Cryptocurrency users looking for ways to manage their digital assets usually come across the two most popular types of crypto wallets: custodial and non-custodial wallets.

The basic difference between them is that with a custodial wallet you entrust the private key to the third party, while a non-custodial wallet comes with the keys that only you control. Giving you full custody of funds, non-custodial wallets at the same time require a higher level of responsibility because the loss of the keys will make it impossible to access the wallet, meaning your funds will be lost forever. On the contrary, with a custodial wallet, you do not manage private keys and you can regain access to your wallet even if you forgot or lost your password.

From this article, you will learn everything about two types of crypto wallets so that you can further decide which one is best for you.

What is a Custodial Wallet?

As the name suggests, custodial crypto wallets take custody of the private keys of users. That means that users are entrusting their cryptocurrency to a third party. Essentially, custodial exchange accounts act like banks, where the funds are yours, but you don’t have full control over them. They carry out transactions on behalf of the wallet account owner.

Example

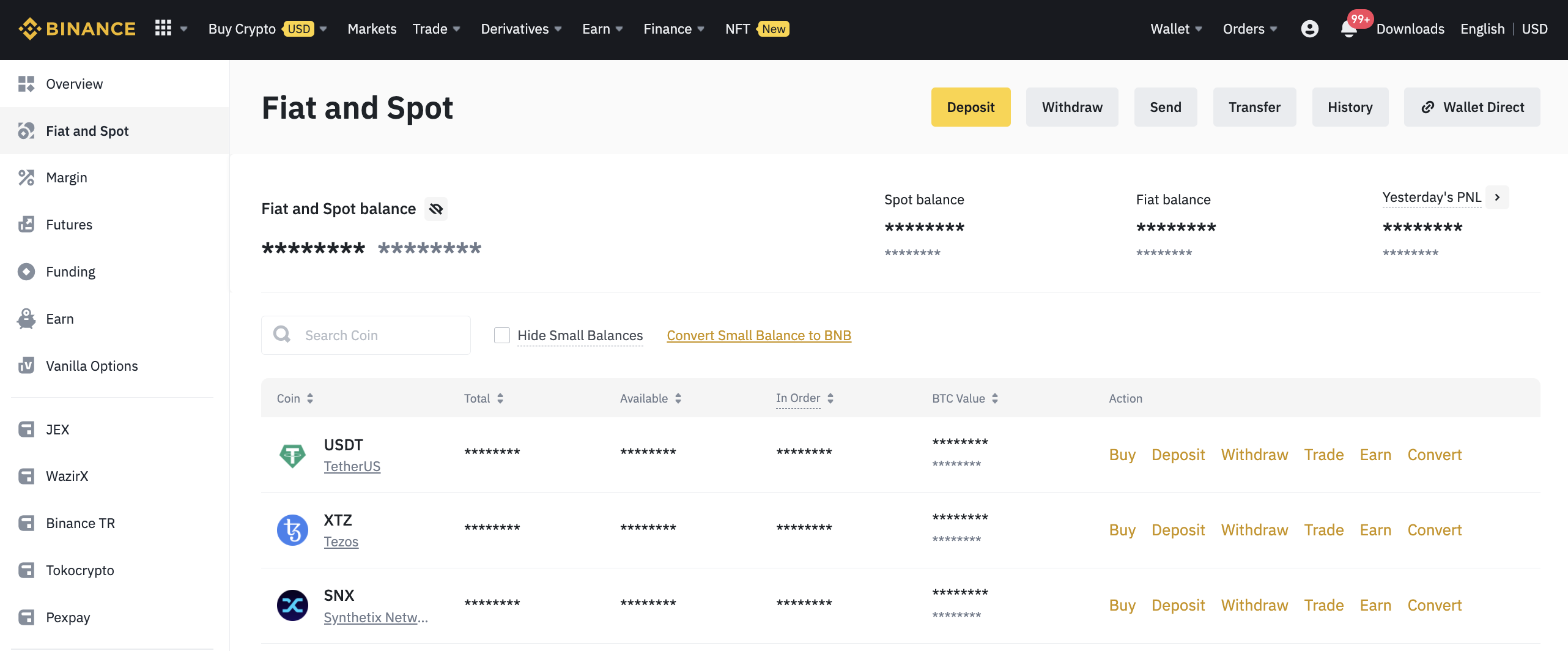

Some examples of custodial wallets include Binance, Free Wallet, and Coinbase. On these custodial exchanges, you can hold or trade crypto assets only after identity verification.

