Over the past few years, DeFi emerged into a full-fledged alternative financial system that at its latest peak in November 2021 held over $250 billion in value. Yet this term is still often clouded with excessive complexity.

In this post, we go past the buzzwords and explore how to invest in DeFi, we outline different opportunities and give a simple step-by-step guide.

What is DeFi and why is it so popular today?

The growth of blockchain technologies and the adoption of cryptocurrencies gave rise to the alternative financial system.

DeFi is an acronym that stands for “Decentralized Finance” and its core idea is to establish a peer-to-peer financial system. DeFi operates on blockchain technologies, most often the Ethereum network. Its distinguishing feature is its independence from traditional banks, brokers, and other intermediaries.

DeFi lets anyone make financial transactions faster, cheaper, and without anyone's permission.

Instead of waiting for approval from a bank or another institution, lending, borrowing, trading, and more can be done through open-source protocols on a decentralized financial network. There are no back-offices or layers of management to process your request — only you and the smart contract.

To enjoy the benefits of DeFi, the main thing you need is a non-custodial crypto wallet. A smart web3 wallet like Zerion can help you navigate the world of DeFi, tracking all your tokens across 10+ Layer-1 and Layer-2 networks.

Let's dig into how to invest in decentralized finance.

Ways to invest in DeFi

First, you should remember that any investment carries risk.

Like the rest of the crypto market, DeFi is on the higher end of the risk spectrum. Even if something looks safe, there are probably risks that you're not aware of. Any promises of "guaranteed" returns or profits should raise alarm bells.

Now, let's look at different opportunities you can use to invest in DeFi.

DeFi asset trading

Investing directly in DeFi assets is the obvious way of getting exposure to Decentralized Finance.

The overall idea is simple: buy and sell DeFi tokens and coins. Of course, making a profit that way is a lot harder in practice.

While tokens and coins may seem to serve the same purpose (and many people use the terms interchangeably), they are slightly different.

DeFi tokens are assets associated with specific DeFi protocols. Each protocol uses tokens differently. Some tokens grant holders governance rights. Others could be staked to earn an income. Finally, some tokens are ‘burned’ (i.e. destroyed) at regular intervals, which reduces the overall supply and acts like a share buyback in the stock market.

Examples of DeFi tokens are:

- UNI, the governance token of Uniswap, the largest decentralized exchange;

- MAKER, the governance token of MakerDAO, the protocol behind DAI stablecoin;

- AAVE, the token of Aave, the largest lending and borrowing platform;

- SNX, the token staked in the Synthetix protocol to create synthetic assets.

To interact with decentralized finance you will need to pay gas fees for each transaction on the network.

The fees are paid in the blockchain’s native coin: ETH for Ethereum, MATIC for Polygon, and so on.

If you’re looking for how to invest in Decentralized Finance without spending all your time researching DeFi protocols, buying the underlying coins could be the easiest way.

Examples of coins used to pay gas fees in DeFi are:

- ETH for the Ethereum mainnet;

- MATIC for Polygon Proof of Stake network;

- AVAX for Avalanche, the Layer-1 alternative to Ethereum;

- FTM for Fantom, the DeFi-focused Layer-1 network.

You can simply leave these coins in your wallet (aka hodl) or use them in various DeFi protocols to earn a yield, for example by staking.

