GMX is a decentralized perpetual exchange with up to 50x leverage.

In this post, we'll explore what GMX is, review the GMX and GLP tokens, and show you how to use this exchange.

What is GMX?

Launched in September 2021, GMX is a perpetual contract trading platform for top cryptocurrencies.

Unlike decentralized spot exchanges, on GMX you trade perpetuals. You don't actually buy or sell any token. Instead, you deposit collateral and can take long and short positions. At settlement, the profit is paid in USDC (for shorts) or the pair's other token (for longs).

On GMX, you get leverage of up to 50x.

Coupled with zero price impact trades, limit orders, and low swap fees, GMX became a magnet for degens. Especially those who try to qualify for potential Arbitrum airdrop.

The market prices are based on Chainlink's oracles, which aggregates price feeds from leading exchanges. This makes positions safe from liquidations due to random ticks on a single automated market maker.

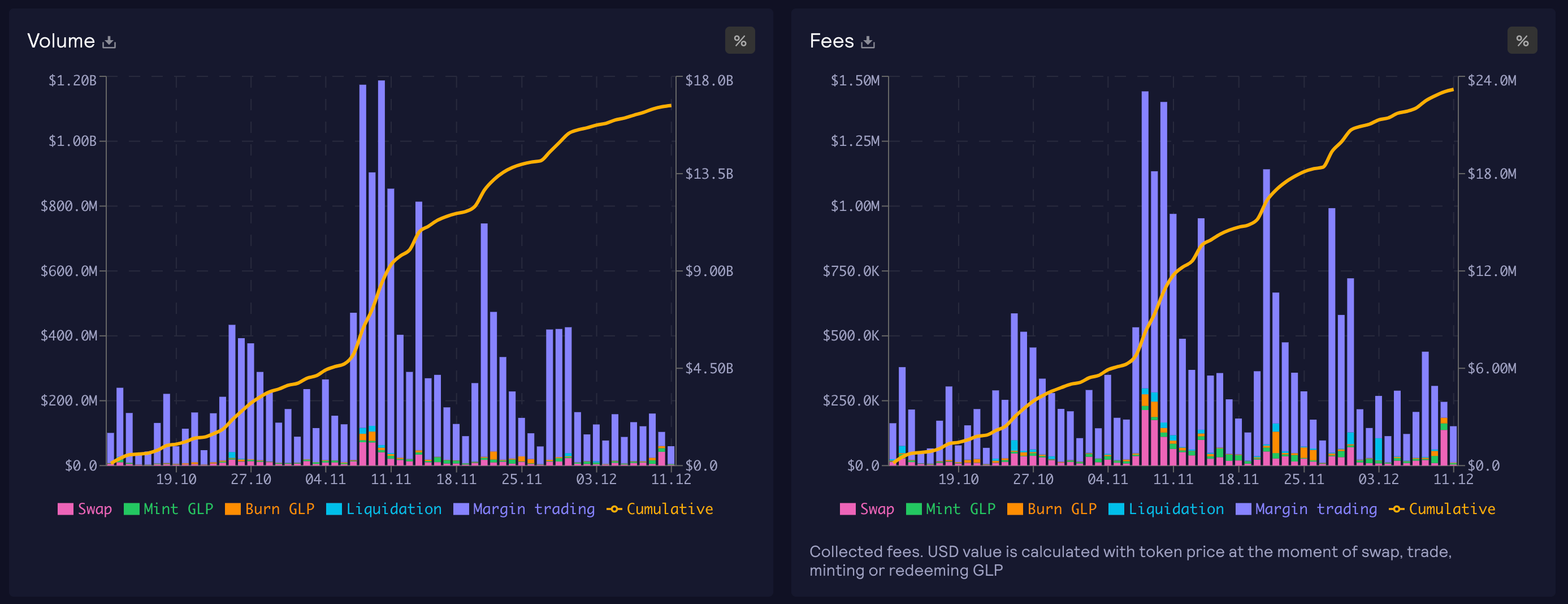

As a result, GMX became the top dapp on Arbitrum by TVL and the leading perpetual exchange in DeFi. The total trading volume exceeded $80 billion, as of December 2022.

