Polygon, recently made headlines when Meta’s Instagram, Stripe, and Adidas announced their plans to partner with the network on a range of upcoming NFT and Web3 projects.

Despite these endorsements, many people still don’t know much about Polygon. While there is hardly a shortage of guides to Polygon, most of them are too heavy with blockchain jargon and tech details. Many crypto exchanges offer MATIC, the Polygon network’s native cryptocurrency, but don’t offer many options to use it beyond trading and basic staking use cases.

This post aims to fix this. We explain what Polygon is in simple terms and then dive into how you can use it to trade, stake, and earn yield with Zerion Wallet.

What is Polygon?

Polygon is a scaling platform for Ethereum.

Developers can use existing Ethereum tools and frameworks to build apps on Polygon with faster transactions and lower fees.

For users, Polygon offers lower fees and faster transactions decreasing the barriers to entry for people who aren’t crypto whales so they can enjoy DeFi, NFTs, and the rest of Web3 with Polygon.

For example, some of today’s top play-to-earn games are on the Polygon network. Also, many artists choose to mint NFTs on Polygon. And major DeFi protocols have versions on Polygon because it’s very easy to port smart contracts from the Ethereum mainnent.

Before exploring what you can do on Polygon, let’s quickly review how its technology has evolved.

Polygon history

Originally known as Matic Network, the network was launched in October 2017. The name of Polygon’s native cryptocurrency MATIC is from that era.

The first version of Matic was a set of Plasma chains that connected to the mainnet Ethereum.

The Matic team continued building during both the 2017 bull run and the 2018 bear market. And in 2019, towards the end of the crypto winter, Matic completed a $5,600,000 token sale through Binance Launchpad.

In 2021, Matic rebranded as Polygon to reflect its expanding range of scalability solutions.

Polygon’s technology

Today, Polygon is more than just an eponymous Proof-of-Stake network.

It's now a flexible framework that lets developers build and connect Plasma chains, Optimistic Rollups, zkRollups, Validium as well as Polygon Proof of Stake.

Most people and apps use Polygon Proof of Stake Chain.

This is an Ethereum sidechain, secured by its own Proof of Stake algorithm. The sidechain (aka Plasma chain) has its own validators and also uses checkpoint nodes that regularly submit fraud proofs to the Ethereum mainnet, which acts as the root chain. This leverages Ethereum for increased security.

