Reliable money in DeFi: stablecoins

This is the second part of our series on Decentralized Finance. Find out how distributed mechanisms of price stabilization change how we create and maintain value. You can read our intro to DeFi here.

Crypto is volatile, it has been and, for the time being, it will likely continue to be. Price swings present a major problem if you want to use cryptocurrencies for anything from purchasing goods to transferring money across borders, to borrowing and lending or hedging against risk in trades. Stablecoins end the price uncertainty.

Stablecoins are programmable stores of value that a network can peg to any other value in the world.

Many early stablecoins hold the value of the U.S. dollar, as the main currency in International trade, but they can theoretically represent any real-life value, such as other currencies or commodity prices.

Two versions exist: asset-backed and decentralized stablecoins.

Asset-backed stablecoins

As with other aspects of the crypto world, some actors have created centralized versions. A single administrator oversees the issuance of asset-backed stablecoins and makes sure that issuers have enough real-life assets, like for example fiat money, as collateral to secure the value of the coin.

Centre, a collaboration of Coinbase and others, allows issuers to give out USDCoin if they comply with strict US regulations and ‘provide monthly published proof of reserves attested to by certified public auditors.’ Although this secures the system, the issuance of coins remains in the hands of a centralized authority, who can then decide who can issue the stablecoin. Essentially, it’s Coinbase and the consortium trying to be a central bank.

Asset-backed stablecoins just continue the same system of money issuance we have today with a different technology for transactions.

Just like centralized exchanges, centralized stablecoins do not represent the spirit of decentralized finance because they bring centralized control over the coin. They do not open up access and control over a stable store of value to more people.

A case in point is the controversy surrounding Tether, another asset-backed stablecoin. Some researchers have found evidence that the organization behind Tether, who hold their own assets to back Tether ‘grants,’ as the company calls issuance events, has propped up Bitcoin prices during the price rally in late 2017. Another study has somewhat refuted the evidence, but manipulation through central issuance authorities is entirely possible. If found to be true, they would have undermined the entire cryptocurrency space by artificially boosting the hype.

We need a different solution.

Decentralized stablecoins: Dai

Fortunately, MakerDAO has created a decentralized mechanism to stabilize the value of a coin around the value of a U.S. Dollar without any central control.

Its stablecoin is called Dai, and it uses market mechanisms to stabilize value instead of a central issuing authority.

Dai is a freely tradeable ERC20 token, which means it is based on the Ethereum blockchain. Anyone with an Ethereum wallet can own, accept, and transfer it, and they can exchange it on decentralized exchanges without any middlemen. No authority has control over it, and so no one can limit its issuance or shut it down.

Just like asset-backed stablecoins, Dai offers instant cross-border transfers with low transaction fees, and merchants can accept it without volatility risk. Customers have an incentive to spend it because its price will not go up and hodling it would mean losing value to inflation.

Using and securing Dai

Most users of Dai will only ever have to buy and sell it or transfer it to partners or merchants, without caring about the mechanism that secures its value.

The beauty of Dai, however, lies in its price stabilization mechanism, so I will give you a quick overview of how it works.