What is a Non-Custodial Wallet?

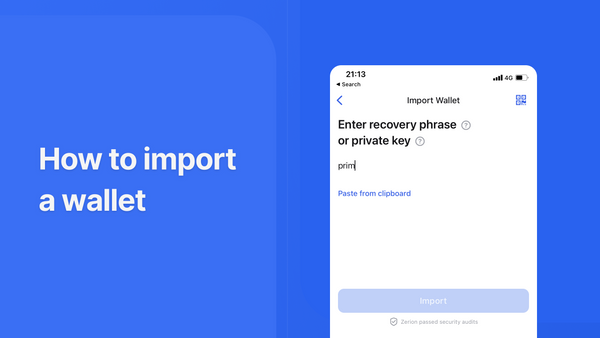

A non-custodial crypto wallet is a decentralised crypto wallet that enables users to keep their private keys by themselves. In other words, users have full control over their crypto funds and authorize each crypto transaction. Upon a custodial wallet set-up, users get a mnemonic phrase. This phrase should be kept in a safe place because it serves as a recovery phrase in case you will need to restore a deleted or lost wallet.

Example

Zerion Wallet is an example of a non-custodial wallet. It's a mobile wallet that supports 11 blockchain and scaling networks and has built-in swaps on decentralized exchanges.

What Types of Non-custodial Wallets Exist?

Non-custodial wallets come in various forms. For example, there are hardware devices, web extensions, or mobile and desktop apps. Hardware wallets are considered to be the most secure because they are essentially offline, but they require more tech knowledge than web and mobile applications. On the other hand, on any computer or mobile device, apps are connected to the internet most of the time, but they are more convenient and offer quick access to assets.

Hardware Wallets

A hardware wallet, also known as a cold wallet, is a physical device specially designed to store private keys offline. This type of wallet is considered to be the safest non-custodial crypto wallet. The device looks like a flash drive and since it is not connected to the internet, you need to plug it into a PC or mobile phone to access your crypto wallet and make transactions. Some popular hardware wallets include Ledger non custodial wallet, Trezor, and KeepKey.

Browser-Based Wallets

Browser-based wallets exist in the form of a browser extension. They store your private key in the browser and allow you to easily connect to Dapps (decentralized applications). Metamask is the most widely used browser wallet. Some web wallets, like Brave, are built directly into your browser and require less CPU to operate.

Mobile Wallets

A mobile wallet is another type of software wallet. It is an application that can be downloaded and installed on a smartphone.

Mobile non-custodial crypto wallets securely store your private key and enable you to trade and manage your crypto through a user-friendly interface. There is a multitude of mobile wallets, with Trust Wallet as one of the most widely-used options. MetaMask is also available as a mobile app.

A modern mobile smart wallet on a mobile device does more than just store your seed phrase. For example, Zerion Wallet automatically tracks the entire DeFi and NFT, finds the best bridges and swaps on DEXes across 10+ networks, and more.

Custodial vs Non Custodial Wallet

Both custodial and non-custodial options have their benefits, and the decision of which wallet to opt for will depend on your needs. Let’s take a look at the similarities and differences between the two wallet types.

| Point | Non-custodial | Custodial | |

|---|---|---|---|

| Private Keys | Controlled by you | Controlled by the third party (e.g. crypto exchange) | |

| Security | Higher security, especially with hardware wallets | Lower security due to the persistent internet connection | |

| KYC | No KYC required | KYC required in most cases | |

| Withdrawal limits | No limits for withdrawals | Some providers set up withdrawal limits | |

| Account recovery | Impossible to recover in case the recovery phrase is lost | Easy to restore an account with a password recovery link | |

| Speed of transactions | Faster transactions as there is no need for approval from a third party | Fast transactions within the platform (e.g. from one account to another) and possible delays for external transactions due to KYC/AML checks |

What Are The Pros And Cons Of Custodial Wallets?

