DeFi Coins Guide: What They Are, Where to Buy, How to Find and Farm

Learn what DeFi coins are, how to buy, trade, farm, and stake them, and how to identify new opportunities in the evolving DeFi landscape.

DeFi has emerged as one of the most transformative sectors in crypto, reshaping traditional financial services through blockchain technology. With clearer regulations gradually taking shape, DeFi coins are once again gaining attention. This guide will walk you through what DeFi coins are, how to buy, trade, farm, and stake them, and how to identify new opportunities in the evolving DeFi landscape.

What are DeFi coins?

DeFi coins are tokens primarily used for governance, incentivizing participation, and facilitating decentralized financial applications built on L1 blockchains like Ethereum and Solana and L2 networks like Base.

These tokens are issued by DeFi apps that enable lending, borrowing, yield farming, staking, and decentralized exchanges (DEXs), and other activities. Popular DeFi coins include Uniswap (UNI), Aave (AAVE), and Lido (LDO).

How to buy a DeFi coin

While you can buy some DeFi coins on centralized exchanges (CEX) like Coinbase, you can also buy all DeFi coins on decentralized exchanges (DEX). This means all you need is a wallet.

Buying on a DEX using Zerion

- Install Zerion Wallet: it's the best self-custodial wallet for DeFi with built-in tracking for protocol positions and rewards

- Fund your wallet: Purchase ETH on an exchange and transfer them to your wallet

- Select coins to buy: Browse Zerion’s explore tab to find and select the DeFi coins you want

- Buy at best price: Zerion swap will automatically find the best DEX rates and facilitates the trade

How to farm DeFi coins

You can also farm some DeFi coins.

Farming in DeFi is the process of getting new coins as a reward for doing something, usually providing some liquidity. Farming is not free – you need some funds to get started and there is always a risk that you might lose them

- Choose a Farming Pool: You can go DeFilama to find the yields

- Connect to the protocol: Once you’ve decided which protocol to use, go to their website and connect your wallet

- Provide liquidity: Deposit the token or the token pair

- Earn rewards: Harvest farming rewards regularly in native protocol tokens or other incentives.