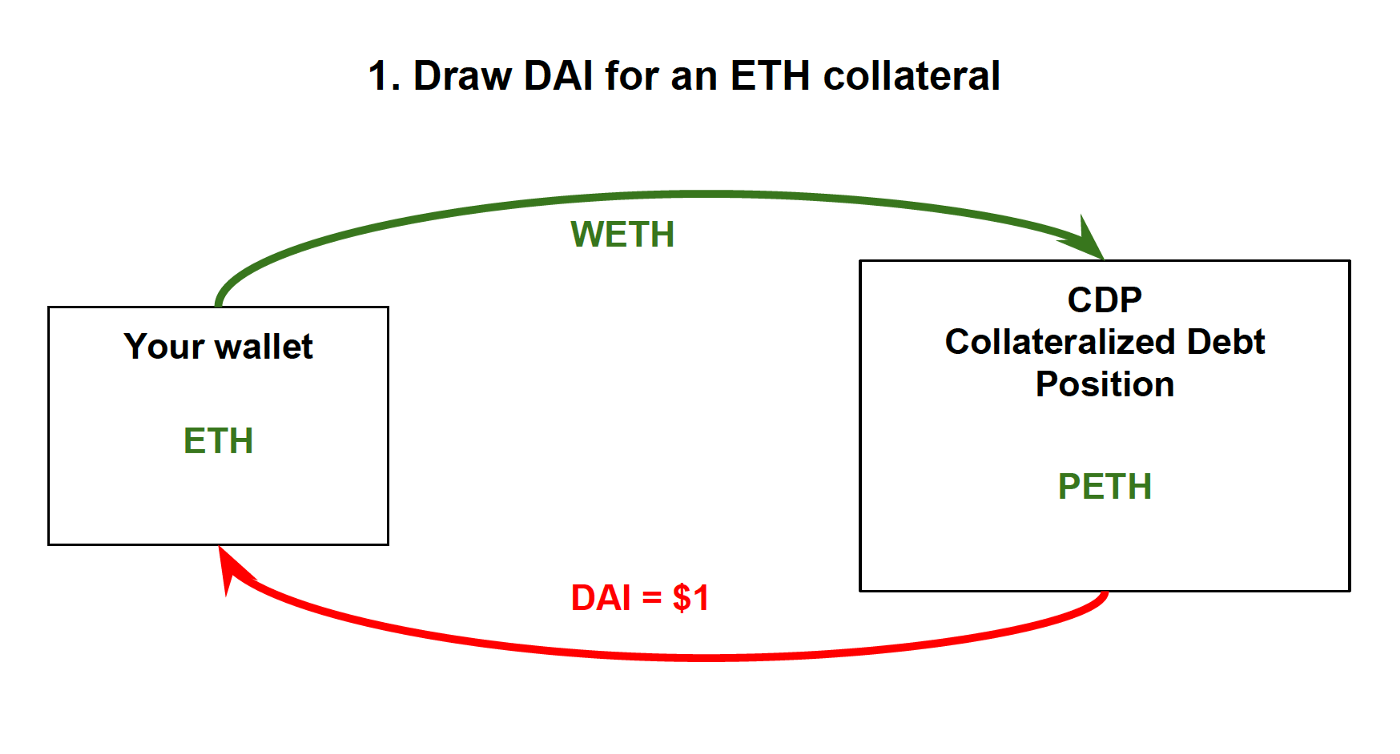

In the first step, anyone can draw Dai against an Ether-backed collateral. The process is like taking out a loan and requires the wallet holder to wrap the ETH into WETH, which then becomes pooled ETH, PETH, in a pooled collateralized debt position CDP.

The wallet holder cannot access the ETH in the CDP until they pay back the DAI loan. The price for drawing and paying back Dai loans is always $1 per DAI.

