Put your DeFi portfolio on autopilot with automated trading strategies

Automated trading strategies managed by smart contracts are one of the most exciting developments in decentralized finance. Think of these as ETFs that allow you to put your investments on “autopilot”.

TokenSets founder Inje Yoe describes the Set Protocol as “smart enough to enter and exit out of positions at the right times based on market conditions, without the emotional risk of pouring hours of time staring at charts for buy and sell signals”.

There are a number of benefits to automated trading strategies:

- Hedging doesn’t require technical expertise. Adequately protecting your investments against volatility risk can often be a daunting task requiring deep technical and fundamental knowledge. Sets do the work for you by automatically rebalancing between tokens and stablecoins at certain market conditions.

- Diversifying your portfolio is easy. Tokensets that consist of multiple underlying assets distribute your investment according to a pre-defined ratio.

- Make smarter investments by following the best. Social Sets allow you to follow other traders’ strategies based on your market sentiment and risk appetite.

- Save time and energy. In a nutshell, Sets put your crypto to work without you doing the work!

What exactly is a “Set”?

Set is short for “Strategy Enabled Token”, an algorithmically structured ERC-20 token that represents a basket of underlying assets according to a range of criteria.

Robo Sets are automated strategies based on predefined rules encoded in smart contracts.

Social Sets are created by human traders and are based on a mix of on-chain and off-chain algorithms. When you buy a Social Set, you’ll copy every single action the trader (or trading algorithm) enacts for a small commission fee.

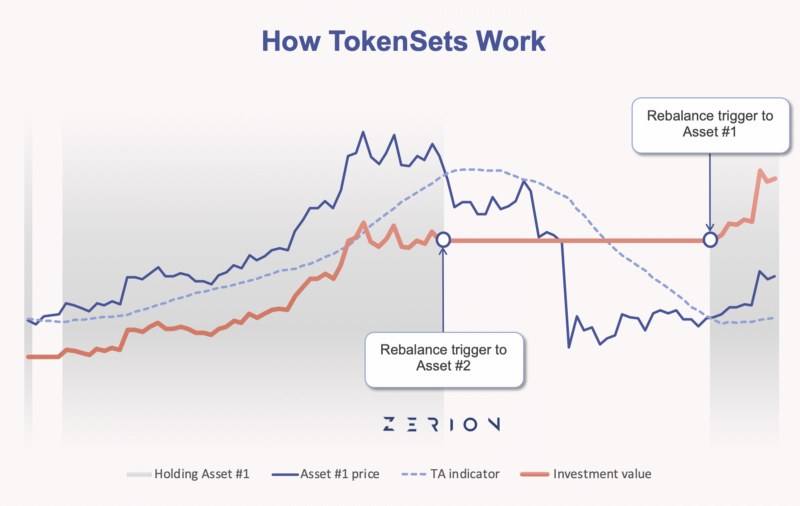

Sets range from very simple to very complex, yet at their core all involve rebalancing a portfolio between two tokens when triggered by certain market conditions. These conditions are identified using technical analysis (TA) indicators such the Moving Average (MA) or Relative Strength Index (RSI).

Moving Average (MA) Sets

These Sets capitalize on short term trends by rebalancing between two tokens based on a Moving Average (MA). MA is a common indicator used in technical analysis that smoothes out price data by constantly updating the average price of an asset within a defined period. There are two common types of MA strategies:

- Simple Moving Averages (SMAs) are calculated by averaging prices within a defined range up to the current period. For example, the ETH 20-day MA Crossover Yield Set holds ETH when the ETH price is at or above its 20-day SMA and sells ETH for interest-bearing Compound USDC when the price of ETH is below its 20-day SMA.