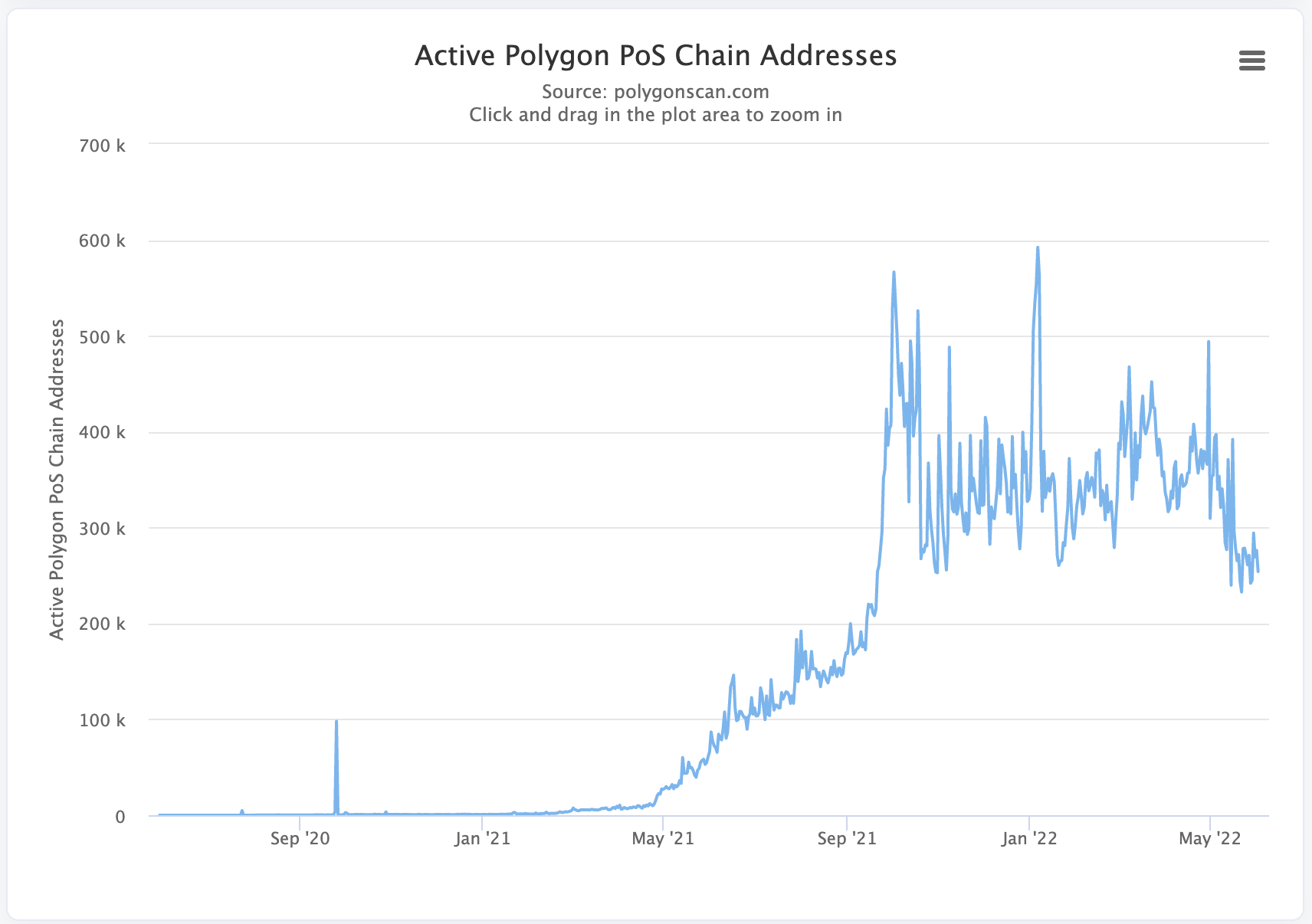

In January, Polygon PoS network hit a record of over 557,000 active addresses.

MATIC vs ETH

Just like ETH for Ethereum, MATIC is the native cryptocurrency of the Polygon network.

MATIC is used to pay for gas for all transactions on Polygon. It could also be staked to secure the network (more on that below).

What makes Polygon different?

Like other scaling solutions, Polygon offers faster transactions with lower fees.

The main differences are in what Polygon offers to developers building on top of the protocol:

- Established track record: Polygon POS mainnet is live since June 2020.

- User adoption: Polygon has over 140 million unique addresses and had a record of over 500,000 unique active addresses.

- Developer community: over 19,000 dapps are live on Polygon.

Coupled with full compatibility with Ethereum dev tooling, this makes Polygon an attractive network to build on.

Polygon ecosystem

Today, Polygon has one of the most developed ecosystems among all scaling solutions.

With a non-custodial wallet for Polygon, you can trade, stake, earn a yield, join play-to-earn games, and more.

Let’s explore these opportunities in detail.

Staking MATIC

Because the main Polygon network is Proof-of-Stake, you can stake MATIC to secure the network and earn rewards.

However, MATIC must be staked on the Ethereum network, which can be expensive.

There are two main options for staking MATIC:

- Centralized exchanges: Many exchanges that list MATIC also make it easy to stake the tokens without paying gas fees. However, exchanges usually take a cut.

- Decentralized staking platforms: If you hold MATIC in a non-custodial wallet, you can also delegate your MATIC to one of the validators. Alternatively, you can easily stake MATIC with Lido with Zerion.

The Polygon network itself, however, has more exciting opportunities than just staking MATIC.

Polygon bridges

To enjoy low fees on Polygon, you first need to move some assets to a non-custodial wallet like Zerion, the best wallet for Polygon.

One way is to first buy MATIC on one of the centralized exchanges and then withdraw tokens to the wallet.

If you already have some tokens on Ethereum or other networks, you can also use a bridge to move them to Polygon.

All bridges work the same way:

- You lock up assets in a smart contract on one chain.

- These assets are automatically minted on Polygon.

- When you bridge back, the assets are burned on Polygon.

- The asset is then released on the other network.