The founding team

GMX is founded by anons.

The protocol started as the merger of XVIX and Gambit, which converted their tokens to GMX. One public-facing devs is X.

While a fully anon team could be a risk, this also insulates the dapp from regulations and frivolous lawsuits.

How does GMX work?

GMX isn't the first decentralized derivatives market but it has many unique features that other projects lack.

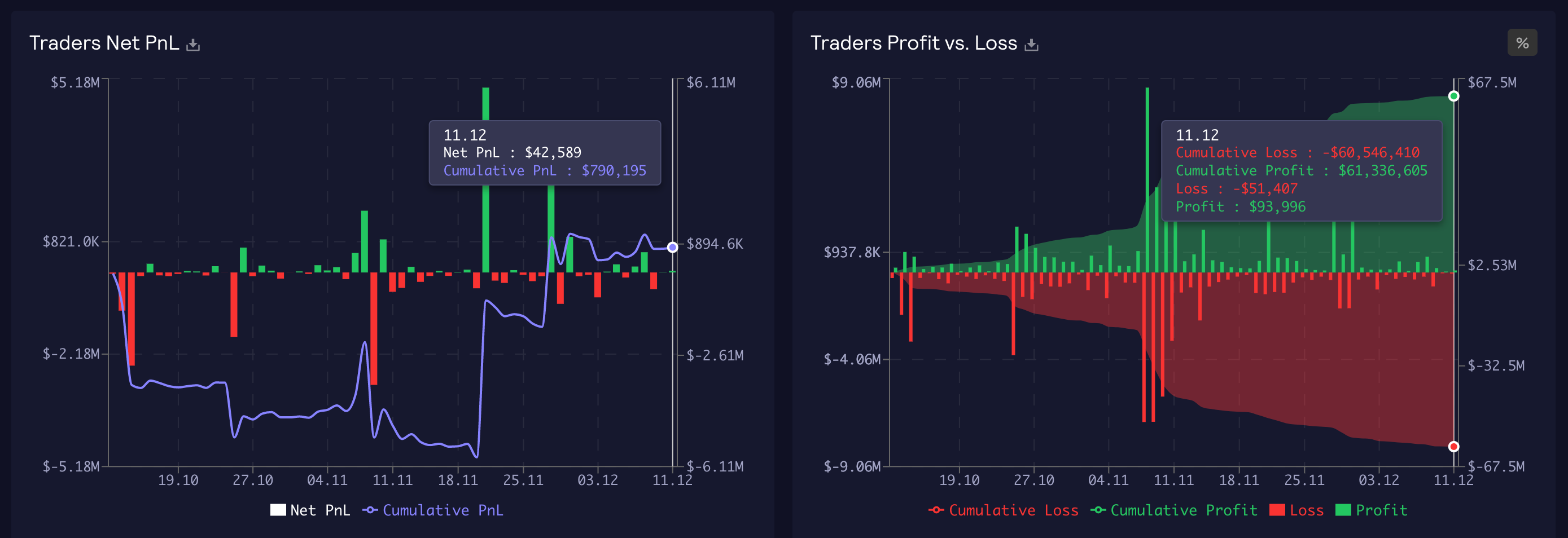

The core feature of GMX is a community-operated ‘unionized' liquidity pool – the GLP pool. GLP is an index used to provide liquidity for leveraged trading. The GLP holders earn when traders lose (leverage makes it easy!) and vice versa.

Traders on GMX benefit from zero price impact trades and pay two types of fees:

- Trading fee of 0.1% of the position size to open a trade

- "Borrow fee" equal to (assets borrowed)/(total assets in pool) * 0.01% per hour

This borrow fee depends on the utilization of the asset: it's lower for less popular assets and higher for more popular assets.

All platform fees are split between GMX and GLP token holders:

- 30% to GMX stakers

- 70% to GLP holders, i.e. liquidity providers.

GLP, the Liquidity Providers token

GLP is a LP token for providing liquidity to traders.