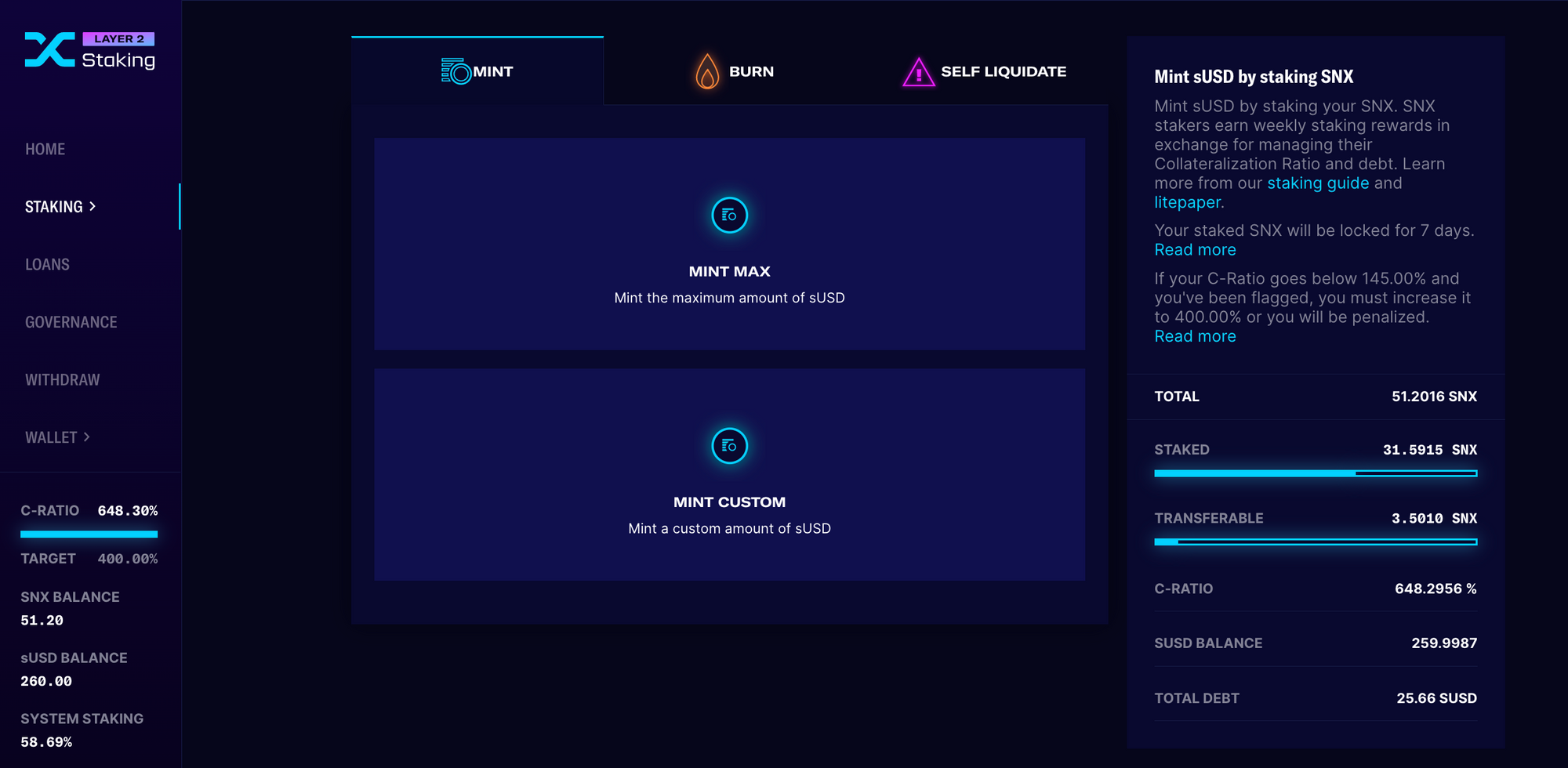

DeFi staking

DeFi staking is a way to earn a passive income with relatively low risk.

Staking is the process of locking DeFi assets in a smart contract and getting a reward. Many DeFi protocols reward their users with the same tokens.

Usually staking rewards have a fixed or variable percentage or annual percentage yield (APY). So the more tokens you stake, the more DeFi rewards you get.

However, high staking APY could be deceptive.

If you got 100% APY in some DeFi token but that token crashes by 90%, the end result might be not that attractive.

