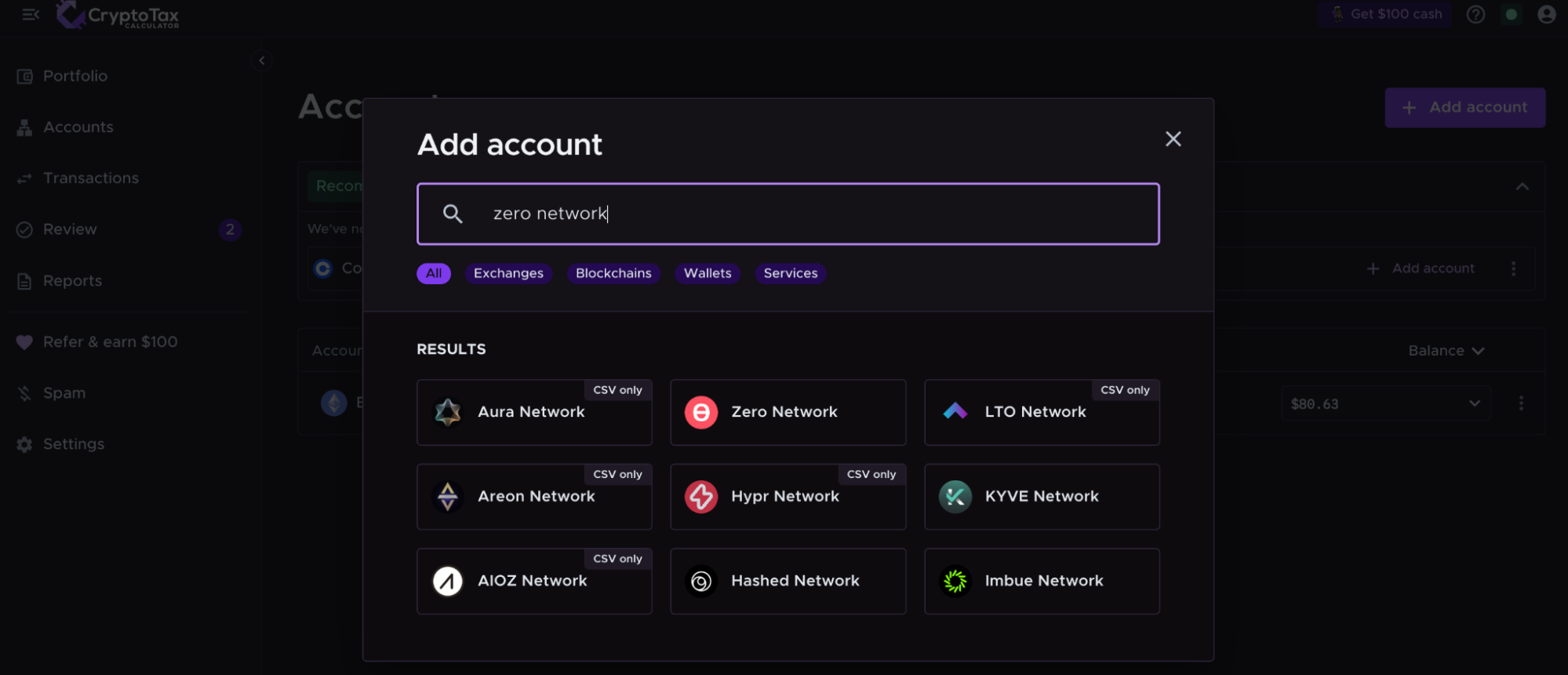

Step 3. Select Zero Network in the accounts list.