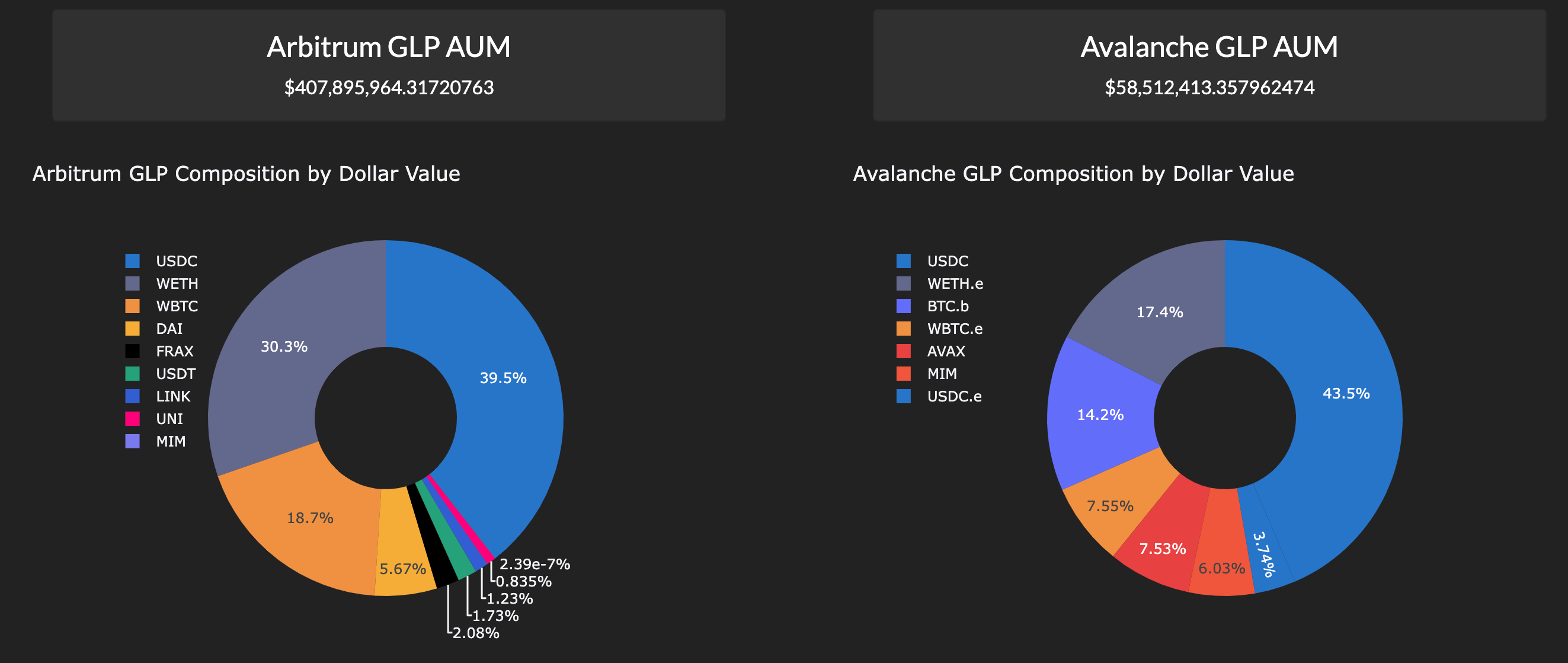

You can buy GLP tokens with any of the asset that are in the liquidity pool: USDC, WETH, WBTC, DAI, etc.

The fee depends on what's in the liquidity pool. It's cheaper to buy GLP with index assets that are demanded by the market but are underrepresented in the pool.

GLP on Arbitrum and Avalanche are different tokens. They have different compositions, different prices, and and cannot bridged.

Importantly, the yield for GLP holders is not based on GMX emissions.

The GMX token

GMX is the governance token for the GMX ecosystem.

It's expected to have a maximum supply of 13.25 million (but could be increased). The total supply now is ~8.2 million tokens, 85% of those are staked.