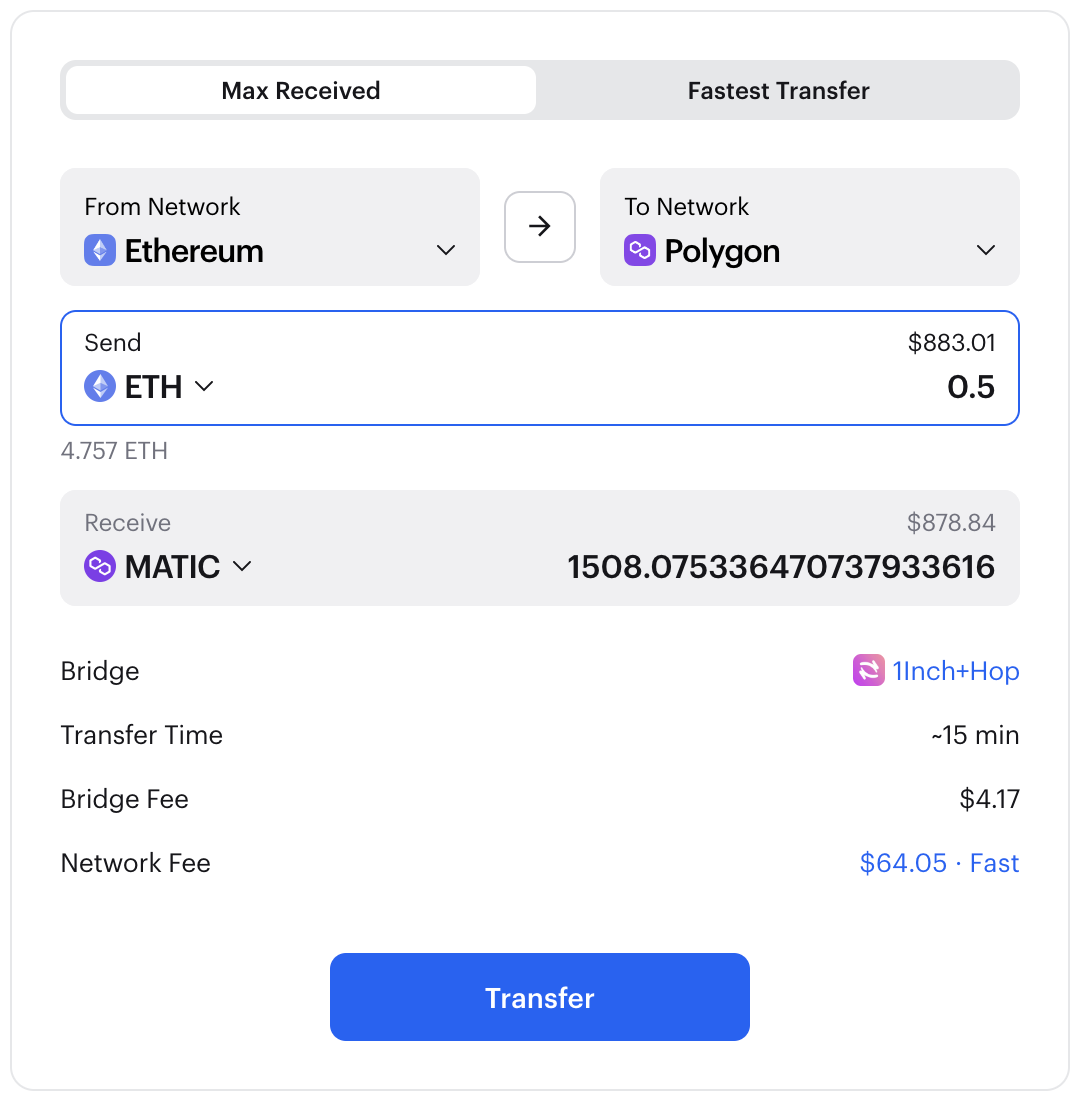

Many bridges support Polygon: Hop.Exchange, Anyswap, and Polygon Bridge to name a few.

Often one bridge will offer a better rate, giving you more of the original asset on Polygon.

Zerion’s bridge aggregator uses Socket to help you find the most efficient and seamless way to bridge assets to Polygon.

Under the hood, Zerion automatically checks rates and speed on all bridges and gives you the best deal. Just head to Zerion’s bridge, and select the networks and assets:

To pay gas fees for transactions on Polygon, you will need to send or bridge MATIC. After that, you can buy tokens on the network.