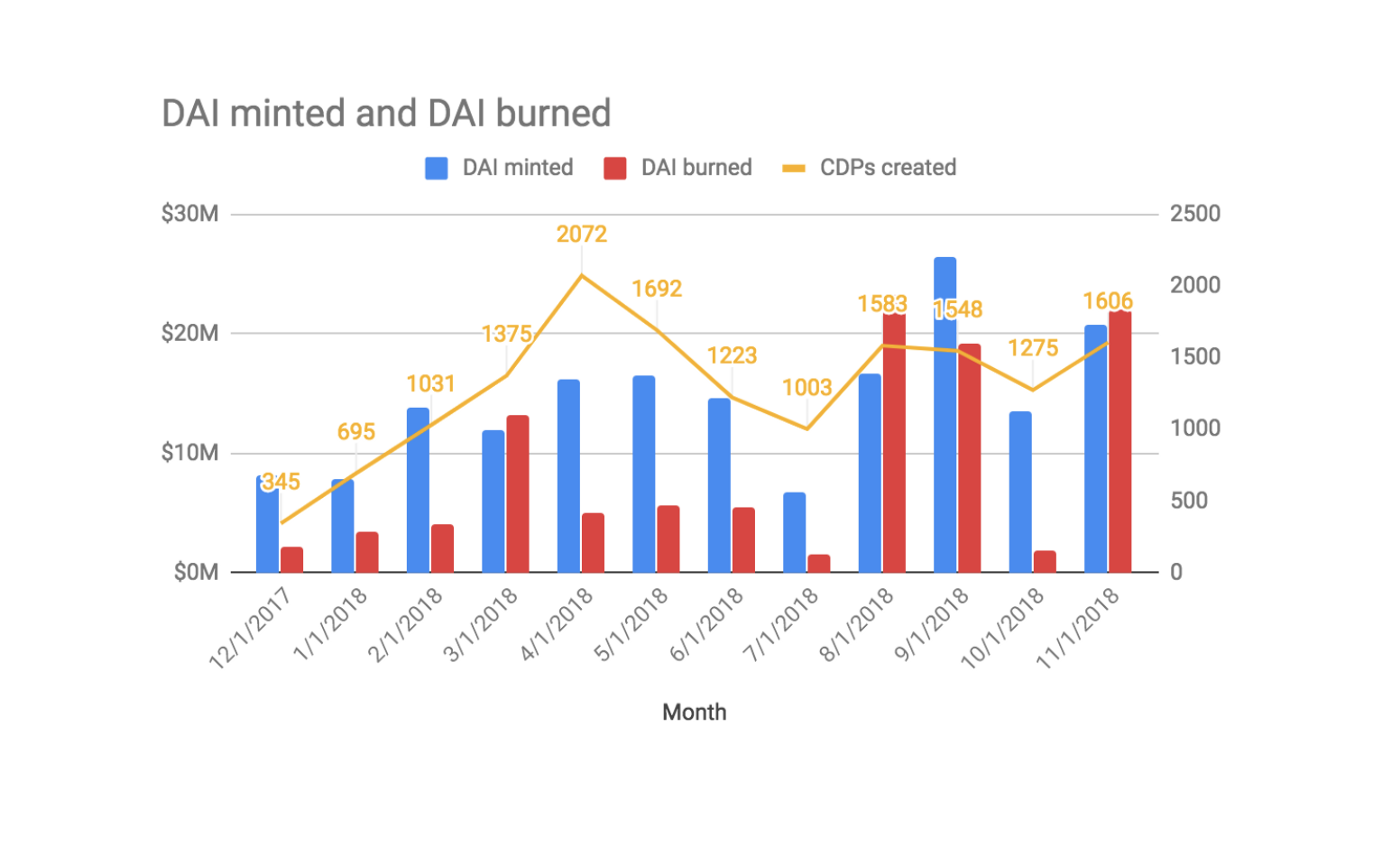

The chart below shows all the Dai minted through CDP creations, and all the Dai burned when lenders pay back their Dai loans to unlock access to their collateral.