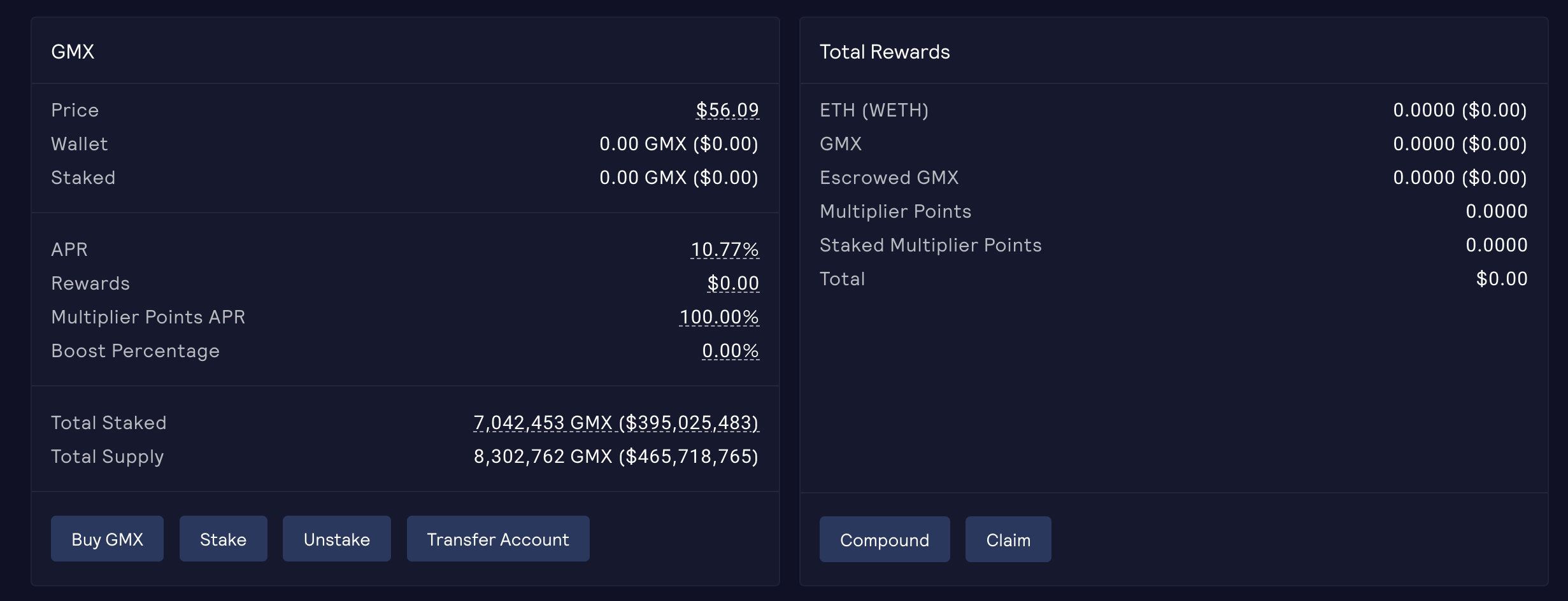

Staking GMX

Staked GMX tokens earn three types of rewards:

- Escrowed GMX (esGMX tokens), which come from liquidity incentives and vest gradually

- Variable ETH and AVAX APR from the 30% of fees generated from leveraged trading

- Multiplier points that boost APRs and encourage long-term staking

How can you use GMX?

The GMX exchange is a viable Web3 alternative to centralized exchanges. It lets you both trade and earn by providing liquidity for market making.

