You’ve seen people brag about big gains with Optimism’s and Arbitrum’s airdrops.

But dozens of other Web3 projects have also done airdrops. Consistently getting airdrops is a great way to build up a portfolio, even when starting with just a few hundred dollars.

In this post, we’ll show how to find and qualify for airdrops with just a smartphone and Zerion Wallet.

Crypto airdrop basics

If you’ve already got some airdrops, you know how they work. Feel free to skip this.

If you’re new to this, here’s how you get crypto airdrops in general:

- You do some onchain actions (trade, mint an NFT, etc) on a new network, in a dapp or a protocol

- The team behind the network/dapp/protocol takes a snapshot, i.e. it records all addresses that interacted with them onchain

- This team cleans up that list, aiming to remove bots and abusers (aka Sybil attackers)

- The team announces the airdrop and publishes the list of eligible addresses — the announcement date can be a few weeks or even months after the snapshot

- Once the new token is live, you can claim it

- That’s it! You can now sell the token on an exchange or hodl it.

But the risks are worth it. Uniswap, one of the earliest DeFi airdrops, distributed at least 400 UNI (~$2,400) to every user, Optimism dropped over $2000 on average, and Arbitrum at least $700.

Many newbies wonder why Web3 projects “give out free money” via airdrops.

Why projects do airdrops

Web3 projects launch airdrops to decentralize.

If a protocol is controlled by a single organization or a few founders, it isn’t really decentralized. However, Web3 projects can launch governance tokens and eventually transfer control to token holders.

The two main ways to distribute tokens are token sales and airdrops.

Selling tokens immediately generates some revenue. But it also has legal risks: the SEC can treat tokens as securities and go after founders.

Airdrops don’t have that risk. Meanwhile, giving away free tokens doesn’t cost anything.

Both token sales and airdrops create new liquid markets into which founding teams and their investors can eventually sell their token allocations.

Of course there are many nuances, but it’s all you need to know.

It’s more important to understand the common types of crypto airdrops.

L2 airdrops

Layer 2 (L2) scaling solutions for Ethereum have done some of the biggest airdrops.

Optimism and Arbitrum are prime examples. Both networks airdropped governance tokens to kickstart their transitions to decentralized autonomous organizations (DAOs).

Many other networks compete in the L2 space, and they could also do airdrops. Zero-knowledge (ZK) rollups such as StarkNet, zkSync, and Scroll are rumoured to be the next ones to launch tokens.

Based on experience, to qualify for airdrops from L2 networks, you need to use them actively:

- Bridge assets from other networks

- Make transactions

- Provide liquidity on DEXes

- Mint some NFTs

- Use different smart contracts

Networks want to filter out bots (aka Sybil attackers)and reward genuine early users. So you need to bridge meaningful amounts (>$100) and make enough transaction volumes (>$1,000).

In Zerion Wallet, you can now add almost any EVM-compatible custom network or testnet.

With Zerion, you can also easily create and use many different addresses. You can also import your existing addresses from MetaMask and other wallets.

However, don’t try to game the system by creating hundreds of small accounts — the connection between wallets is likely visible onchain, and you will get excluded from the airdrop. Instead, genuinely use the networks. Wallets that have ENS or other domains and other, non-airdrop related activity (e.g. used leading dapps such as OpenSea or 1inch).

You can also increase your odds and potential gains using dapp and protocols on those networks.

Dapp and protocol crypto airdrops

There are no set definitions of dapps and protocols, but you can think this way:

- Dapps are any application where you log in with a wallet

- Protocols can have wallet-facing apps but they are also used by other applications

Some examples of high-profile airdrops by dapps are Uniswap, ENS, and DYDX.

To find future crypto airdrops, look for crypto projects that:

- Have funding from VCs or other investors

- Don’t yet have a token

- Don’t have any “pre-mining” or reward points

First, look for projects that already have enough funding. If a project is strapped for cash, they are more likely to take the risk and do a token sale to get some money immediately. This is particularly true for anon teams.

If a project already has a token, they are extremely unlikely to do an airdrop. Instead, they might have rewards for specific actions such as making trades or providing liquidity (aka liquidity mining or liquidity farming).

It’s the same thing with reward points or bounty airdrops: they are typically for completing tasks or other specific actions. You can grind those, but it’s unlikely to result in life-changing gains.

To maximize your chances, it’s best to use many different apps and protocols with at least a few transactions each.

