In this article, we'll discuss:

- How is crypto taxed?

- Why is crypto tax so complicated?

- How to make crypto taxes easy?

- How are DeFi transactions taxed?

- The best way to prepare DeFi taxes

Disclaimer: This article serves only as a general guideline and does not constitute tax advice. Cryptocurrency tax requirements vary across jurisdictions. Generally, the article will use US tax guidelines as a basis for the content covered.

How is crypto taxed?

How cryptocurrency is taxed depends entirely on the tax jurisdiction in which you are a resident. There are some countries around the world which do not tax cryptocurrencies whatsoever. However, for those countries that do tax digital assets, such as the US, there are typically two types of taxes which you may be subject to.

The first is capital gains tax, which is triggered when you dispose of or sell a capital asset. If your tax jurisdiction treats crypto as a capital asset, this may be applicable to you if you have sold or disposed of any cryptocurrency.

The second is the income tax. It could be triggered in a variety of situations, such as rewards from liquidity pools, interest earned from referral rewards or lending tokens, staking rewards, or airdrops. The treatment of each individual transaction type is entirely dependent on each individual tax jurisdiction.

The Internal Revenue Service (IRS) released a guidelines guideline in 2014 that states that in the United States, cryptocurrencies are not treated as currency for tax purposes but as property.

This means that any purchase, sale, or exchange of cryptocurrency is a taxable event and must be reported on your tax return if you are a US resident for tax purposes.

Other countries around the world have released similar guidelines. However, the exact treatment of crypto in each country is not uniform, and you must check the guidelines for your tax jurisdiction.

Why is crypto tax so complicated?

To calculate and report your crypto taxes, you need to compile all your DeFi transactions in a standard format, often across many years. You need to be able to track your purchase price (the cost basis) in order to calculate your net capital gain or loss, even if it is several years down the track.

For example, if you were lucky enough to purchase some Bitcoin at a price of $1000, then decided to sell it all at a price of $20,000, you would need to retain the buy record from several years ago to give it a cost basis. Without the buy record, you would not be able to deduct the $1000 cost from the proceeds, leading to a higher tax bill.

DeFi crypto taxes are even more challenging because it's not always easy to download transaction histories or tell the difference between what is a taxable event and what isn't. It doesn't help that many wallets don't properly track DeFi transactions and things like liquidity pool tokens and staked governance tokens.

Luckily, smart wallets like Zerion Wallet make it a lot simpler.

How to make crypto taxes easy?

If you have interacted with DeFi protocols and/or traded NFTs, you might be staring down the barrel of a crypto tax nightmare. Luckily, some tools will help you sort out your tax obligations so you can finally get a good night of sleep.