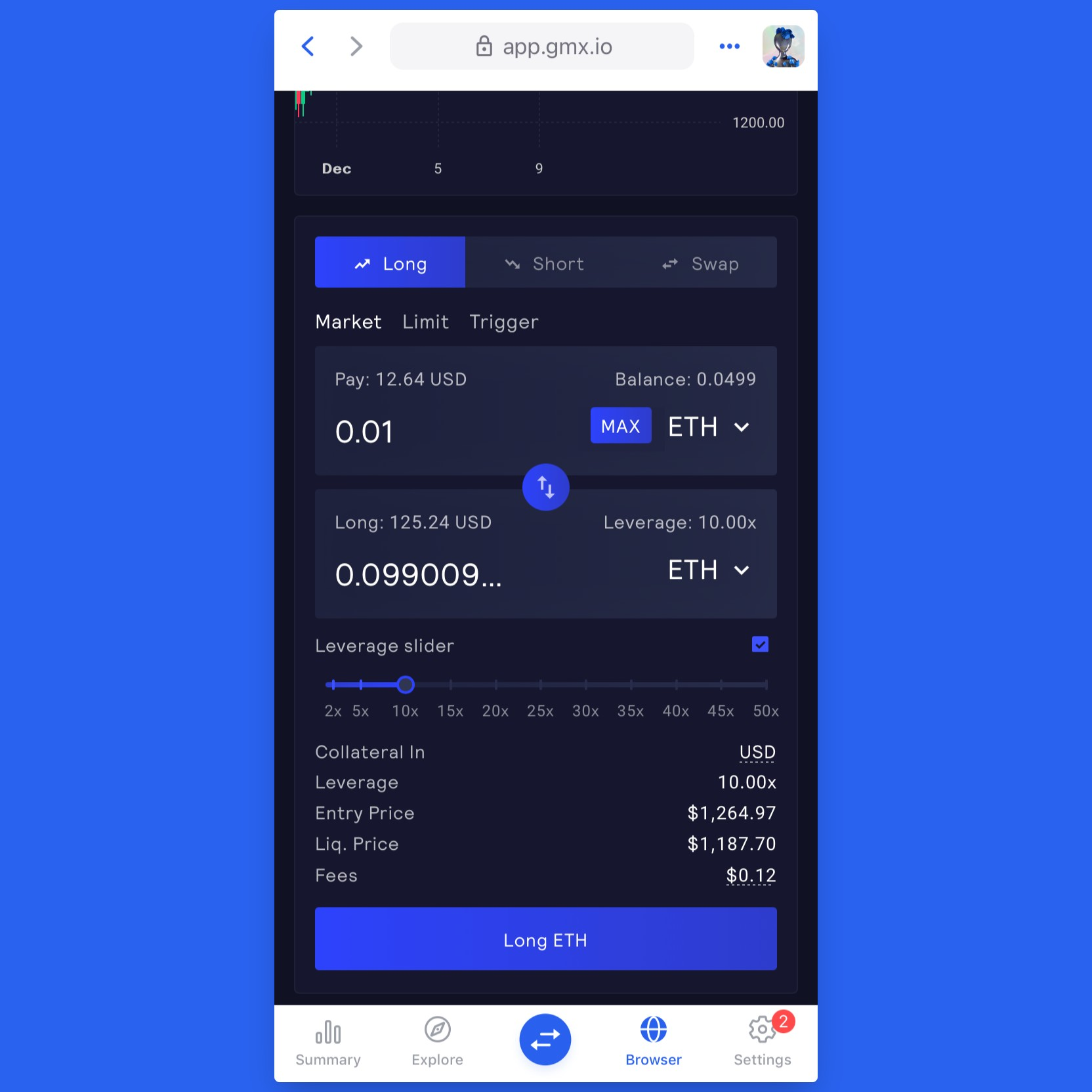

Trading with leverage

There' no registration process, no account, all you need is a wallet for Arbitrum!

With zero price impact trades and a friendly user interface, GMX could be a great way to scratch your degen itch without going to a centralized exchange.

Thanks to low fees on Arbitrum and Avalanche, the leveraged trading experience feels close to what you could get on a CEX. But be careful with leverage.

Staking GMX to earn a yield

By staking GMX token, you can earn a yield with compounding and boosted rewards.

However, the GMX token is not backed by anything. Its price depends entirely on supply and demand. There is, however, a floor price fund to support the GMX price in ETH and GLP terms.

The GMX yield is ~10% in ETH before any boosts.