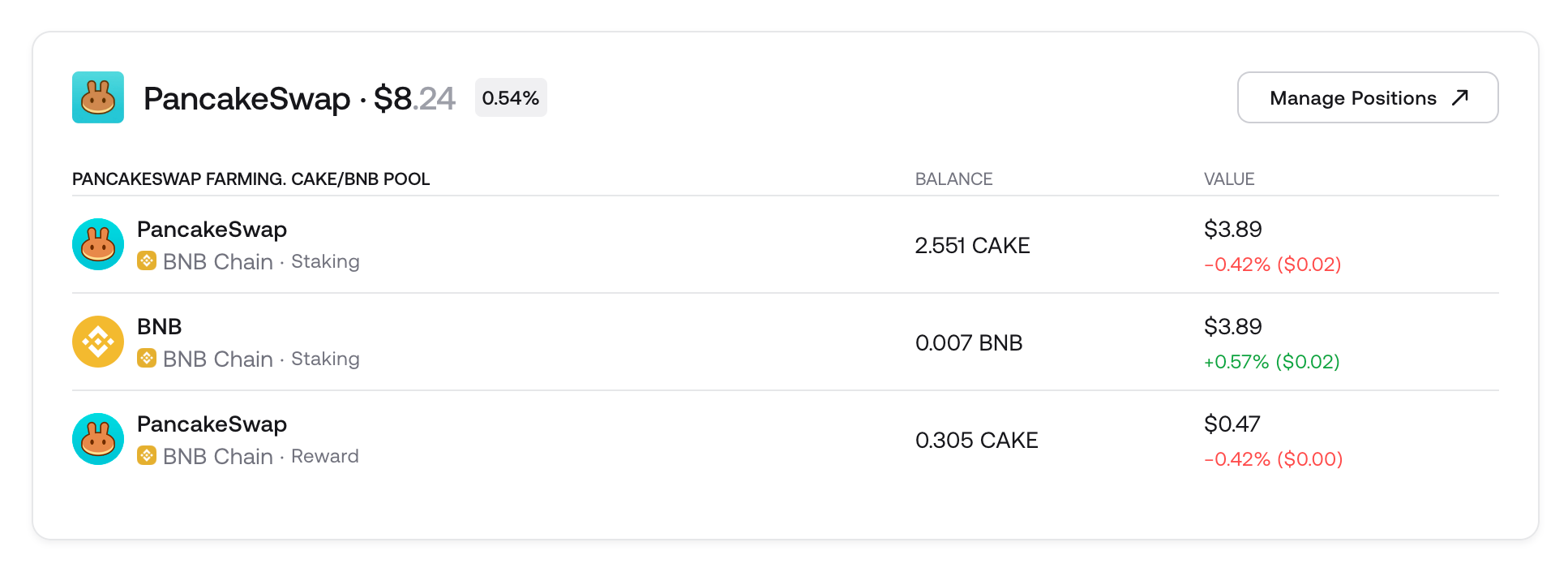

Zerion Wallet will show your DeFi position and rewards. For example, here is how a LP on PancakeSwap looks like in Zerion.

How to stake DeFi coins

Staking locks your DeFi tokens to support the protocol or network, earning you rewards as passive income. These rewards come either from emissions of new tokens (more common) or from protocol revenue (less common).

Each DeFi protocol is different and has a different flow. Let’s use 1INCH to illustrate the general steps to staking a DeFi coin:

- Buy the DeFi coin: To stake, you first need to get the coin. For example, 1INCH token can be staked to earn rewards.

- Connect to the protocol: Click connect wallet and follow the steps.

- Stake: Sign the ‘approve’ transaction to let the protocol use your 1INCH tokens and then sign another transaction to stake the tokens

- Claim rewards: You can Claim or Restake rewards.

