How to Create a DeFi Portfolio

Learn how to save, invest and track your decentralized finance (DeFi) assets using Zerion’s simple interface

Learn how to save, invest and track your decentralized finance (DeFi) assets using Zerion’s simple interface

If you’re completely new to decentralized finance (DeFi), then you’re in the right place! Zerion is the simplest way to invest in DeFi from anywhere in the world. This easy step-by-step guide will teach you how to set up your complete DeFi portfolio in less than 10 minutes!

First, what is DeFi? 🤔

Decentralized finance — or DeFi for short — is an umbrella term for services like investing, borrowing, lending and trading based on decentralized, non-custodial infrastructure. Intrigued? We’ve written extensively on what DeFi is and why we need it.

The protocols that underpin DeFi are interoperable, programmable and composable.

Interoperable means that functionality isn’t siloed. The current financial system is controlled by middlemen and rent seekers, so it’s the norm to restrict access based on arbitrary factors like nationality, income or the bank you use. DeFi is defined by transparency and functions that work seamlessly together, regardless of who created them.

Programmable means that transactions are controlled by smart contracts, not people. This makes the system more secure and customizable, so there are limitless possibilities.

Composable means that the entire system is a bit like a box of Lego blocks — there is no limit to what can be built. Everything can be assembled in multiple combinations and there’s always a perfect fit.

How do I get started with DeFi?

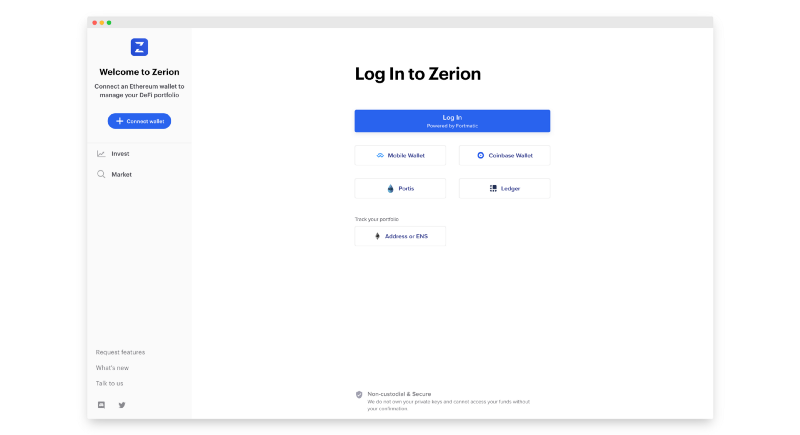

Step 1: Zerion is non-custodial, which means we don’t have user accounts and never have access to your funds. To make the most of Zerion, you’ll need an Ethereum wallet. Once you have this, go to app.zerion.io and connect your wallet.