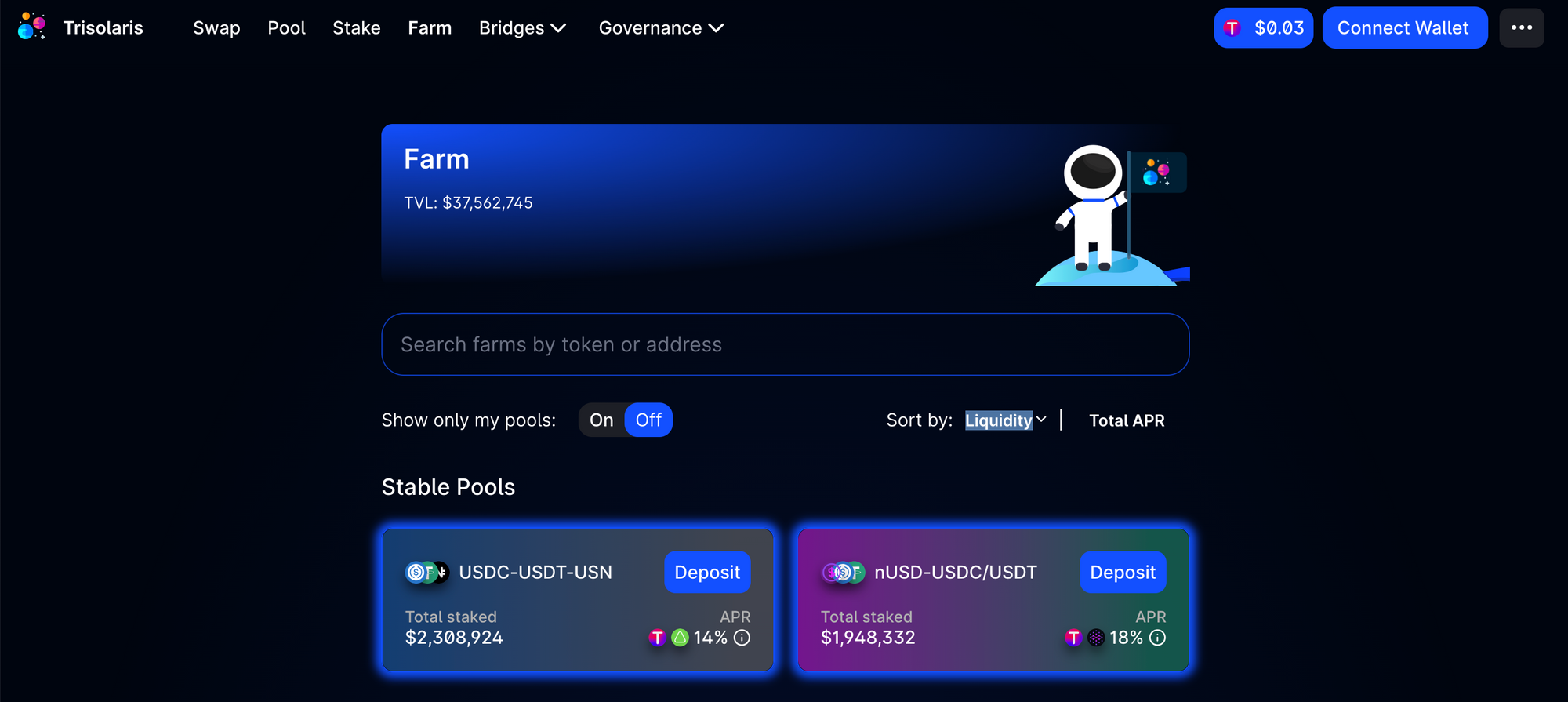

DeFi yield farming

Yield farming is a more complex version of staking.

The term originated as a meme and comes from the way farmers can maximize their profits by switching from one crop to another. Similarly, yield farming in DeFi is about rotating to the different farms.

With DeFi yield farming, instead of staking a single asset (like SNX) you might need to do some action for DeFi protocol, get another token for that action — and then stake that token.

It might be easier to understand this with an example.

There are many different types of yield farms, including:

- Liquidity Provider. Deposit coins to a decentralized exchange (DEX), providing liquidity to traders. You'll earn the trading fee from swaps that traders make plus the DEX's native tokens and any additional farming tokens.

- Lending. Token owners lend crypto assets to other users via smart contracts and profit through the interest of the loan. The platform can also reward lenders with its own token.

- Borrowing. Use one token as collateral to borrow another coin and pay the interest rate. The borrowers can often receive rewards that exceed the interest they pay.

If this is all confusing, don't worry. You don't need to do this all yourself.

Plenty of automated platforms have emerged to simplify yield farming for regular users:

DeFi lending

Another strategy to diversify your DeFi investment portfolio is through lending.

Most lending protocols rely on collateral-based loans:

- Lenders can offer their cryptocurrencies as a loan to others

- Borrowers lock up some assets as collateral and can borrow another asset. For example, a borrower might lock up ETH as collateral and borrow USDT.

Lending protocols typically use an algorithm that calculates the interest rates based on the supply and demand for loans. As a result, if there is high demand there will be a higher interest rate.