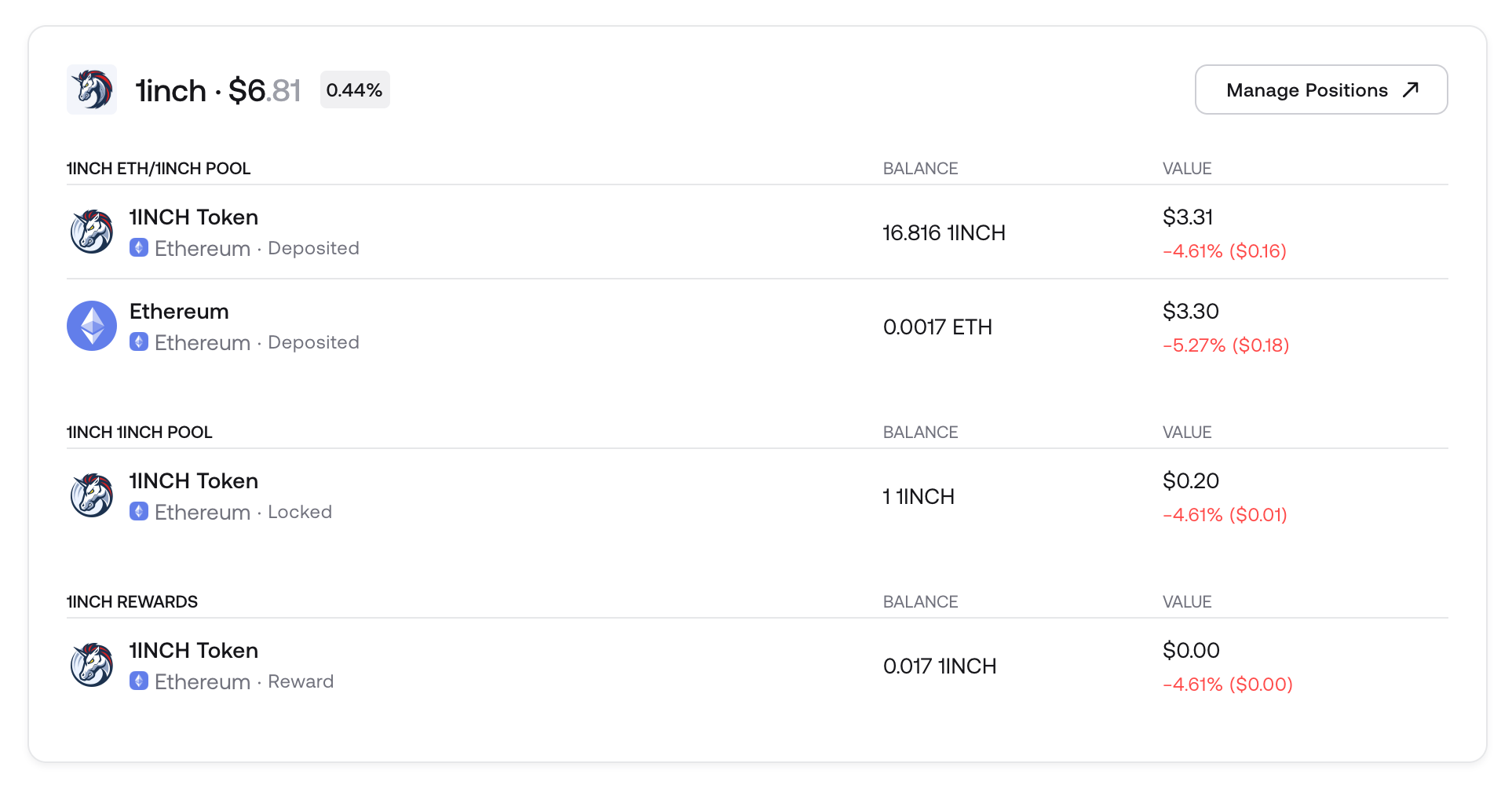

Zerion’s DeFi portfolio tracker can track all your staked tokens and rewards. For example, here is how staked 1INCH tokens look in Zerion.

How to find new DeFi coins

New DeFi coins are launching all the time and being early could be a great way to get the upside. Of course, it’s also very risky: most DeFi coins never make it.

Discovering promising DeFi coins involves:

- Monitoring New Launches: Follow launchpads (e.g., DEX listings, and social media platforms (Twitter, Telegram).

- Exploring Analytics Platforms: Use DEXScreener, CoinGecko, and DeFiLlama for real-time market data.

- Following wallets: Find addresses that are early to new DeFi coins and follow wallets with Zerion.

Top DeFi coins

Below is a list of of best-known DeFi coins. You can find even more DeFi coins on Zerion’s Explore page.

UNI (Uniswap)

The leading decentralized exchange on Ethereum, enables permissionless token swaps.

AAVE (Aave)

A decentralized lending protocol where users earn interest on deposits or borrow assets.

ENA (Ethena)

An innovative protocol for stablecoin-based yields and asset management.

LIDO (Lido DAO)

Offers liquid staking solutions primarily for Ethereum (ETH), allowing users to earn staking rewards without locking assets.

MAKER (MakerDAO, aka Sky)

Maker issues the stablecoin DAI, backed by crypto collateral, which is widely used in DeFi ecosystems.

SNX (Synthetix)

Enables synthetic asset creation, mirroring real-world asset prices and offering DeFi derivatives.

GMX

Decentralized perpetual futures trading platform offering leverage and trading incentives.

CAKE (PancakeSwap)

Top decentralized exchange on Binance Smart Chain, popular for yield farming and staking.

FAQ

How many DeFi coins are there?

Thousands of DeFi coins exist, continuously increasing as the DeFi space expands.

Where can I buy DeFi coins?

DeFi coins can be bought on centralized exchanges like Coinbase or Binance and decentralized exchanges like Uniswap or PancakeSwap.

What are the best DeFi coins to buy now?

Top DeFi coins to consider include UNI, AAVE, LDO, MKR, SNX, GMX, and CAKE, based on their utility, adoption, and growth potential.

Is ETH a DeFi Coin?

ETH is foundational for DeFi but isn't classified solely as a DeFi coin since it powers many applications beyond DeFi.

Is Chainlink a DeFi Coin?

Chainlink (LINK) supports DeFi by providing critical oracle services, though it is typically considered an infrastructure coin rather than a direct DeFi coin.