DeFi Indexes Explained

DeFi indexes are the easiest way to get passive diversification for your crypto portfolio

DeFi indexes are the easiest way to get passive diversification for your crypto portfolio

Against the backdrop of an explosion of DeFi tokens and structured financial products, decentralized index funds, or DeFi indexes, have emerged as an easy way to get passive, diversified exposure to the market.

DeFi indexes are similar to traditional ETFs

What is an index?

Say you want to eat a fruit salad.

There are two ways of going about that: you can either buy each individual fruit, chop them up and attempt to create a snack that tastes good… Or you can buy a fruit salad that has already been assembled by a vendor who balanced ingredients in order to make it just right. An index is like a fruit salad.

In traditional finance, the closest analogy to a decentralized index fund is an exchange traded fund (ETF) which tracks the performance of an index, sector, commodity or specific asset.

ETFs can be passive or active. For example, the Vanguard S&P 500 ETF is a passive equity basket of 500 large companies that are publicly traded on US markets. On the other hand, active ETFs usually have a team making decisions on the underlying portfolio allocation. These kinds of ETFs have been gaining steady attention for outperforming their passive counterparts, pioneered by the likes of ARK Invest.

Differences between ETFs and DeFi indexes

While there are strong similarities between ETFs and DeFi indexes, there are some fundamental differences too.

Set-up costs

Launching an ETF is a costly business and comes with hefty regulatory obstacles. DeFi indexes can be set up relatively quickly because they’re built on permissionless technology and use smart contracts to manage portfolio composition.

For example, indexed.finance’s Degen Index took just 4 weeks to launch after a community member proposed the idea. This highlights how DeFi dramatically reduces the barriers to creating and participating in new financial products.

Management

Regardless of whether a DeFi index follows an active or a passive strategy, portfolio composition is a largely automated process. For example, a simple smart contract might swap an index’s underlying stablecoin for one that offers a higher interest rate. A more complex index could be run on a rebase smart contract, where the supply of the index is a function of its price.

In DeFi, index management and rebalancing are transparent and automatic, so user’s funds are always following the index's initial strategy. DeFi index funds proactively communicate how the index is composed and it is rebalanced going forward. An example can be found in the documentation for the Phuture DeFi Index, PDI.

Bonus yields

Most DeFi indexes are managed by DAOs who use liquidity mining as an incentive to bolster market liquidity and as a way to distribute governance tokens. When you stake index tokens, you’re eligible to earn further rewards.

DeFi’s composability also allows for index funds to boost their returns by utilizing DeFi’s yield-generating protocols. The first DeFi index to do so is PDI, using Yearn’s Vaults. Additional returns are always good for investors, no matter if it’s a bull or bear market.

What to look for in a DeFi index

A straightforward way to compare DeFi indexes is to look at price performance and market cap. You can do this with Zerion Wallet’s Index page by toggling between columns.

It’s also important to understand how DeFi indexes are structured and managed, known as the index methodology. Differences in weighting, rebalance methods and other factors can mean that two indexes with the same underlying tokens produce different returns.

- Construction: Which tokens are eligible to be included in the index, and why?

- Weighting: How are tokens in the index weighted relative to one another?

- Rebalancing: How and when are tokens added and deleted from the index?

- Portfolio structure: What kind of contract is used to operate the index?*

Not all indexes represent a basket of underlying assets held in a smart contract. For example, synthetic indexes do not actually hold any underlying tokens, but rather use price feeds to track their value such as Synthetix’s sDeFi.

Liquidity pool indexes offer both diversified exposure to a basket of assets and the ability to earn trading fees. The downside is that index holders can also be exposed to impermanent loss, like any liquidity pool. For example, PowerPool indexes are built as Balancer pools and Indexed Finance uses a similar model forked from Balancer.

Finally, investors should also consider fees and staking opportunities (liquidity mining) as these will affect net returns. Below we’ll break down four popular DeFi indexes: the DeFi Pulse Index, the Phuture DeFi Index (PDI), Metaverse Index, and the Bankless BED Index.

DeFi Pulse Index

- Symbol: DPI

- Creator: Index Coop

- Construction: 12 of the most popular DeFi tokens on the Ethereum blockchain

- Weighting: Market cap-weighted

- Rebalancing: Monthly, community-managed

- Portfolio structure: ERC20 contract on the Set Protocol holding a basket of underlying tokens

- Fees: 0.95% annualized streaming fees paid to Index Coop

- Liquidity mining: Yes, eligible to earn INDEX governance rewards

- Advantages: Easy passive strategy for anyone who wants to invest in DeFi, no impermanent loss

- Disadvantages: Highly correlated with the price of Ethereum and may not be an effective form of portfolio diversification.