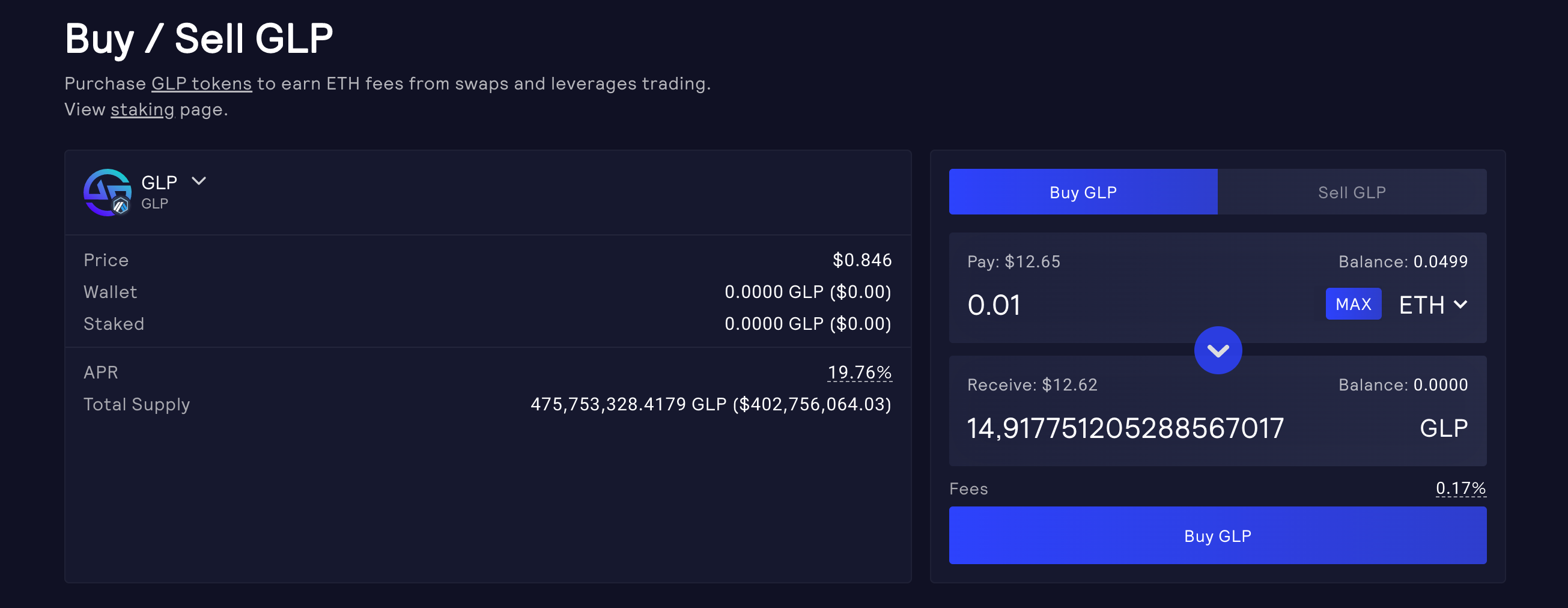

Providing liquidity with the GLP pool

You can earn a 'real yield' by swapping any constituent token for GLP pool.

The GLP pool is backed by assets in a transparent way. The yield comes from leveraged traders. But it's not risk-free: if traders win, GLP holders lose. Degens will lose on average but a sophisticated whale might find a way to exploit the model.

The GLP yield is ~19% in ETH. It's not fixed and will change.

Where to buy GLP pool

You can only buy GLP on GMX.

- Connect your wallet to GMX

- Go to the Buy GLP tab

- Select the asset you want to swap — it's cheaper if the asset is underrepresented in liquidity pools