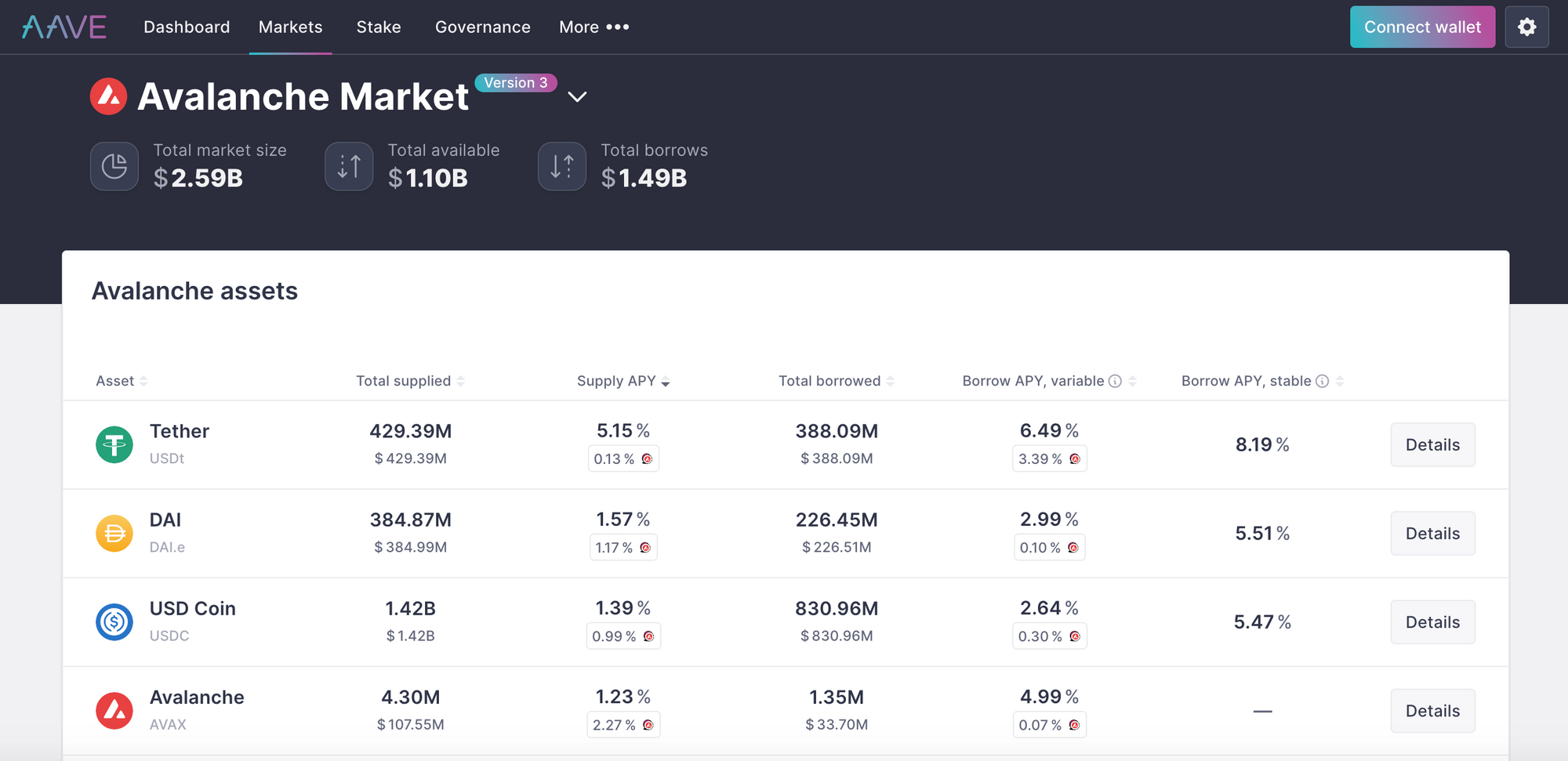

This is often the case on other Layer-1 networks such as Avalanche markets on Aave, which even have additional rewards in AVAX (see those red question marks on the screen below?).

The oldest and the most popular lending/borrowing platforms are:

DeFi indexes

A quick way to diversify your crypto portfolio and join Decentralized Finance is to invest in a DeFi index.