Custodial online crypto wallets are more suitable for beginners with few crypto assets. They don’t require as much responsibility as non-custodial wallets and are easy to use. The process of creating an account is similar to that of any online service, where you only need an email and password to get started.

Pros of Custodial Wallets

Zero fees for some transactions

Some custodial crypto exchanges, such as Free Wallet, allow free crypto transactions within its ecosystem. Moreover, users can use various investment products and participate in staking without worrying about gas fees.

However, external transactions such as paying for something or sending crypto to someone still carry fees.

No hassle with private key

With a custodian wallet, you do not have to bother about saving and storing your private keys. Even if you forget the password, you can easily reset it by requesting a password recovery link to your email.

Backup provision for transactions

Everyone knows that blockchain transactions are irretrievable. Crypto sent to the wrong address can be lost forever. However, custodial exchanges sometimes have tools to recover the assets sent without a memo or to an incorrect address.

Cons of Custodial Wallets

The convenience of custodial wallets comes at a cost. You don’t actually control your money, must share your identity documents, and risk losing your funds due to exchange hacks.

Custodian controls your money

Keeping funds in a custodial wallet, you have to agree with its policy and there is no guarantee you will always receive coins in the case of a fork or an airdrop. Also, there is a chance that withdrawals may be closed for maintenance or your account gets frozen, thus not allowing you to make quick financial decisions.

Lack of anonymity

Since most of the custodial wallets are centralized, they must abide by KYC (Know Your Customer) regulations and require users to submit their identity information. This might be a major drawback for individuals who want to keep their privacy.

Security breaches

Though custodial wallets are not easy to hack, they are more vulnerable to security breaches than some types of non-custodial wallets. Centralized custodians control millions or even billions of dollars worth of crypto and are attractive targets for hackers.

Therefore, before transferring your crypto funds to a certain wallet, it is important to check whether it has passed any security audits and if the users are reimbursed in case the wallet is compromised.

Persistent internet connection

Unlike such non-custodial wallets as hardware devices, custodial wallets require an internet connection for performing any type of transaction. This makes the wallet vulnerable to online attacks.

What Are The Pros And Cons Of Non-custodial Wallets?

Non-custodial wallets eliminate the third party, so it is an option that gives you direct ownership of crypto assets. At the same time, setting up a self-custodial wallet is less intuitive and requires basic knowledge about private key storage.

Pros of Non-custodial Wallets

Direct control over assets

Non-custodial wallets give you full control over your private key, allowing you to act as your own bank. People storing large amounts of crypto on exchange accounts may feel more comfortable knowing they have complete ownership of their cryptocurrency.

Full access to DeFi and NFTs

With a non-custodial wallet, you can freely interact with Web3 — the emerging decentralized internet. It already includes a wide range of DeFi (decentralized finance) protocols that can let you earn income from your crypto holdings. With NFTs or nonfungible tokens, you can support artists you like, join various communities, play games, and much more.

Data security

Since non-custodial wallets offer you complete control of the movement of your assets, the risk of a data breach is significantly lower. Hardware wallets are especially safe as they are not connected to the internet most of the time and cannot be exploited by hackers.

Faster transactions

Due to the absence of AML/KYC checks, withdrawals take less time. Also, with many wallets, users can choose the transaction gas fee they wish to pay based on how fast they want it processed.

Cons of Non-custodial Wallets

Increased responsibility

Storing the private key by yourself requires greater personal responsibility from your side. You have to make sure to keep your keys and your wallet safe. Moreover, you should take some precautions to be able to restore your wallet, such as noting down the mnemonic phrase and keeping it in a secret place.

No customer support

In case you encounter some difficulties while using a non-custodial wallet, you won’t be able to get help from a specialist directly but will have to look for the answer on one of the crypto forums. Additionally, no support means no chance to recover your funds if you send them to the wrong address, for example.