- Make several transactions over on different days, ideally also weeks and months

- Provide liquidity if you can

- Complete any of the project’s on-chain quests

How to find new protocols and dapps

The easiest way is to open Twitter, search “airdrops,” and read the threads.

Data aggregators like DefiLlama also compile lists of protocols that are likely to do airdrops.

But that’s what everybody else does. And even if those projects do airdrops, you’d probably be late to the game — you’ll have fewer transactions and likely get fewer tokens.

Instead, here’s what you can do.

Research wallets

Find wallets that have successfully got previous airdrops and see what they are doing now.

To find them, you can check blockchain scans for:

- Optimism distribution smart contract

- Arbitrum distribution

- Blur distribution

- other recent airdrop distributions

Then copy interesting address and paste it into the Zerion mobile or web app — it will show transaction history for all chains. Look for ‘contract executions’, ‘deposits’, and ‘trades’. Check which contracts the user is interacting with now.

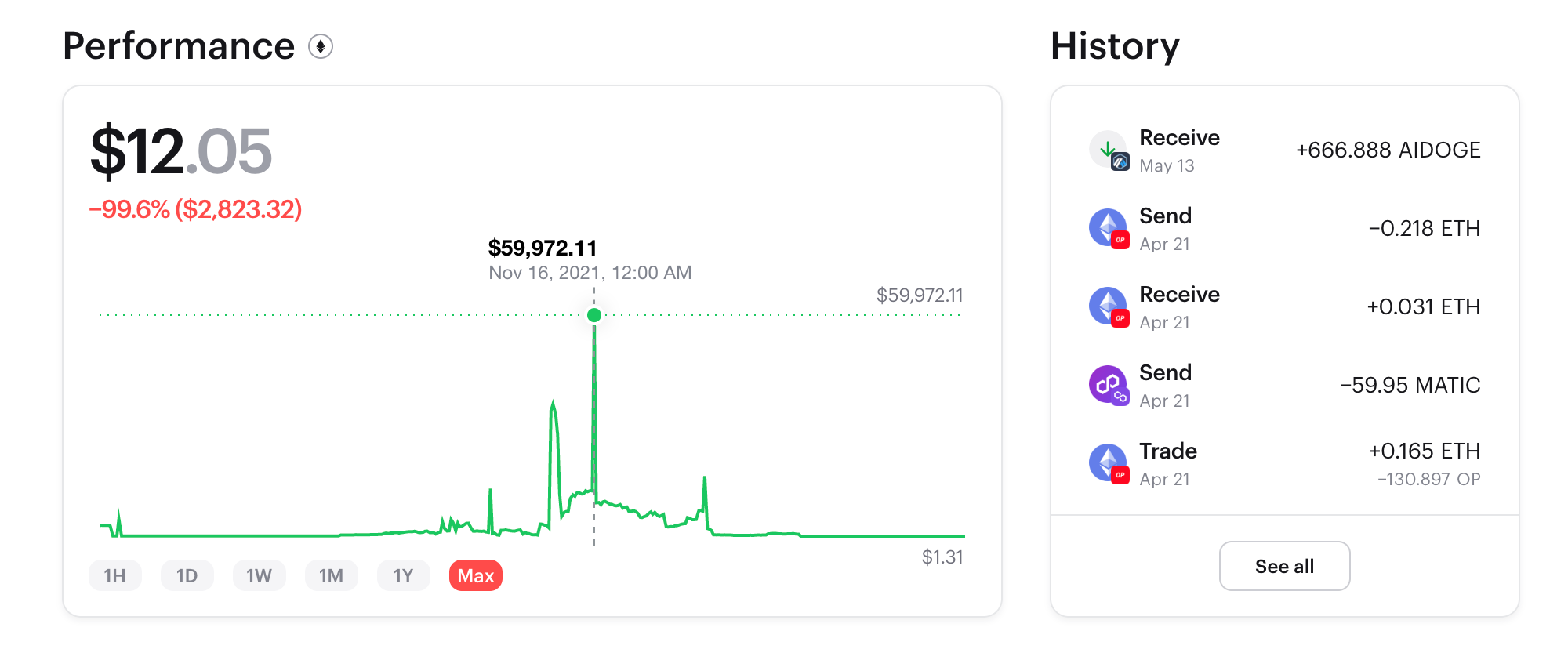

For example, this wallet is one of the top 100 OP airdrop recipients. It received 32,432 OP tokens (~$52k at the current price). It also got quite a few other airdrops as is evident from those spikes.