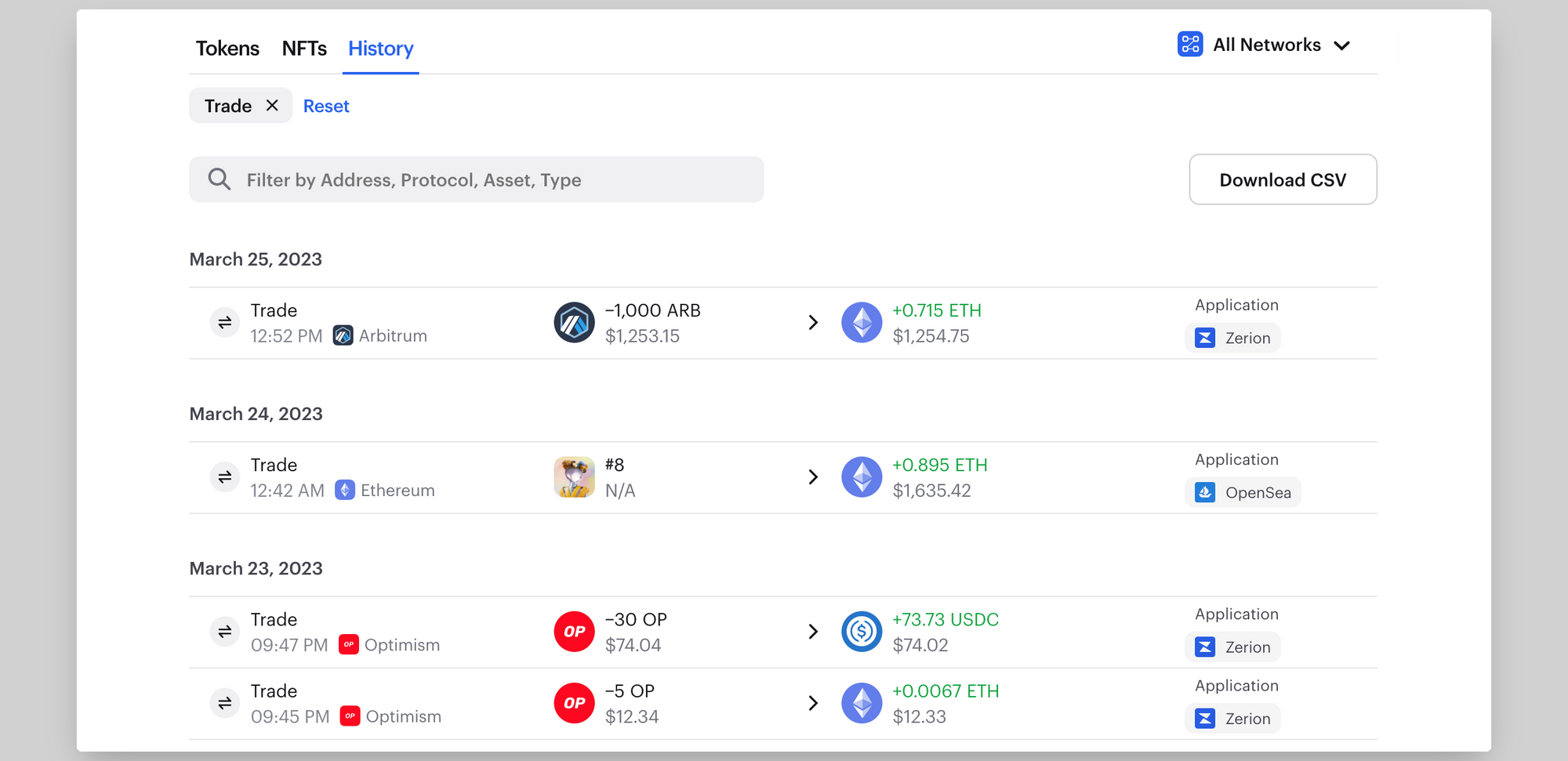

Zerion Wallet tracks your entire DeFi portfolio from one place and shows you a complete multichain transaction history.

Zerion also recognizes liquidity pools, governance tokens, assets in crypto lending pools, yield farming and liquidity mining rewards, and all sorts of other DeFi protocols.

By connecting to the Zerion app, you can also export a CSV of your entire DeFi portfolio history, categorized by the kind of transaction taking place. Then you can further sort into transaction types for taxation purposes – such as deposit, income, or trade.

Some crypto tax software options can also assist in calculating your crypto taxes, however, not many of them can handle more complex DeFi and NFT related activity. Advanced crypto tax software like CryptoTaxCalculator can further simplify your taxes by automatically recognizing complex on-chain transactions and generating tax reports.

Regardless of what tools you use, it's still important to understand how and when you need to pay DeFi tax.

How are DeFi transactions taxed?

Decentralized finance (DeFi) has opened up an entirely new world of possibilities for investors to partake in peer-to-peer financial activities. The opportunities to earn yield are almost endless, and while this can be a fantastic opportunity for investors willing to go down the rabbit hole, it also opens up a can of worms in regards to tax.

Many DeFi transactions could constitute a disposal event. For example, depositing funds into smart contracts technically means the funds have left your wallet and are no longer controlled by you. If you aren’t careful, you may trigger capital gains tax events unintentionally when apeing into the next DeFi protocol. Token rewards are also generally counted as income at the time they recieved, which can have a significant impact on your tax obligations when it comes to tax time — especially if your tokens fall in price after they are recieved.

To help you stay on top of your tax obligations and avoid getting yourself in a sticky situation come tax time, let's take a look at the potential tax treatment of different DeFi strategies.

HODLing

This is the simplest of actions: you simply buy a cryptocurrency or DeFi token and hold it. Any loss or profit you make is based solely on the price movement of the assets being held. In most tax jurisdictions, HODLing is not taxable. However, some tax jurisdiction have a “wealth tax,” which is often implemented as a % tax on the market value of your assets on a certain date.

In tax jurisdictions that treat crypto as a capital asset, such as the US, Australia, Canada, or the UK, if you dispose of your cryptocurrency for fiat currency, another token, or goods and/or services, you'll need to pay capital gains tax.