Complicated for beginners

Even though non-custodial wallets, especially cold storage devices, reduce your risks of losing your crypto to hackers, they are more difficult to set up. Mnemonic phrase storage and management might be too overwhelming for first-time crypto users.

Deciding Which Wallet is Best for You

Both custodial and non-custodial wallets have their share of advantages and disadvantages.

Custodial wallets are easy-to-use, let you save up on fees, and can help you to recover assets in case of a mistake. On the other hand, with non-custodial wallets, you can trade anonymously and always be in control of your crypto and confident that no one can stop your transactions.

Before deciding which option is best for you, consider all the pros and cons, as well as your requirements.

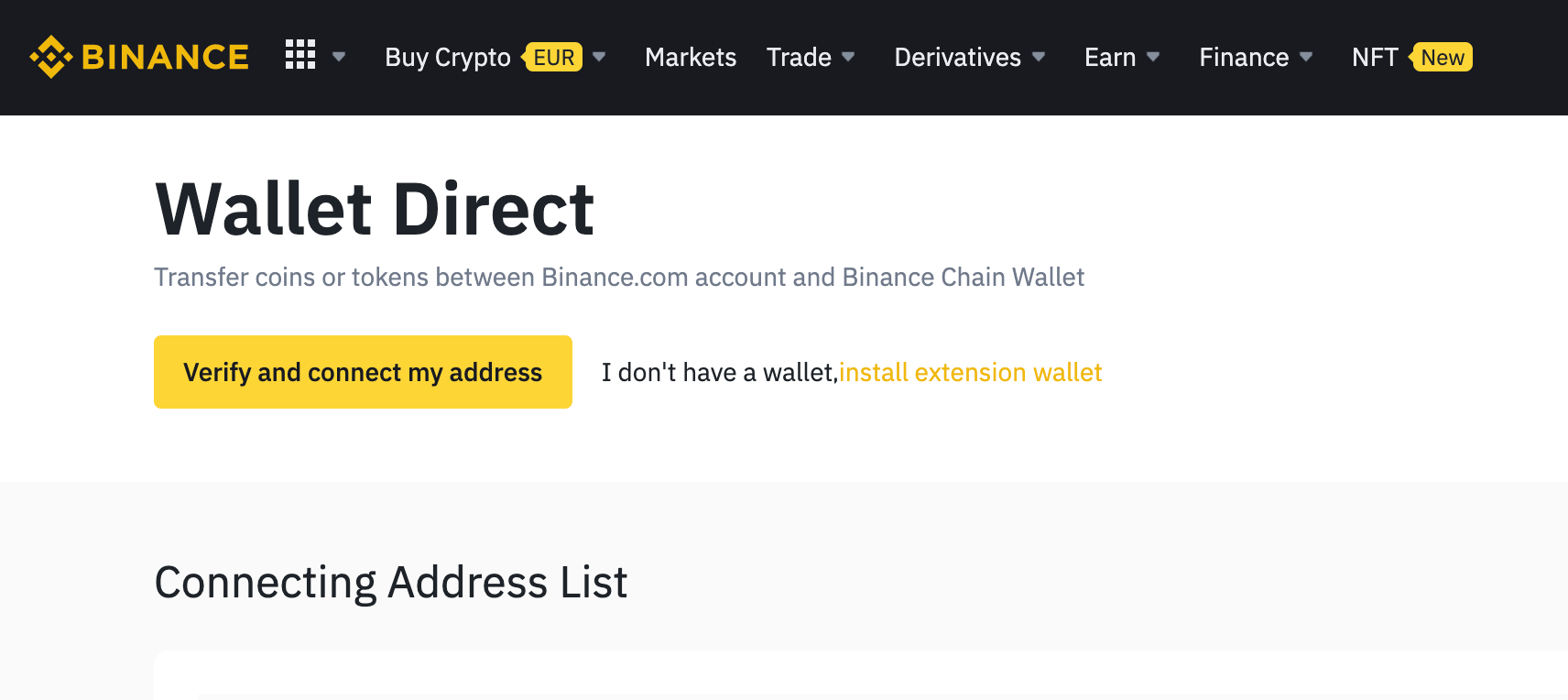

Are There Exchanges With Integrated Non-custodial Wallet Applications?