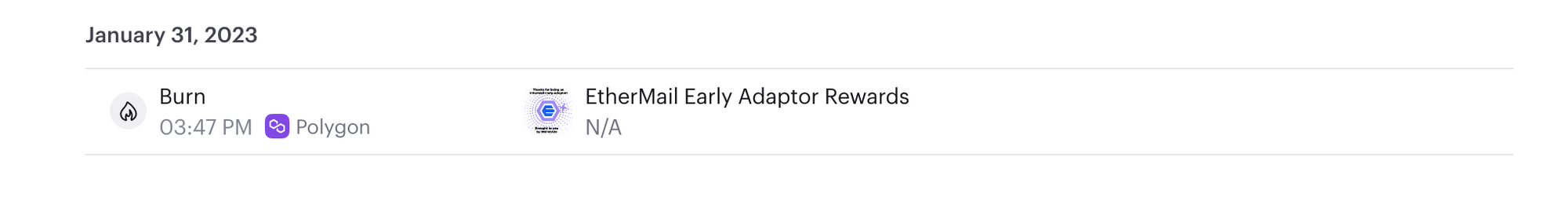

If you check the history, you can find that the address is also doing something with Ethermail.

Follow other crypto wallets with Zerion

Once you’ve found interesting wallets, add them to your watchlist in Zerion. The Zerion mobile app will also send you notifications when these wallets do something. That’s a great way to find new protocols.

The flow is:

- Check the transaction in Zerion’s history and in Etherscan and its alternatives

- Check if the associated dapp or protocol already has a token

- If there is no token, try the dapp/protocol and do some onchain interaction with the protocol

You can do this right on mobile with Zerion.

Try dapps with the Zerion Wallet dapp browser

You can open almost any dapp in Zerion Wallet’s built-in dapp browser.

Often, just opening a URL in the dapp browser, your wallet will automatically get connected to the dapp. You can then sign transactions right on mobile.

If you already use MetaMask or other wallets, you can import all your addresses into Zerion via your seed phrase. Alternatively, you can import selected addresses with private keys.

A word on timing

Web3 projects are most likely to do airdrops when two conditions are met: they have traction, and the market is favorable.

Most airdrops were done by projects with many users and sizeable total value locked (TVL) in their protocol. If there are only a few hundred users, there are simply not enough addresses for the airdrop.

Bullish markets are also better for launching airdrops. Without new buyers, airdropped tokens will quickly get dumped and the price will crash. This would make it more difficult for teams and investors to sell their own tokens. Also, it’s outright disappointing to see the number go down — the project is then viewed as “failed”.

However, bear markets are perfect for getting in early. There are fewer people doing this. Gas is cheap. Meanwhile, the market can completely change in a matter of months or even weeks. And the crypto project could choose to take the snapshot at a block that was several months ago — cutting off the most recent inflow of users and rewarding earlier supporters.

To sum up

It pays to be an active Web3 citizen.

By trying new Layer-2s, dapps, and protocols, you can maximize your chances of getting the airdrop. Zerion Wallet is here to help you with that.

FAQ

What is an airdrop in crypto?

An airdrop is a token distribution strategy where crypto projects give away tokens for free to users and the community. Usually, addresses qualify for an airdrop if they have interacted with the projects onchain.

How do I get new crypto airdrops?

To get retroactive airdrops, you must have done some onchain actions (trading, providing liquidity, etc) before the airdrop is announced. New crypto airdrops are not announced in advance. Instead, you need to start using dapps and protocols that do not yet have a token. In future, these projects might announce their native token and distribute it through an airdrop.

How much does crypto airdrop cost?

Retroactive airdrops are given away for free (although you need to pay gas to claim the airdrop). However, to qualify for airdrops you need to do some transactions onchain. These transactions cost gas but aren’t expensive compared to even the smallest airdrops.

How do I find good crypto airdrops?

The best crypto airdrops are never announced in advanced. Instead, you should try using different layers, dapps, and protocols. Be an active Web3 citizen and it will pay off in the longer term.

Am I eligible for airdrops?

You should only check your eligibility on the project’s official website. Never trust randon tweets or DMs, claiming that you are suddenly eligible for an airdrop. Those are most likely scams that will drain your wallet after you connect it to a fake airdrop website.

Are crypto airdrops risky?

The main risk in crypto airdrops is using a fake website to claim tokens. With real airdrops, there is never an urgency to connect your wallet and claim tokens. Always double check the URL and the messages you sign with your wallet.