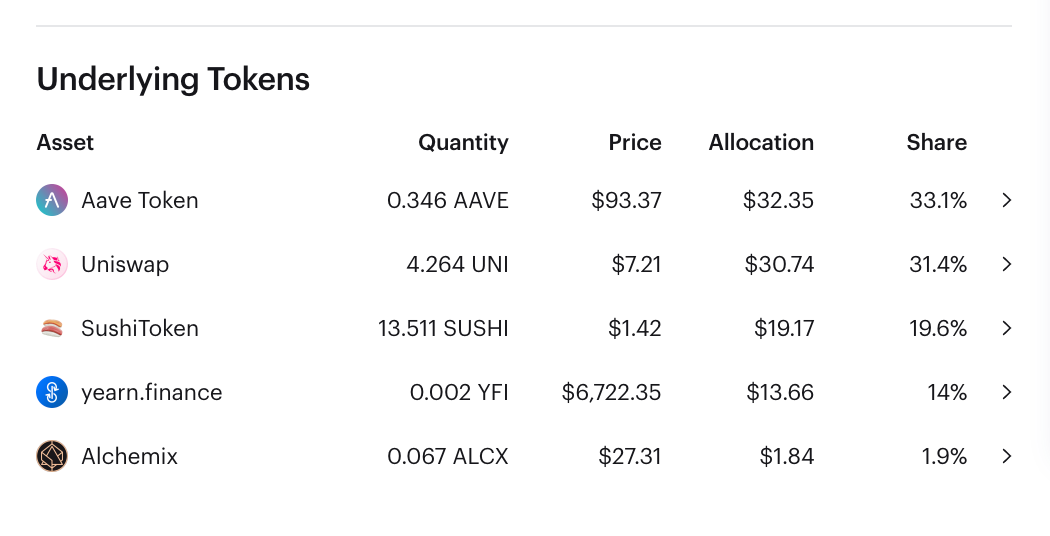

Similar to ETFs in traditional finance, DeFi indices invest in different assets according to fixed rules. For example, here is what Phuture DeFi Index holds:

There are two key elements to pay attention to before deciding which index to choose: the price performance and the market cap.

Although past performance does not guarantee future returns, it shows how volatile the index is and how its price moves in different market conditions.

Meanwhile, the market cap shows how popular the index is. DeFi indexes with larger market caps are likely to be more secure (although there are no guarantees).

Some of the most popular DeFi indexes are listed below:

Where to buy DeFi tokens?

Now that you are aware of your DeFi investment choices you need to know where you can buy DeFi tokens.

Various centralized exchanges (CEXes) offer easy onboarding from fiat (i.e. paying by bank cards) and straightforward interfaces that make it easy to sell and buy DeFi cryptocurrencies. Some of the most popular exchanges with lots DeFi tokens are:

- Binance

- Coinbase

- Kraken

However, many newer DeFi tokens are often only available through decentralized exchanges (DEXes). To buy tokens on these exchanges you should have a Zerion Wallet or any other non-custodial crypto wallet. The largest DEXes are:

- Uniswap

- SushiSwap

- PancakeSwap

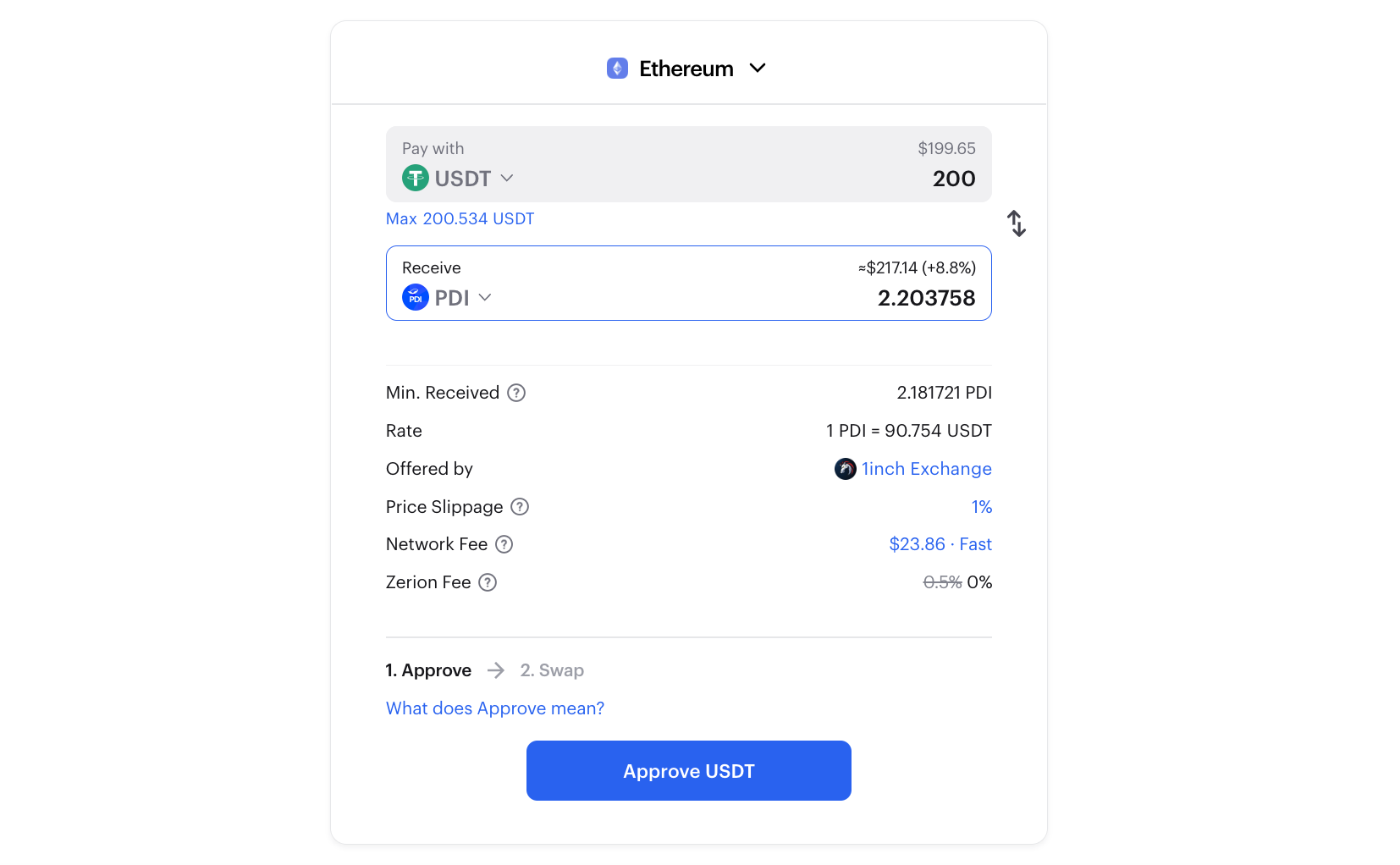

Prices often vary across different decentralized exchanges. Zerion's trading aggregation can help you find the best price by automatically scanning all DEXes to make sure you buy DeFi tokens at the best price. After connecting your wallet, just select the asset you want to pay with and the token you want to buy — and Zerion will find the best DEX.

How to invest in DeFi: a step-by-step guide

Once you decided to invest in DeFi you need to follow the steps in the list below:

Step 1. Create a wallet.

To make the most of DeFi — including staking and lending — you will need a non-custodial wallet like Zerion Wallet.

Zerion Wallet is perfect for DeFi:

- Track any DeFi assets, including staked tokens, liquidity pools, farms, and debts

- Find the best swaps on DEXes

- Easily switch between 10+ Layer-1 and Layer-2 networks.