- GLP is automatically staked

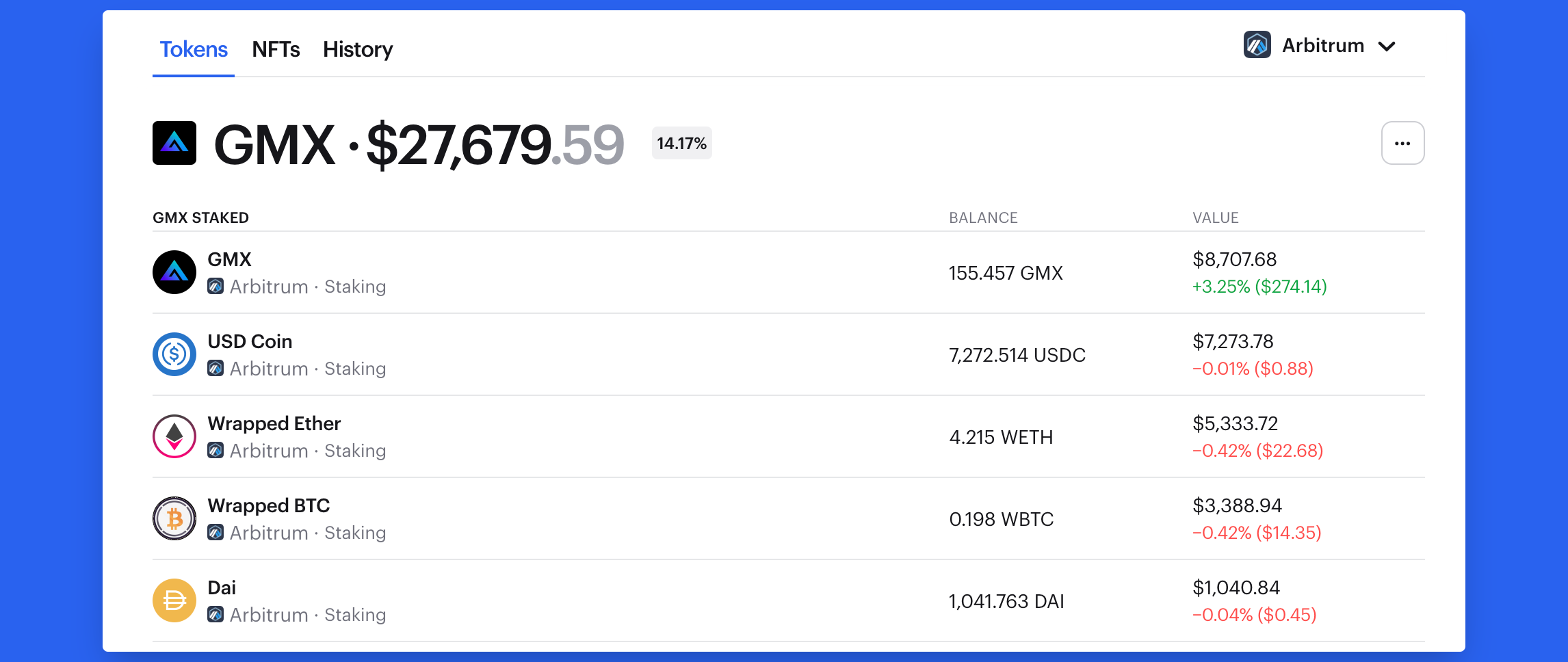

Zerion will show all staked tokens from your GLP index:

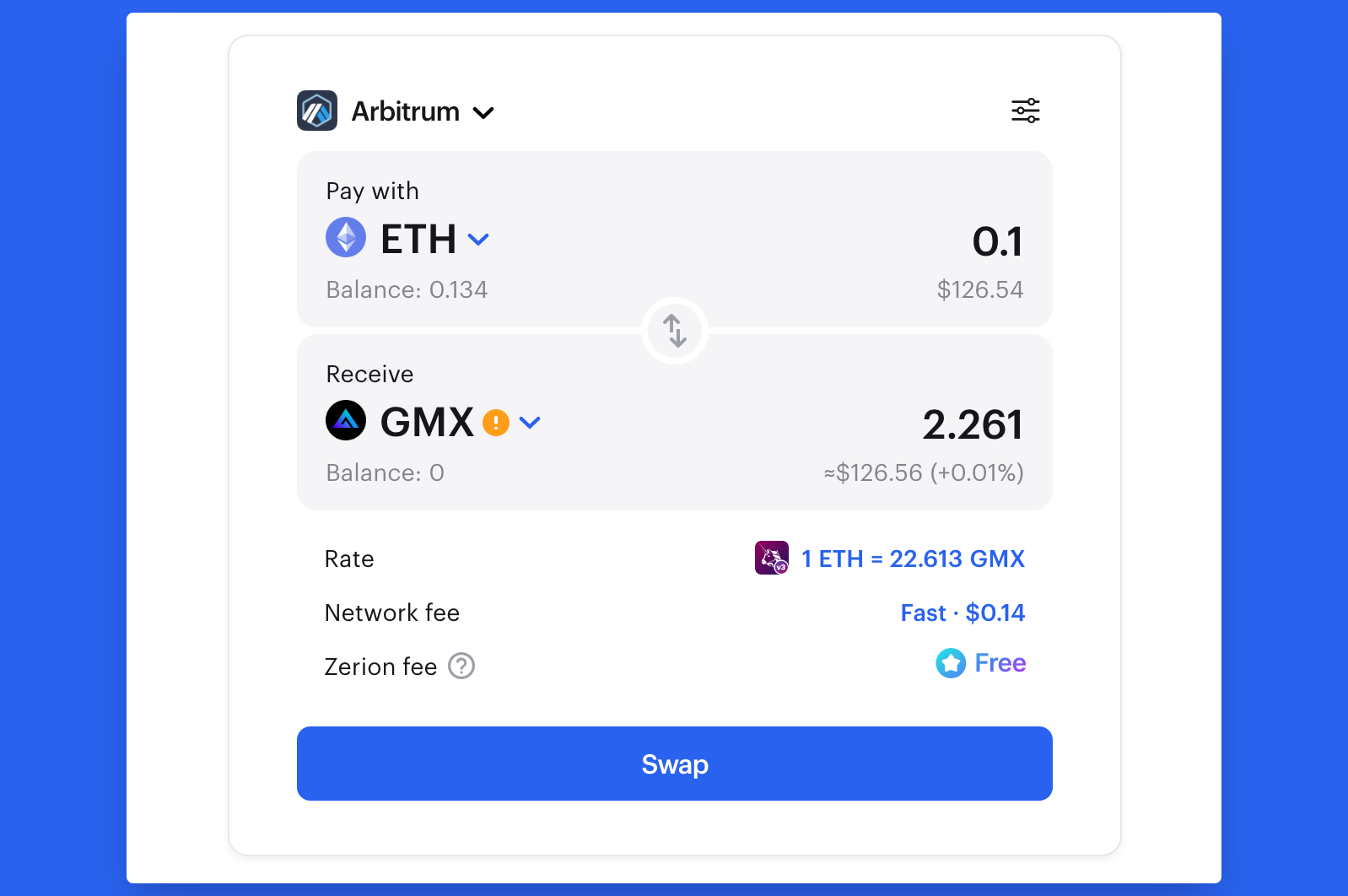

Where to buy GMX tokens

You can buy GMX on one of many decentralized exchanges.

Zerion swap can help you find you the best GMX price across all markets.

- Connect your wallet to Zerion web app

- Go to the Zerion Swap tab or just open your Zerion Wallet

- Select GMX, the Arbitrum network, and the token that you want to pay with

- Approve and sign the transaction

Once you got GMX in your wallet, you can stake it to earn a yield.

How to stake GMX

- Connect your wallet to GMX

- Go to GMX Earn tab

- Approve and sign the transactions

- Zerion will show your staked GMX balance and pending rewards

With Zerion Wallet, you can do trade on GMX, join liquidity pools, and stake your tokens to earn a yield — all on mobile!

FAQ

What is GMX vs GLP tokens?

GMX tokens are used for governance and accrue 70% of the total fees. GLP tokens are used by liquidity providers of the remaining 70% of fees.

Is GMX a good investment?

It depends on your goals and risk tolerance. GMX offers an attractive yield but it's certainly not risk-free.

What is GMX? Who owns the GMX exchange?

GMX is a perpetual exchange, community-owned by holders of GMX tokens. The GMX team is fully anon and there are no confirmed external investors.

Where can I get GMX tokens?

You can buy GMX on one of cryptocurrency exchanges that listed it. Zerion swap can help you find the best rate for GMX on Arbitrum and Avalanche.

How do I stake GMX tokens?

You can stake GMX tokens on the GMX platform to earn swap fees and fees from leverage trading.

How do I sell GMX crypto?

You can sell GMX on decentralized spot exchanges on the Arbitrum network. Alternatively, you can swap with Zerion's trading aggregation.

What is GLP token?

GLP is an index asset backed by tokens for which GMX offers perpetual futures.

What is GMX blockchain?

The GMX perpetual exchange is deployed on Arbitrum and Avalanche networks. GMX can be staked to earn 70% of swap fees. With the total trading volume exceeding $80B, even low swap fees add up to decent revenues.