Swapping, Selling, Trading ,and Exchanging Crypto

For tax jurisdictions that tax the disposal of a digital asset, selling crypto to fiat or any crypto-to-crypto swapping, exchanging, or trading will result in a taxable event.

Even if you swap one stablecoin for another, such as USDC for DAI, you could owe capital gains tax.

Lending Crypto

Protocols like Compound, Maker, and Aave allow you to deposit crypto and earn interest at algorithmically variable rates. Unlike in a traditional savings account, interest is earned every few seconds. Interest payments from most protocols — whether exchanged for fiat or not — are generally taxed as income at its current fair market value (in fiat) according to your marginal income tax rate.

Let’s cover an example:

Some DeFi protocols do not pay the interest out directly, but rather let the value accrue to the deposit in the original token. Using the above example, this may look like the investor depositing 10 ETH at the start of the year and withdrawing 11 ETH at the end of the year. This situation is a grey area for taxes — if the investor recieved a receipt token when first deposited and traded it back to the protocol to withdraw the original ETH + accrued interest, it could be argued that this is a capital gains event.

In any case, it is worth consulting with a tax professional for your particular situation.

Borrowing

Crypto lending platforms let you put collateral and borrow funds in another asset, for example, USDC.

Providing funds to be used as collateral is still a grey area in most tax jurisdictions. As long as your collateral is not deemed to have been sold, disposed of or exchanged (including if it's liquidated), generally, no taxes will be triggered. This is useful if you want to pay taxes without selling crypto and facing additional tax consequences.

There are special tax rules if you use borrowed crypto to make additional investments. However, this varies by situation and tax jurisdiction. In general, your interest payments could be classified as investment interest expense. These expenses could be tax deductible but only up to your net investment income.

If you have participated in any lending or borrowing activities, it is recommended that you speak with a tax professional regarding your individual situation.

DeFi Liquidity Pools

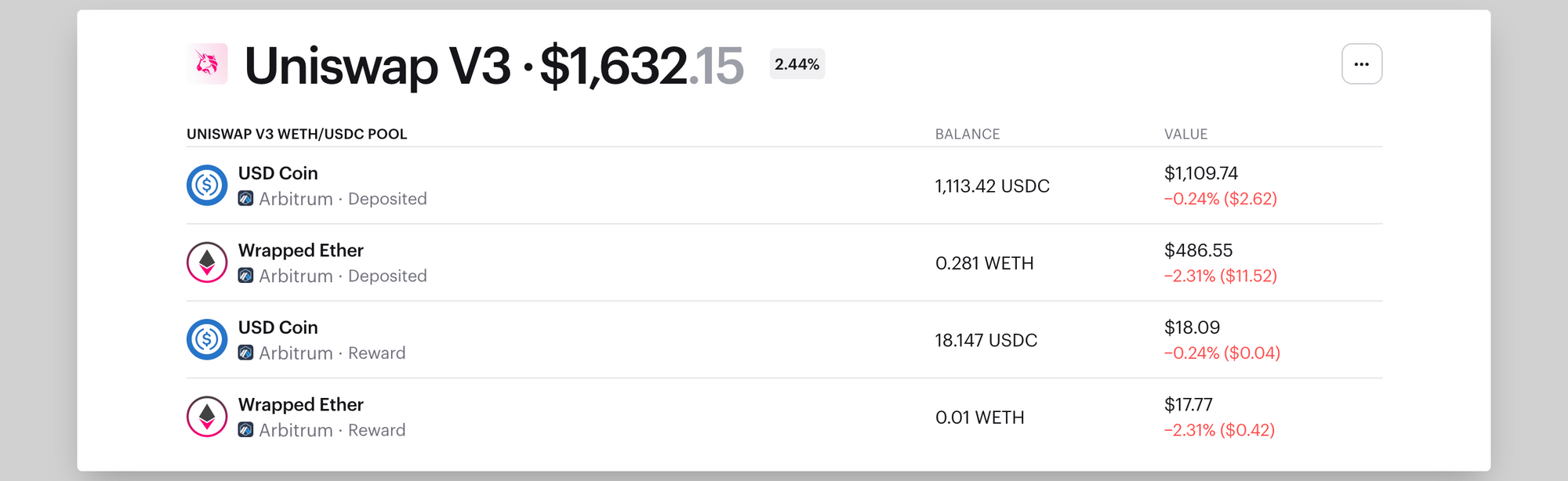

Liquidity pools on decentralized exchanges like Uniswap, Curve, and Balancer allow you to earn trading fees proportional to your deposit in an asset pool, such as ETH-DAI, each time that pair is traded.