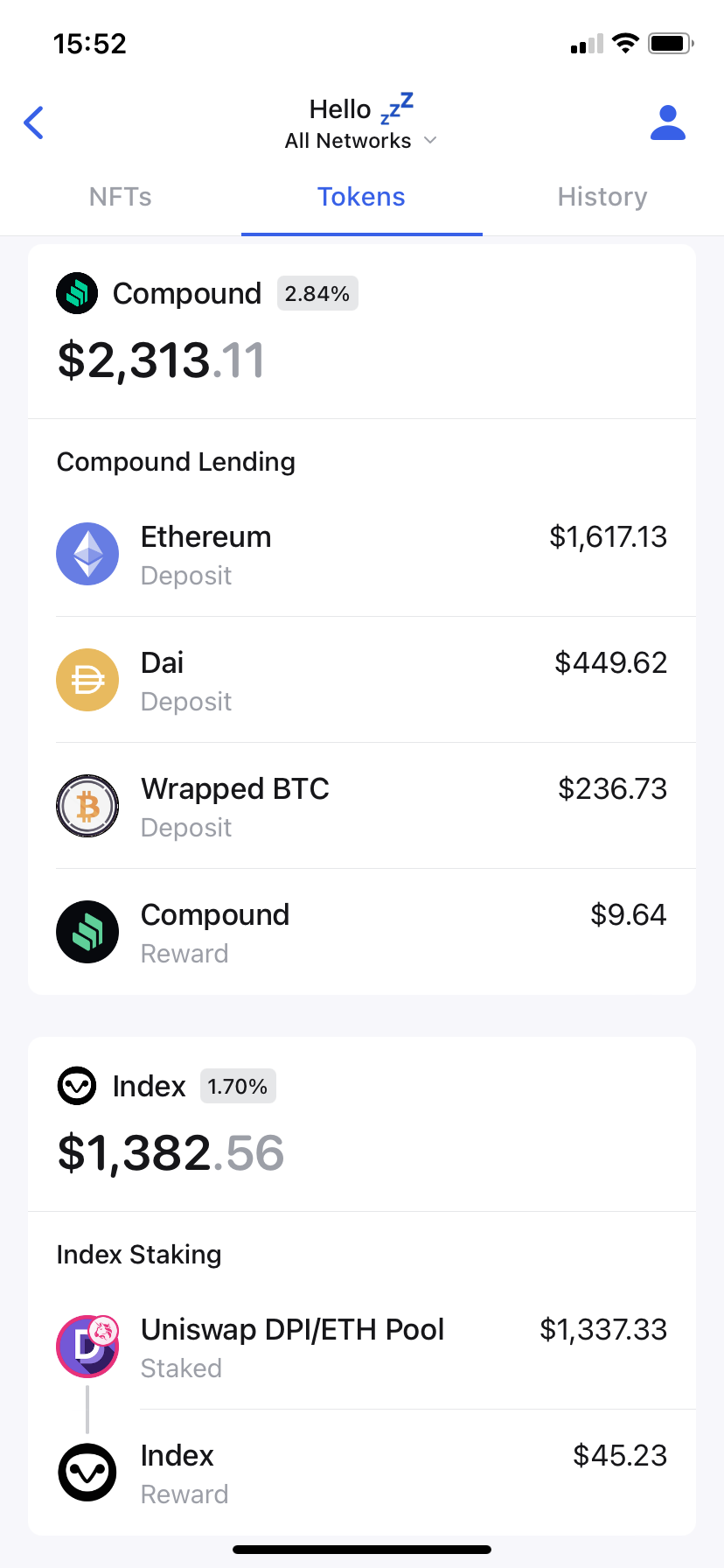

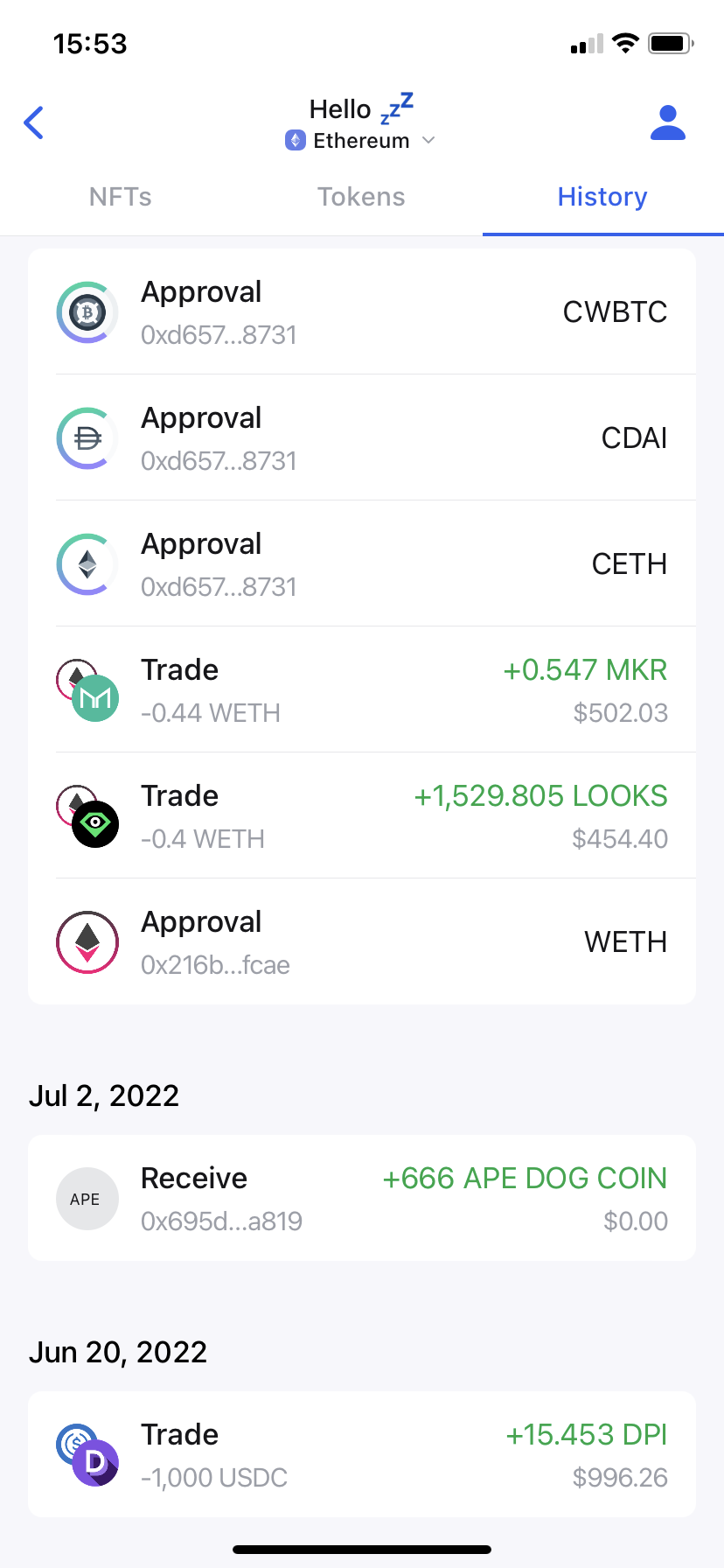

Zerion Wallet tracks all DeFi investments and shows the history of all transactions

Step 2. Choose your blockchain network.

After your crypto wallet is ready, you should pick the primary network for your DeFi investing.

Ethereum is still the leading blockchain for DeFi. However, its high gas fees might make it prohibitively expensive if you're just starting out. On some days, a simple transaction might cost over $10 and a more complex action like lending tokens can set up back by up to $100.

Alternative Layer-1 networks or Layer-2 scaling solutions for Ethereum have transaction fees under $1.

Here is a list of some well-known networks that are supported by Zerion Wallet:

Step 3. Fund your wallet.

Buy the native tokens for the blockchain of your choice: ETH for Ethereum, FTM for Fantom, and so on. You can either buy these cryptocurrencies on one of the centralized exchanges or use an on-ramp, which is built into Zerion Wallet.

Step 4. Acquire your DeFi coins.

Once having chosen the DeFi protocol you are interested to invest in, you need to purchase the corresponding DeFi coins or tokens.

You can buy tokens on any of the decentralized exchanges or right in Zerion Wallet, which can automatically find the best price for you.

Step 5. Stake, lend, use DeFi protocols.

DeFi lets you maintain ownership over your assets.

As we’ve discussed, you can stake your tokens, lend them, or provide liquidity to earn rewards. The easiest way to try this out is with Zerion’s 'Explore' feature that shows some of the options you have in DeFi.

Step 6. Choose a Liquidity Pool.

Investing in liquidity pools could be another way to diversify your DeFi holdings.

Zerion's Pools tab shows you some of the most popular liquidity pools and makes it very easy to join them in a few taps.

The bottom line

DeFi became one of the fast-growing investment trends in crypto.

However, as with any other investment, there are some risks. Before putting significant money into DeFi investing, it's important to start small, see how it works, and do your own research.

Invest in DeFi with Zerion Wallet

FAQ