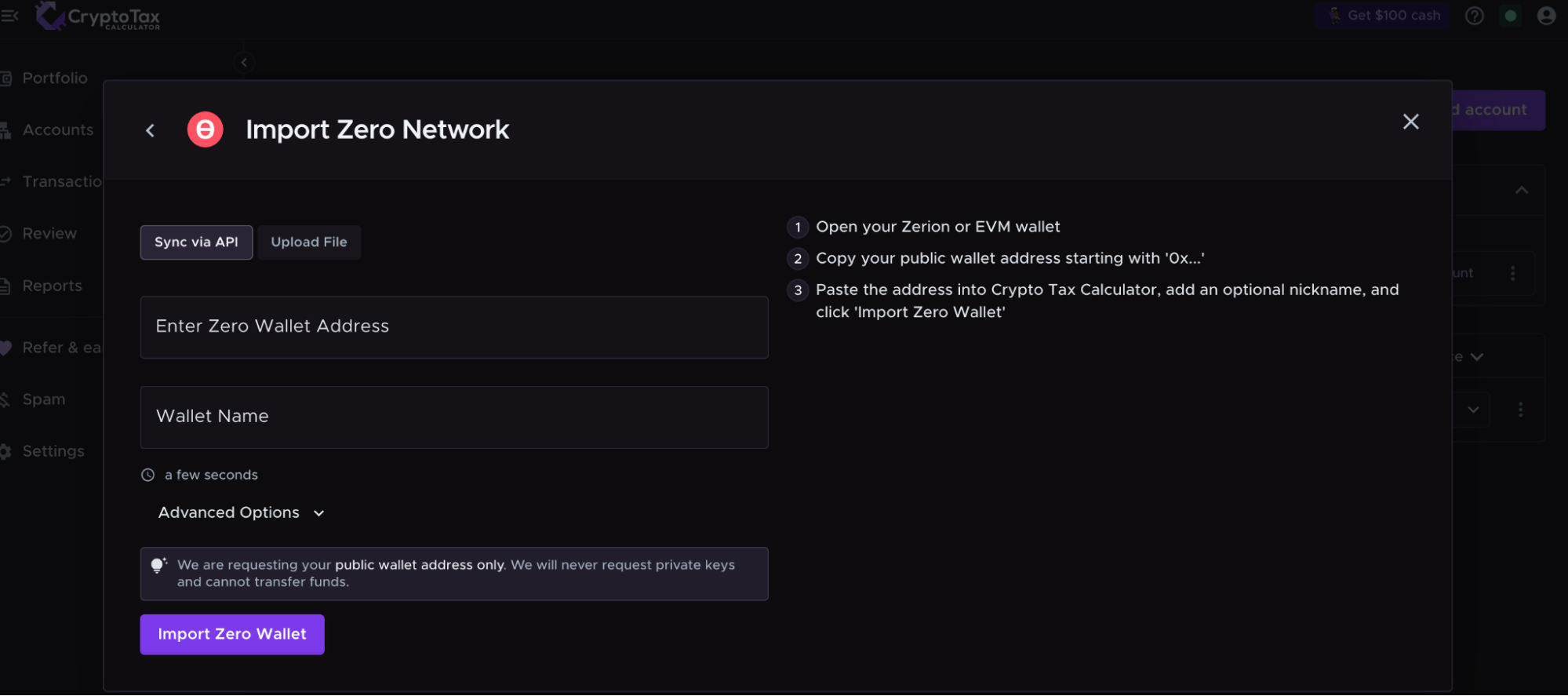

Step 4. Open your Zerion or EVM wallet.

Step 5. Copy your public wallet address starting with “0x…”

Step 6. Paste the address into Crypto Tax Calculator, add an optional wallet name and click ‘Import Zero Wallet.’

How to get your Zerion tax documents?

Zerion doesn’t provide ready-to-file tax documents as it doesn’t have insight into all of your other crypto wallets and transactions. That’s why we’ve partnered with Crypto Tax Calculator, so you can easily connect your Zerion account, import your transactions, and quickly get the tax documents you need.

How to file your Zerion tax report?

Once you’ve imported your transactions from the ZERO Network and any other exchanges or wallets you trade on, you can generate a tax report on Crypto Tax Calculator. Here’s what you need to do:

- Review your transactions

Make sure all your transactions look right and that nothing is missing. If you need to make any changes, click the Review tab in Crypto Tax Calculator to check all your transactions, and the Accounts tab to make sure all your accounts have been added.

- Get the tax forms you need

Crypto Tax Calculator can produce a range of tax forms, ready for you to file or send to your accountant. Just check the options available in the Downloads section of the tax report and choose what’s relevant for you.

Quick tip: If you’re based in the US, Crypto Tax Calculator can produce tax reports ready to upload to TurboTax.

If you want to make tax season less stressful, take advantage of 15% off Crypto Tax Calculator for your first year. Save yourself a headache and file with confidence this financial year.