When you deposit crypto to a DeFi liquidity pool, the protocol mints a token that represents your share in the liquidity pool. Similar to the example described in the lending example above, if the DeFi protocol distributes interest earnings with additional tokens, that interest is taxed as ordinary income.

Liquidity mining rewards are generally distributed like this and would also generally fall into the income tax treatment category. If you sell your liquidity mining rewards or interest down the track, it is important to remember you are also triggering a capital gains tax event. If the tokens have increased in value since they were first received, you could have further tax obligations.

However, if the protocol distributes yield not through additional tokens but through an increase in the value of an existing token balance, that interest could be taxed as capital gains when disposing of the receipt token.

Finally, when decentralized exchanges offer liquidity mining rewards, these would be subject to income tax (at a price you when you claim them). If you sell your liquidity mining rewards, you might also need to pay capital gains tax.

Wrapped Tokens

A wrapped token is a special version of the token that exists on another blockchain (such as WMATIC on the mainnet Ethereum) or a smart contract (such as WETH, the ERC-20 version of ETH). Wrapping tokens generally still falls into a grey area in most tax jurisdictions.

The price of a wrapped token is typically pegged 1-to-1 to the underlying asset. So when you convert MATIC into WMATIC, it could be argued that they are the same asset.

However, it could also be argued that small price differences between when the original token and the wrapped version result in a capital gains tax, just like a regular crypto-to-crypto trades.

Staking Tax Implications

There are many types of staking.

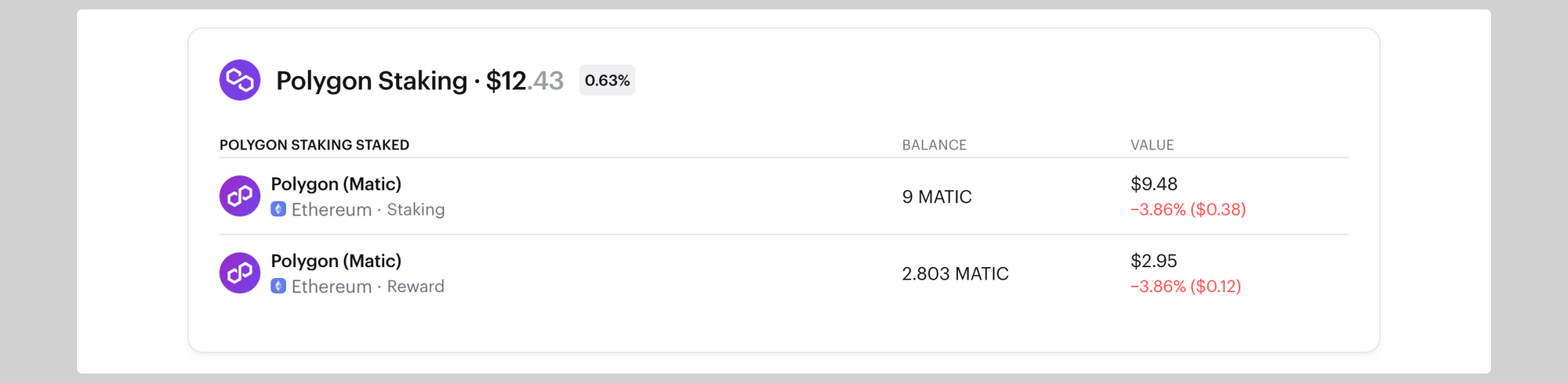

Some DeFi protocols like Synthetix (SNX), Sushswap, or Aave let you stake their governance tokens in the protocol and earn some rewards.

In Proof of Stake networks, you can stake the native tokens such as MATIC or ETH and earn block rewards for helping to secure the network.

In general, you receive new tokens as your staking rewards. These rewards are generally taxed as ordinary income at the fair market value at a time when you receive them in your wallet.

Some liquid staking protocols could offer certain advantages from the tax perspective. For example, you can buy stETH, which represents your share of the pool, and simply hold it. Earned yield is added to the pool and accrues as further value to the held token. So you may only need to pay capital gains tax when you eventually sell your stETH.

Other liquid staking DeFi platforms might have crypto income in form of another token (like rETH for StakeWise). This can result in income that needs to be declared come tax time.

Yield Farming Tax Implications

Yield farming can come in all shapes and sizes, but the end goal is simple: earn yield.