Tokens on Polygon network

Most ERC-20 tokens from the Ethereum mainnet are also available on Polygon.

This includes stablecoins such as USDT and USDC as well as wrapped coins from other blockchains, for example, WBTC.

DEXes

Most major DEXes support the Polygon network, including:

- Curve

- Uniswap

- SushiSwap

- Balancer

Even greater liquidity is available on Polygon-native DEXes:

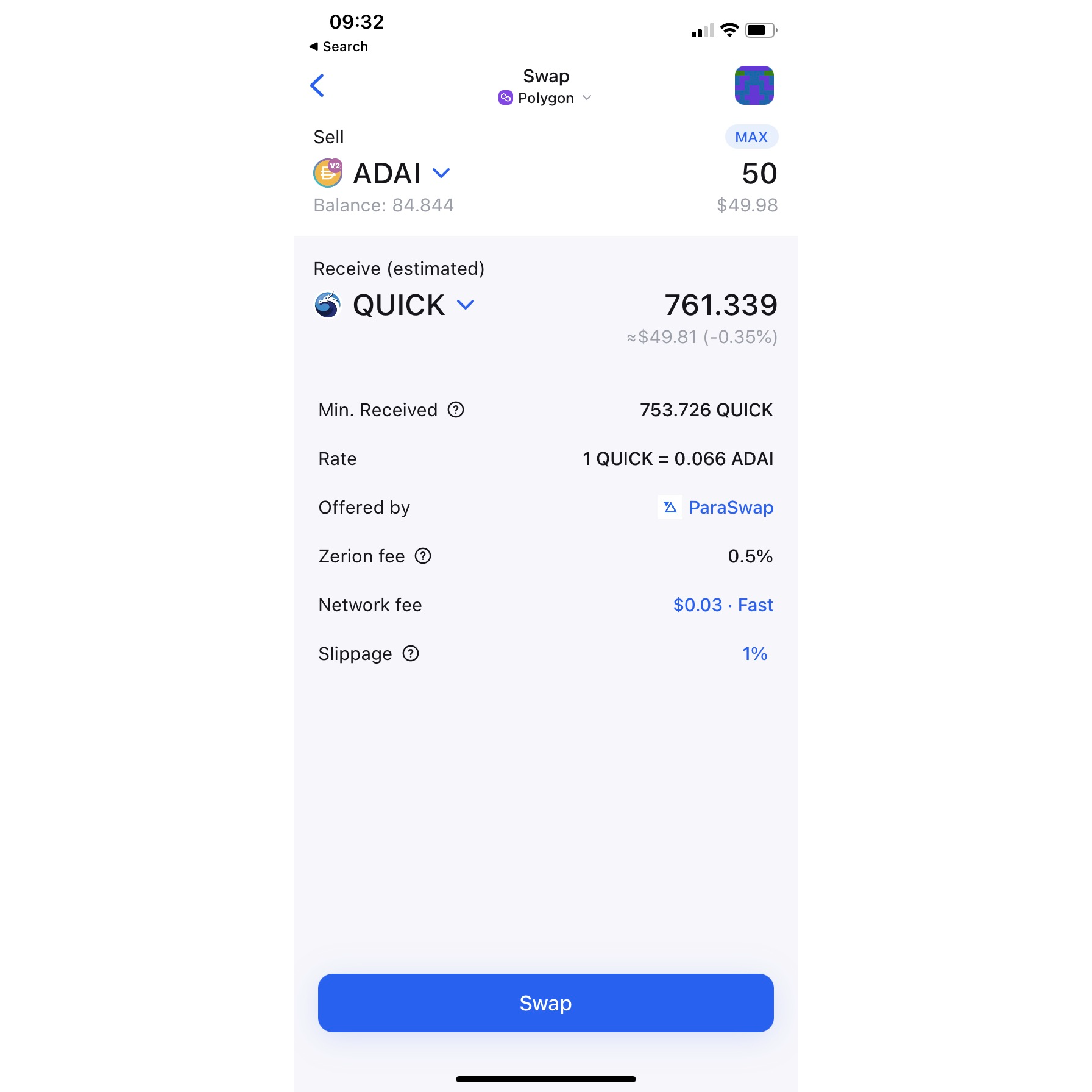

- QuickSwap (QUICK), which has the highest total value locked (TVL) on Polygon

- Meshswap, which is the third DEX by TVL on Polygon

With Zerion’s built-in trading aggregation, you can find the best rates across all the DEXes on Polygon.