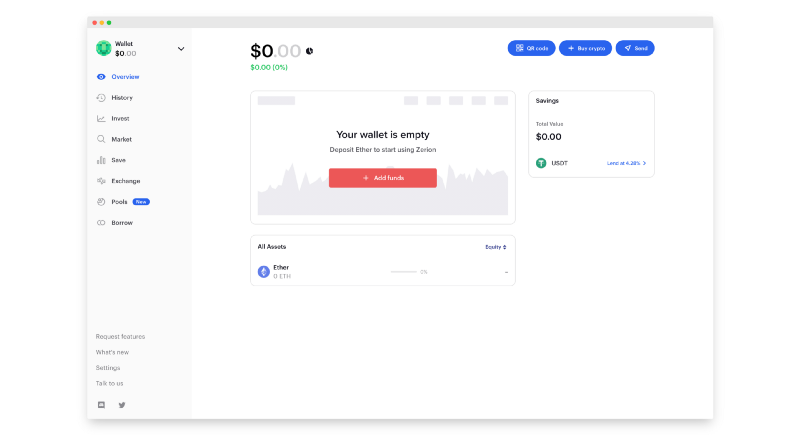

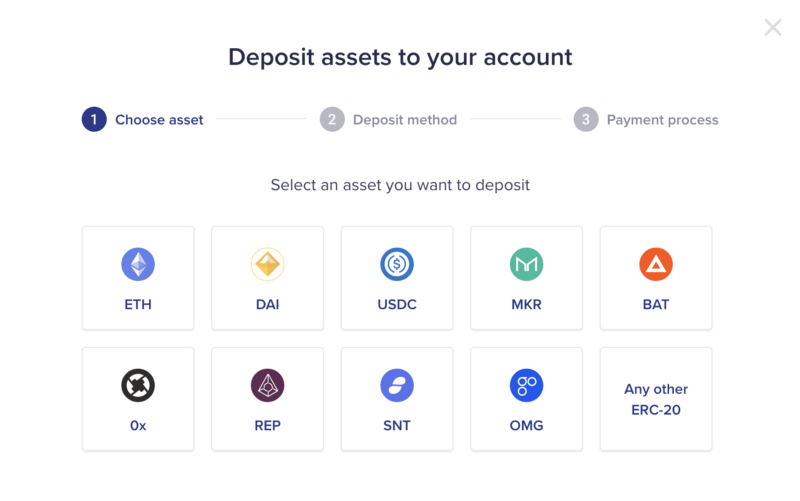

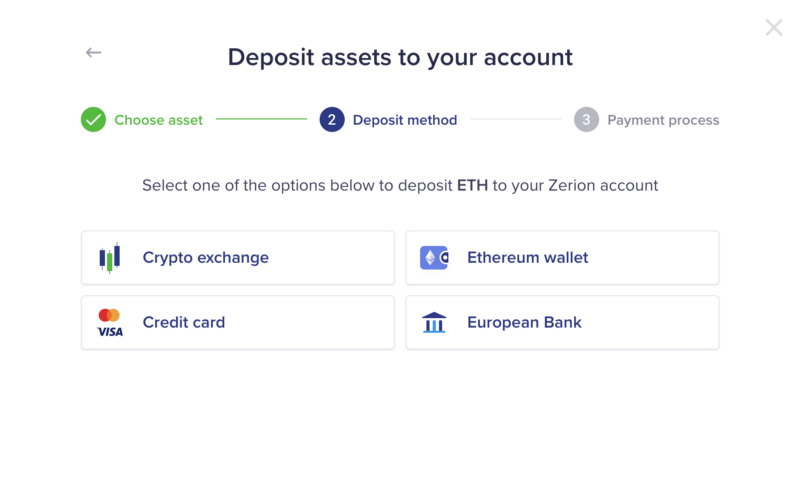

Step 2: If you don’t have any funds in your wallet, you’ll see a dashboard like the one below. Click “Buy crypto” and choose the asset you want to deposit, as well as the method you want to use.

Step 3: Now it’s time to put your money to work! The Zerion interface lets you do just about everything with your DeFi assets — earn interest on passive funds by investing in liquidity pools or providing collateral to crypto loans, borrow crypto to leverage the market, or trade tokens at the best rates. Not sure where to start? We recommend starting out with one of our template Bankless portfolios, which you can find here. Alternatively, start investing in DeFi liquidity pools by checking out this tutorial.

Step 4: Get familiar with Zerion: download the Zerion Android or iOS app. You can now track your assets on the go, get the best DeFi rates and explore latest market trends using the Explore Tab.

FAQ

How to create a DeFi portfolio?

To create a DeFi portfolio, start by selecting a secure non-custodial wallet like Zerion, which supports 40+ chains and 500+ DeFi protocols. Next, research and choose a mix of assets, such as stablecoins, blue-chip tokens, and yield-generating options like staking or liquidity pools. Diversify based on your risk tolerance and long-term goals. Finally, track and manage your portfolio using Zerion to monitor PnL and adjust as needed.

How to set up a DeFi portfolio?

To set up a DeFi portfolio, first connect a crypto wallet like Zerion to access decentralized finance applications. Deposit funds into your wallet, then allocate them across different DeFi opportunities, such as lending platforms, decentralized exchanges, or staking protocols. Regularly review and rebalance your holdings to optimize returns and minimize risks.