What is DeFi in the crypto world?

DeFi stands for Decentralized Finance and offers peer-to-peer financial services.

DeFi is accessible to anyone with a non-custodial crypto wallet. Its key feature is the absence of a third party to facilitate financial transactions. Instead, transactions are done through smart contracts as defined in each DeFi protocol.

How much should I invest in DeFi?

This depends on how much you have at your disposal. Never risk what you cannot afford to lose.

Also, Ethereum has high gas fees, especially for the more complex DeFi transactions. So you need at least a few thousand dollars to make it worthwhile.

However, other scaling solutions for Ethereum such as Polygon and Arbitum have lower gas fees. You can also use a different Layer-1 network such as Avalanche or Fantom.

How do you make money with DeFi?

There are many different ways you can make money with DeFi (and even more, ways to lose money).

This all depends on how much you can invest and what risk you are ready to take. Some of the strategies you can use in DeFi are:

How do I start DeFi?

To start with Decentralized Finance, you need to follow some simple steps: set up a cryptocurrency wallet, fund it, and connect it to DeFi protocols.

Of course, you also need to research DeFi protocols to at least understand where the rewards are coming from. The more time and effort you put in to learn about DeFi the less likely you are to lose money to avoidable pitfalls.

Is DeFi a good investment?

A "good investment" depends on who it is for: every investor has different timeframes, risk tolerance, and desired returns.

DeFi could offer very high returns but it also comes with high risks.

How can I buy DeFi?

If you want to buy DeFi assets you need to own a self-custody wallet and native coins (e.g. ETH) to pay for gas fees. Once you have a funded wallet, you can buy individual DeFi tokens on decentralized exchanges. Alternatively, you can buy DeFi Indices that are like ETFs.

Do I need to pay for DeFi?

Yes, you most likely need to pay taxes on DeFi positions. Depending on the protocol and your country, your profits could be treated as capital gains, income, ora combination of both.