When you tap Swap in the Zerion Wallet and choose the assets to sell and buy, Zerion will automatically scan every DEXes and give you the best deal.

But decentralized finance on Polygon isn’t limited to DEXes.

DeFi on Polygon

Because it’s easy to port any application from Ethereum, Polygon now boasts a thriving DeFi ecosystem.

This includes some of the top protocols from Ethereum, including:

- Aave (AAVE): The largest decentralized liquidity protocol that lets lenders and borrowers

- PoolTogether (POOL): A savings protocol that gives a chance to win prices every week, like a “lossless lottery”. Even if you don’t win, you get whole deposit back or try next week.

- Set Protocol (wen token?): A portfolio management app that lets you buy sets of tokens that are automatically managed by various strategies. For example, if you’re bullish on MATIC, you can buy MATIC2X-FLI-P, a set that gives a 2x leverage (by taking a loan in USDC). Or if you think the bear market will continue, you can buy iMATIC-FLI-P, the “Inverse MATIC” set that gives a -1x (negative) leverage. And with sets you don’t need to worry about the risk of liquidations or emergency deleveraging.

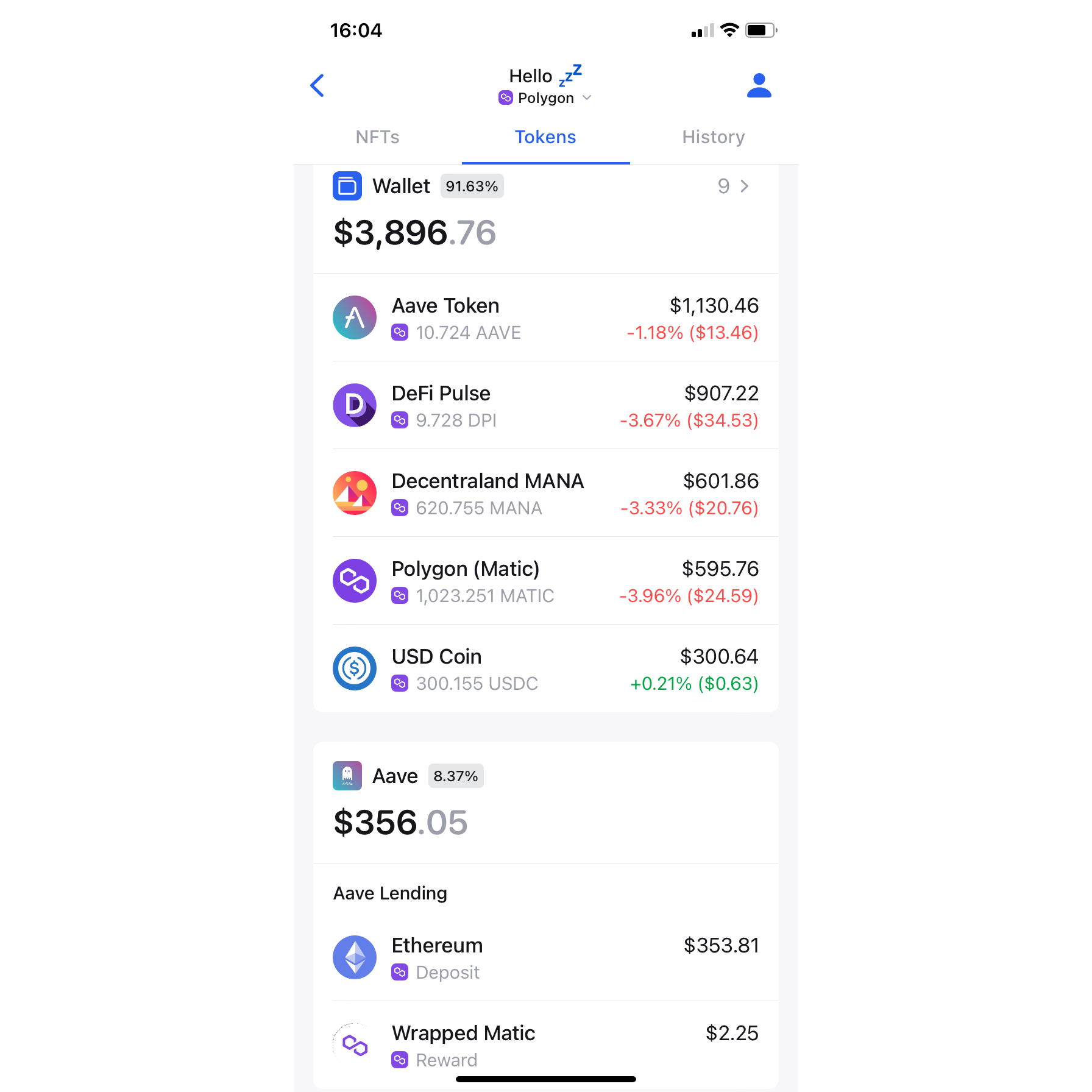

All these protocols are also on Ethereum but gas fees can make them too expensive to use unless you have a big portfolio. Polygon can give you a taste of DeFi without spending hundreds of dollars on gas fees. With Zerion Wallet you don’t need to set up Polygon or manually add tokens — you can easily switch the network in a tap. Zerion Wallet will automatically find your positions, debts, and rewards.

However, Polygon is not only about finance.

Play-to-Earn games on Polygon

Some of the most popular play-to-earn games (also known as gamefi) initially launch on Polygon because low gas fees make it easier for users of all experience levels to get involved.

Here are a few examples:

- Aavegotchi (GHST): Stake NFT-based digital pets with Aave’s interest-generating tokens and increase the pet’s rarity through mini-games.