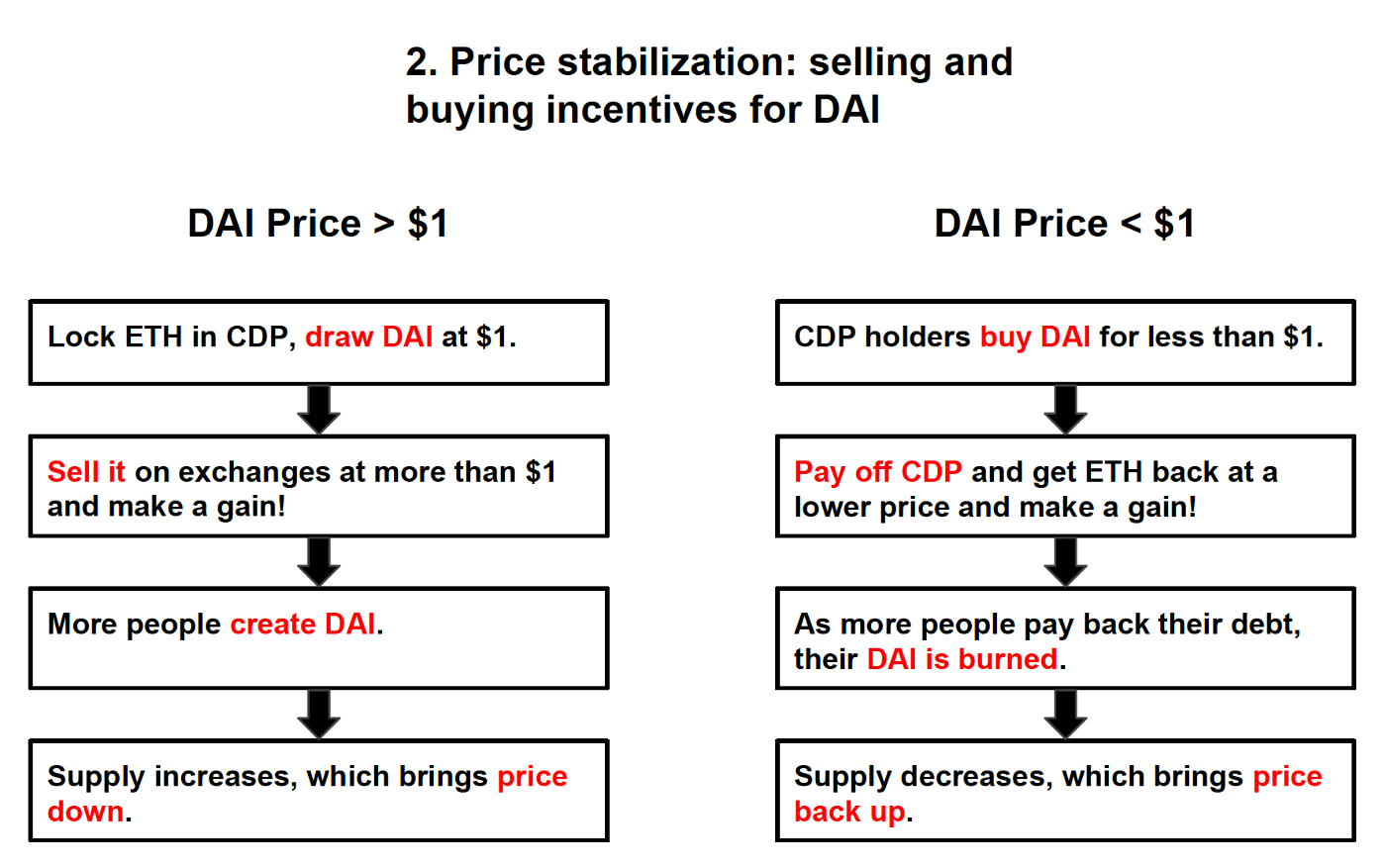

Dai holders can trade the token on exchanges and therefore demand and supply of Dai vary, which should lead to price swings. However, if lots of Dai demand has pushed up prices, a simple mechanism that incentivizes further Dai creation, and therefore an increase in supply, can counter the upward price pressures.

Conversely, when Dai supply is more than demand and its price falls below $1, Dai holders can make a gain on paying off their debt, which triggers the burning of their Dai, and therefore decreased supply, pushing prices back up.

In addition to the automatic stabilization mechanism, the MakerDAO stands behind the Dai stablecoin and its members can vote to reverse any big changes in the case of a coordinated attack on the network. MakerDAO functions as the emergency help, but it does not have a mandate to influence prices in any way.

The best part about the Dai stabilization mechanism is that it is not just a smooth theory, but successful in implementation.

The Dai peg to the USD has never broken, while the daily trading volume is consistently in the millions of USD and the market cap has reached around US$60 million.

The success of a decentralized stablecoin like DAI shows the potential for DeFi to recreate money without central control, and why it is better that way. We will look at more fascinating decentralized financial tools in the next parts of the series.

Read Part 3 on Decentralized Exchanges here!