Ultimately, yield farming consists of providing tokens as liquidity to a protocol which has token incentives. These token incentives are paid out in the platform’s native token. In general, these rewards are taxed as income using the market value at the time they were received. If you decide to hold the tokens and sell them at a higher price down the track, you may also be liable for capital gains tax.

Governance Token Income

There is a wide range of governance tokens, and some of them pay a share of their native platform’s revenue as income. Just like the examples outlined above, token rewards generally taxed as income using the market value at the time they were received.

If the yield is paid through the price appreciation of the governance token (as is the case with xSUSHI), then you'll face capital gains tax, but only when you sell the token.

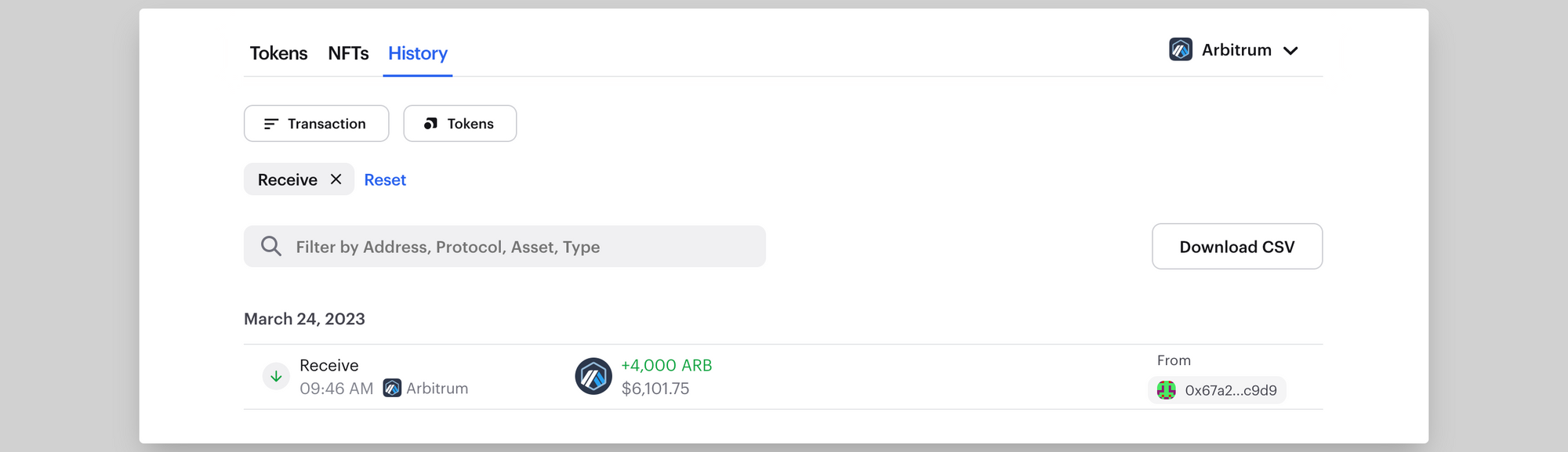

Airdrops

The are two types of airdrops:

- When you claim some tokens (like was the case with the Optimism airdrop)

- When you just get something in your wallet without asking for it (sometimes worthless spam or scam tokens).

If you claim an airdrop from a DeFi protocol, this would most likely be classed as ordinary income at the fair market price when it lands in your wallet. If and when you sell an airdrop, you might also have capital gains if the price had gone up since when you claimed them.

Meanwhile, worthless spam and scam tokens can be marked as spam. Advanced software like CryptoTaxCalculator will automatically highlight suspected spam tokens so that you don’t end up having a huge tax obligation from fake tokens.

Options

DeFi protocols like Lyra and Opium let you take buy call and put options. Crypto options are still a relatively grey area, not only for tax purposes but as an entirely under-explored component of the Web3 industry. In general, options contracts are typically treated like other capital assets and are subject to capital gains tax if there are gains made at the point of sale or settlement.

If you deposit into a liquidity pool that enables option trades, the rewards and fees you earn will generally be subject to income tax.

Automated strategies

Some DeFi protocols let crypto investors automate certain actions or save on transaction fees. Tax treatment of automated crypto strategies depends on how these strategies are set up.

In general, automated DeFi protocols have some user-controlled actions (like a deposit to a liquidity pool) and algorithmic actions executed by the smart contract.

An action that you execute could result in a taxable event. Meanwhile, any automatic action done by the smart contract is unlikely to count as a taxable event.