- REVV Racing (REVV): A car-racing game where players can earn REVV for competing in tournaments. Cars are NFTs and play sessions are saved on the blockchain but the game looks like a regular 3D game on a PC or a console.

- Crypto Raiders (RAIDER): A retro-style NFT-based RPG game where players can explore dungeons and fight monsters. Holders of RAIDER token can also stake it to earn AURUM, the in-game gold.

Most play-to-earn games like these require some initial investment but the bear market has pushed the prices down and it’s relatively easy to find bargains. And with Polygon you don’t have to worry about spending much on gas if you later decide to sell your in-game NFTs.

Getting Started with Zerion Wallet on Polygon

The first thing you need to enter Polygon is a non-custodial wallet like Zerion Wallet.

While many Ethereum wallets support Polygon, Zerion Wallet is the only one that offers:

- Trading on Polygon, Ethereum, and 8 other networks

- Connecting to any dapp on mobile, signing any Polygon transactions

- Advanced tracking for your DeFi positions on Polygon

Here are the steps you need to enter the Polygon ecosystem with Zerion Wallet.

1. Download Zerion Wallet for iOS or Android.

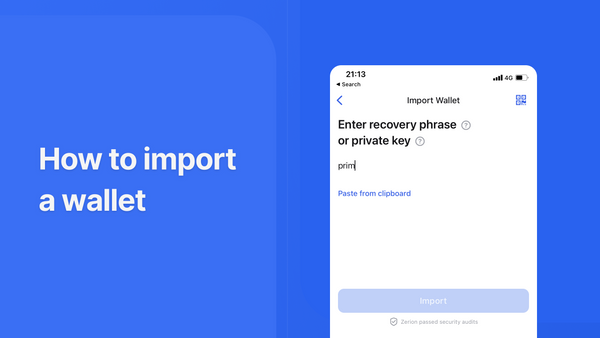

2. Create a new wallet or import an existing wallet. To import an existing wallet like MetaMask you need to export your private key or enter your seed phrase.

3. Buy MATIC. You can buy it on any major centralized exchange like Binance or Coinbase.

If you already have some ETH on a non-custodial wallet, you can buy Matic on Zerion’s trading aggregation tab — it will scan all DEXes and find you the best rate.

4. Send MATIC to your Zerion Wallet.

If you bought MATIC on a centralized exchange, you will need to withdraw it and enter your Zerion Wallet’s address as the receiver.

If you used a DEX to buy MATIC on Ethereum, BSC, or any other network, you can use Zerion’s bridge aggregation to find the best bridge for transferring MATIC to your Zerion Wallet.