Some centralized exchanges offer built-in crypto wallets with self-custody, though their adoption is relatively low compared to centralized exchanges. For example, Binance owns Trust Wallet, a non-custodial mobile wallet, and also offers Binance Chain Wallet, a browser-based wallet, which can be connected to the exchange.

There have also been numerous decentralized exchanges appearing on smart contract platforms like Ethereum, widening the users’ options. Uniswap and SushiSwap are the best-known examples of decentralized exchanges. Still, some issues need to be tackled, like front-running. The transparent nature of blockchain transactions enables front-runners to place their orders with higher fees (to ensure they are mined first) before a substantial pending transaction to benefit from the price change.

In the long run, a mix of centralized and decentralized solutions might prevent front-running and other issues, where the transactions are not executed publicly, but the customers have control over their private keys and funds.

Do All Major Cryptocurrency Exchanges Offer Only Custodial Wallets?

While every major exchange is equipped with a custodial wallet, their security is being improved, allowing users to have more control over their funds.

Users on some exchanges like Kucoin have complete control over their assets until the moment they sell them. There is a chance that over time, more exchanges will apply a similar approach.

How Do I Know Which Type of Wallet I’m Using?

Unlike custodial wallets, non-custodial wallets put users in full control of their private keys associated with the wallet’s public address.

So if you access your crypto wallet only with a login and password and don’t have your own private key, this means you have a custodial wallet.

Why are Custodial Wallets Considered Less Safe?

By using a custodial wallet, you are trusting a third party to keep the private keys on your behalf. Even though wallets deploy numerous security measures, they are still susceptible to hacks. When you are the only person holding your private keys, there is less chance someone will even know about the existence of your wallet and try to steal your keys and funds. However, a custodial wallet may be a honeypot for a hacker, as by compromising a wallet they gain access to all the users’ funds. The problem is that you have to make sure you can trust the custodial wallet provider and rely on their security measures.

Your Choice

In this article, we covered the basic information about custodial and non-custodial wallets, the differences between them, and their advantages and disadvantages.

The final choice between these types of wallets will depend on your purposes and the number of crypto assets. An obvious choice for a beginner with a small amount of cryptocurrency would be a custodial wallet, which provides a simple way to access your crypto assets.

Non-custodial wallets, on the other hand, fulfill the purpose of decentralization and security. They suit users who want to keep large sums of crypto with full control over their funds.

FAQ

What is a custodial and non-custodial wallet?

A custodial wallet is a crypto wallet that stores your private keys. By contrast, a non-custodial wallet gives you the complete responsibility for your keys. The first one works similarly to a traditional bank, while the latter makes you act as your own bank.

How do you create a non-custodial wallet?

Non-custodial wallets exist in the form of a mobile app, web extension, or hardware device. Mobile or web-based software wallets can be downloaded from a mobile or web app store. Hardware wallets can be purchased online and come with set-up instructions.

How do non-custodial wallets make money?

Most non-custodial wallets do not make any profit. They are created by larger projects who have income from other products or have a native token that accrues value with time. These projects might also raise money from investors or through crowdfunding.

What is the difference between a custodial and non-custodial wallet?

The key difference between the two types of wallets is that a custodial wallet provider takes custody of your private keys, while a non-custodial wallet allows you to hold your own private keys. Custodial wallets are easily recovered in case of a password or device loss, but you have to trust a custodian and rely on their security system. With a non-custodial wallet, the responsibility for the assets' security as well as wallet recovery is on you.

Do you need a non-custodial wallet?

If you are looking for a wallet to store a big sum of crypto assets, a non-custodial option might be the most suitable option, especially a hardware wallet.

Also if you want to invest in DeFi, you will need a non-custodial wallet to interact with decentralized applications — a smart wallet like Zerion Wallet might be perfect.

Keep in mind that with full control over your assets also comes greater responsibility. You will need to create a wallet backup and find a safe way to store your private keys.