DeFi indices on TokenSets could be an example. When you buy and sell the index, you get capital gains or losses. However, any automatic rebalancing of the index is not taxed as this occurs outside of your wallet.

Rebase tokens

Some decentralized finance protocols increase or decrease the supply of tokens based on the rules in smart contracts. If you buy rebasing tokens, you will see the number of tokens in your wallet change over time.

OlympusDAO's OHM and Wonderland's TIME are two best-known examples. These tokens fall into a grey area regarding tax, with an argument that the new tokens are capital acquisitions (have a cost basis of zero) rather than income. It is best to discuss your exact situation with a tax professional on how to best treat the rebase tokens you have interacted with.

Bridging

When you bridge tokens from one network to another, you interact with smart contracts. Depending on the bridge and the network you are bridging from/to, some tax jurisdictions may see the bridge transaction as a disposal of the original asset and a ‘buy’ of the asset on the new network. There is also a strong argument that if the same asset is received on the other network (it has the same token symbol and value), then it should not count as a disposal event. It is best to check the local guidance for bridging to ensure you remain compliant

Specialized crypto tax software should be able to automatically recognize bridge transactions and help you categorize them correctly.

Margin Trading

Margin trading involves borrowing funds to trade larger amounts of a specific asset and is supported by DeFi platforms like dYdX and GMX.

If the value of your collateral crypto goes down too far, or if the value of assets borrowed increases too much compared to your collateral, you'll trigger a margin call. This could lead to capital gains or losses.

To prevent your collateral from being sold off, you need to deposit more crypto as collateral. For margin trading, taxable amounts are the net capital gain or loss at purchase and sale.

Lottery-like rewards

Depending on your jurisdiction, variable rewards from protocols like PoolTogether are taxed as ordinary income according to the marginal income tax rate.

How to prepare your DeFi taxes

Zerion partnered with CryptoTaxCalculator to make calculating your DeFi taxes incredibly easy, save you a stack of time and help you feel confident your tax reports are correct.

This tax software was built by Web3 enthusiasts who weren't satisfied with other software and decided to build their own specifically for complex DeFi transactions.

To get started, import your exchanges and wallets via the platform's direct integrations. Once all of your transactions are imported, the platform will automatically categorize your transactions. As DeFi and NFT transactions are inherently complex, the platform will also provide smart suggestions that can assist in optimising your tax report for accuracy so that you do not overpay on tax.

After the suggestions have been checked, you are ready to generate your tax-optimized reports — it's that simple.

Quit screwing around with Excel spreadsheets and sort out your crypto tax nightmare with CryptoTaxCalculator.

You get 40% OFF if you hold a Zerion DNA in your Zerion Wallet — and if you don't have the DNA yet, you can mint it for free after installing the wallet.

Use the code ZERIONCTC40 when checking out — try CryptoTaxCalculator now.

FAQ

How do I pay taxes on DeFi?

When you interact with decentralized finance, you can trigger both income tax and capital gains tax. Your tax reporting and the size of your tax bill would depend not only on your actual profit but also on how those DeFi protocols work.

Can I use DeFi to avoid taxes?

In short, no — DeFi is not useful in avoiding taxes. Blockchains are immutable, public ledgers of all transaction history. Tax authorities around the world are aware of this and are working towards doing mass audits of the chain to see who has or hasn’t been paying their taxes. KYC’d exchanges and IP address tracking makes it very simpler to put names to wallets. Don’t put yourself in a sticky situation down the track. Stay on top of your DeFi taxes.

Can the IRS track DeFi wallets?

Yes, the IRS can most certainly track DeFi wallets. Decentralized blockchains like Ethereum are immutable, public ledgers of all transaction history that has taken place on-chain. If you ever interacted with a centralized exchanged or completed a KYC to on-ramp or off-ramp, your on-chain wallets can be linked to your identity very easily.

Does a DAO pay taxes?

DAOs are extremely new, and there is yet to be specific guidance on the tax structure for these organisations. As a result, it's possible that individual members of the DAO or any affiliated entity could have tax implications for DAO involvement. It is best to discuss this with a tax professional.

How are tokens taxed?

If you buy and sell tokens, they are most likely taxed as capital gains.

Any tokens you earn (as an airdrop, interest payments, or other crypto income) will likely be subject to income tax.

Do you pay taxes on decentralized crypto?

Yes, in most countries, you need to pay tax on decentralized crypto in DeFi platforms. You would either have capital gains or income tax, depending on what type of taxable event you get.