5. Explore Polygon. Now that you have MATIC, you can buy tokens, swap, earn a yield, and more.

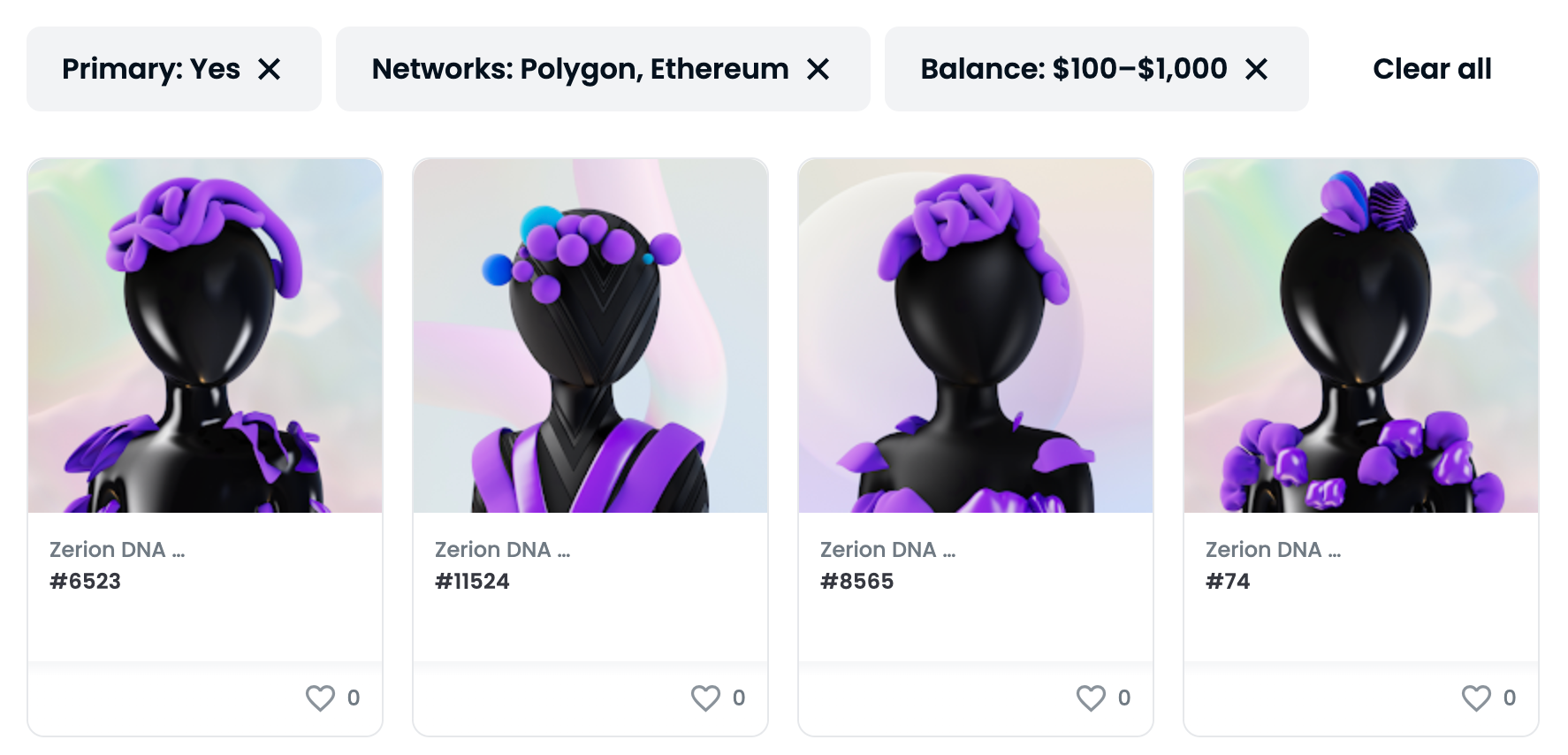

But before you go on your Web3 adventure, don’t forget to claim your Zerion DNA, the living NFT that changes with your every on-chain action.

If most of your assets are on Polygon, your DNA will be mostly purple.

While you hold Zerion DNA in your Zerion Wallet, every transaction — swapping, sending, adding LP — increases its rarity.

With Polygon’s low gas fees and many DeFi and play-to-earn apps, you can quickly rack up your transaction count.