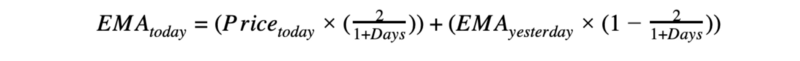

- Exponential Moving Averages (EMAs) assign more weight to recent prices and are therefore more responsive to sudden price fluctuations. For example, the ETH 26-day EMA Crossover Set holds ETH when the ETH price is at or above the 26-day EMA and sells ETH for [non-interest-bearing] USDC when the price of ETH is below its 26-day EMA. In the general EMA below, “2” is the smoothing factor which gives the most recent observation more weight — if this number is increased, more recent observations will have more influence on the EMA.

Relative Strength Index (RSI) Sets

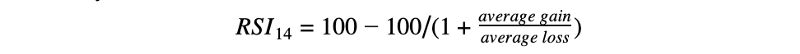

These Sets use another indicator commonly used in technical analysis, the Relative Strength Index (RSI). RSI measures the magnitude as well as the speed of price movements of an asset (usually within a 14-day period) and is therefore more suited to markets that do not display strong trends, unlike Moving Averages.

For example, the ETH RSI 60/40 Yield Set automatically rebalances to interest-bearing Compound USDC when the RSI is below 40 for the first time in an existing uptrend, and automatically rebalances to hold ETH when the RSI is above 60 in an existing downtrend.

The 14-day RSI is calculated as follows:

Where average gain is the sum of the amounts by which the price has increased each day over the 14-day period and average loss is the sum of its loss amounts over the 14-day period. An RSI over 50 typically indicates a bullish trend and an RSI below 50 indicates a bearish trend. Sets that use this strategy are:

With the Link RSI Set, if the RSI falls below 45 when the Set is holding LINK, the Set rebalances into USDC. If the RSI breaks above 55 when the Set is in USDC, the Set rebalances back into LINK.

Social Sets

There are a number of Social Sets that employ a range of strategies. We’ll look at just two that have performed the best since inception:

- LINK/ETH Price Action Candlestick Set (+115.9% since inception): This Set was created in March 2020 by Aaron Kruger, and is based on price action candlestick analysis.

- Intelligent Ratio Set (+98.8% since inception): This Set was created by Tradespot to “beat the huge market swings that Bitcoin and Ethereum have in relation to each other and ultimately put your holdings to work to accumulate more over time.” Unlike Aaron Kruger’s Set, this Set works purely on algorithmic strategy.

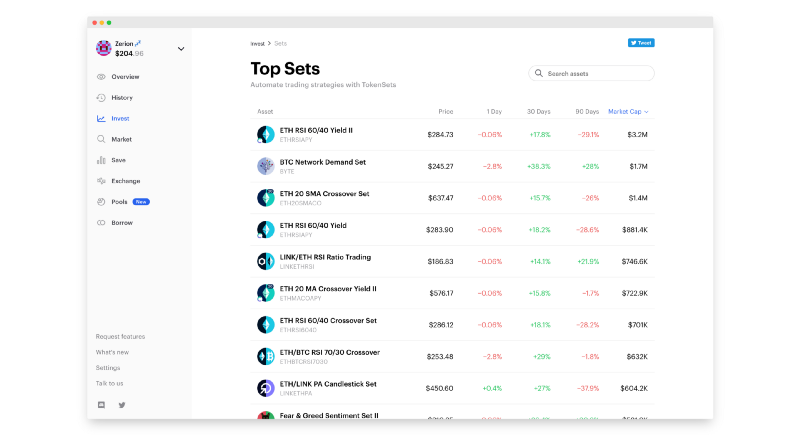

Track your Sets with Zerion

Before making an investment, check out the Explore page directly on TokenSets, where you can filter Sets by the assets they hold, whether they’re interest-bearing or not, market sentiment (very bullish to very bearish), and daily, weekly and monthly performance. You can now also filter sets on Zerion to see top market movers.

Tokensets are a great way to buffer market volatility without the pain of manually managing your investment yourself. For example, in Q1 of 2020 the ETH 20-Day MACO and ETH 50-Day MACO offered 137.63% and 75.22% returns respectively.

👉🏼 app.zerion.io | [email protected] | Twitter | Discord | LinkedIn