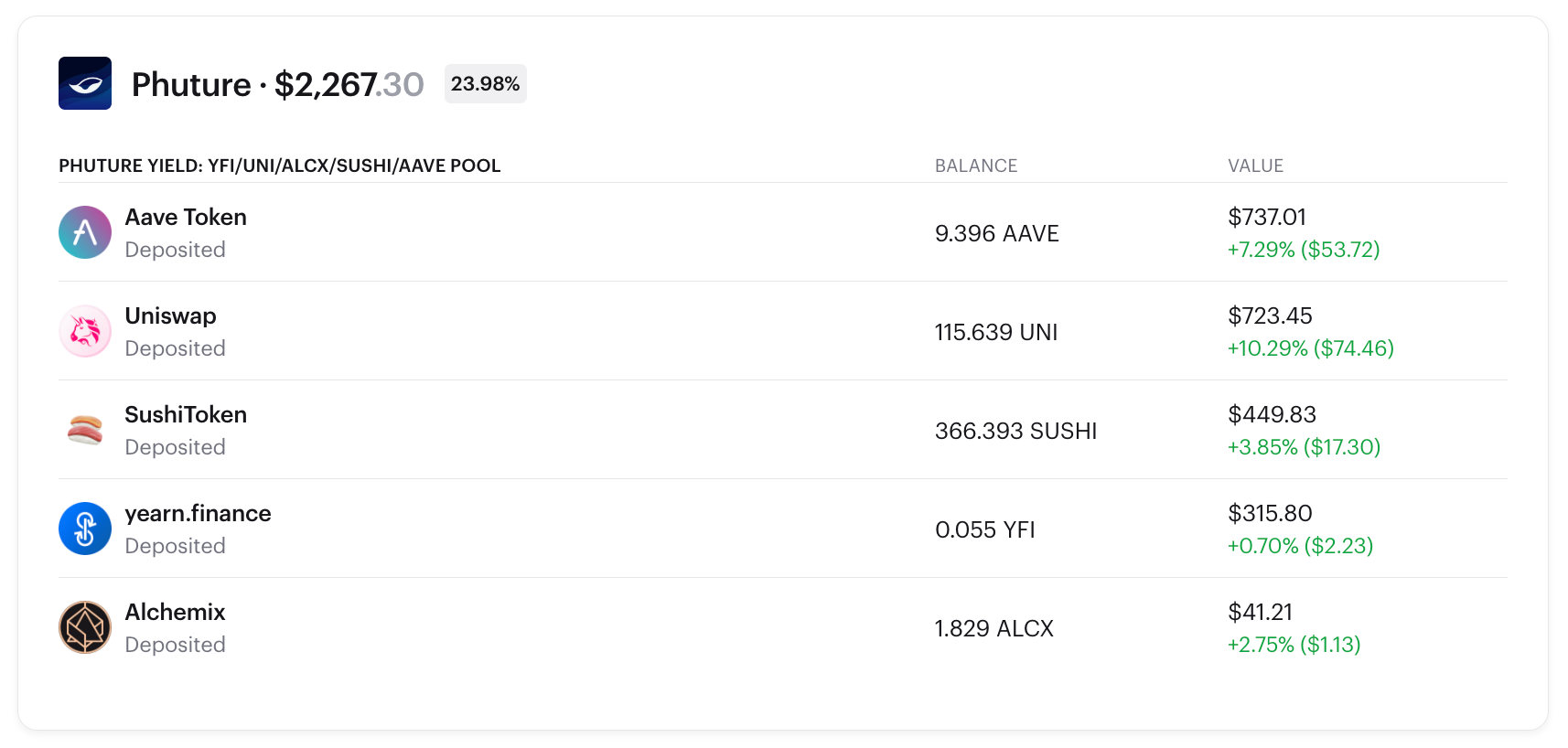

Phuture DeFi Index

- Symbol: PDI

- Creator: Phuture

- Construction: Top DeFi assets by market capitalization on Ethereum

- Weighting: Circulating market cap-weighted

- Rebalancing: Monthly. The methodology is available here.

- Portfolio structure: The index token is an ERC-20 contract on the Phuture protocol, that holds the underlying assets, manages the index’s token exposure and generates additional yield through Yearn.

- Fees: Yearly fee of 1% on assets under management. More info here.

- Liquidity mining: Not available.

- Advantages: Exposure to the DeFi sector, the first DeFi index to bring additional returns from Yearn’s protocols, robust and impartial methodology.

- Disadvantages: This index doesn’t capture small-cap DeFi assets.

Metaverse index

“The Metaverse Index is designed to capture the trend of entertainment, sports and business shifting to a virtual environment, with economic activity in this environment taking place on the Ethereum blockchain.”

- Symbol: MVI

- Creator: Index Coop

- Construction: Most popular DeFi tokens that fall under the Coingecko category of Non Fungible Tokens, Entertainment, Virtual Reality, Augmented Reality or Music.

- Weighting: Market cap and liquidity-weighted

- Rebalancing: Monthly, community-managed

- Portfolio structure: ERC20 contract on the Set Protocol holding a basket of underlying tokens

- Fees: 0.95% annualized streaming fees paid to Index Coop

- Liquidity mining: Yes, eligible to earn INDEX governance rewards

- Advantages: Easy passive strategy for anyone who’s bullish on NFT and entertainment protocols like Axie, Rarible and Audius

Bankless BED Index

This “portfolio solution” for beginners was created by Bankless DAO and Index Coop and perfectly illustrates what a themed index can look like.

- Symbol: BED

- Creator: Index Coop and Bankless DAO

- Construction: Each constituent token in BED represents one aspect of the future of finance: store of value tokens (Wrapped Bitcoin), programmable money (Wrapped Ethereum) and decentralized finance (DeFi Pulse Index)

- Weighting: Equal weighting (33.33%)

- Rebalancing: Monthly

- Portfolio structure: ERC20 contract on the Set Protocol holding a basket of underlying tokens

- Fees: 0.25% annualized streaming fees split 50/50 between Index Coop and Bankless DAO

- Liquidity mining: None

- Advantages: Easy passive strategy for beginners

To recap, DeFi indexes have several advantages:

- No technical analysis is required as an investor

- Save on gas costs that would be spent on purchases and rebalances

- Additional rewards when indexes are staked

But aside from offering easy investment opportunities for beginners and people interested in specific investment themes, DeFi indexes illustrate what’s possible when finance is made truly composable.

To hold any of these DeFi indexes, you will need a non-custodial wallet. Zerion Wallet might be just what you need:

- Buy and sell indexes right in the app

- Track the value of your DeFi indexes and assets that they hold

- Import your existing wallets (such as MetaMask) and connect your hardware wallets like Ledger

For example, here is how a Phuture DPI would look in a Zerion Wallet: