Best Solana DEXes: A Comprehensive Guide

decentralized trading, processing billions in daily volume across dozens of DEXes. This guide breaks down what makes Solana DEXes unique, compares the top platforms, and shows you how to trade efficiently using Zerion Wallet.

Solana has become the home for decentralized trading, processing billions in daily volume across dozens of DEXes. This guide breaks down what makes Solana DEXes unique, compares the top platforms, and shows you how to trade efficiently using Zerion Wallet.

What is a DEX?

A DEX, short for decentralized exchange, is a cryptocurrency exchange that lets you trade directly from your wallet without first sending crypto to a centralized platform.

Any DEX is a set of smart contracts that govern how tokens are traded. You can interact with these smart contracts via a DEX website or directly through a Solana wallet that integrates them.

Here’s what sets DEXes apart from centralized exchanges like Coinbase or Binance:

- Non-custodial: You make trades directly from your self-custodial wallet

- Transparent: All transactions are recorded on the blockchain, open to everybody

- P2P: You trade directly with other participants, either via orders or through a liquidity pool

Solana DEXes are decentralized exchanges on the Solana blockchain.

What Makes Solana DEXes Unique

Solana blockchain's architecture transforms how DEXes work compared to other chains.

- Faster transaction: Solana can process up to 65,000 transactions per second, making it much faster than Ethereum and most other EVMV chains.

- No token approvals: Unlike on Ethereum, you don’t need first to approve the token to be used by a DEX. This means you can make a trade much faster.

- Ultra-low fees: Fees on Solana are negligible compared to Ethereum. You can make a lot more trades without worrying about fees eating into your profits.

- Innovative mechanisms: Solana’s programs enable new applications that were not possible on older blockchains.

But most components are the same across DEXes on Solana and Ethereum, where the first decentralized exchanges originated:

- Automated Market Maker models, where liquidity providers deposit token pairs into pools. Traders swap directly with these pools using mathematical formulas to determine pricing.

- Liquidity pools hold token pairs, and the balance of tokens determines the price.

- Aggregators can route trades via different pools to get the best price.

Top Solana DEXes

Let's break down the leading platforms and what makes each one unique.

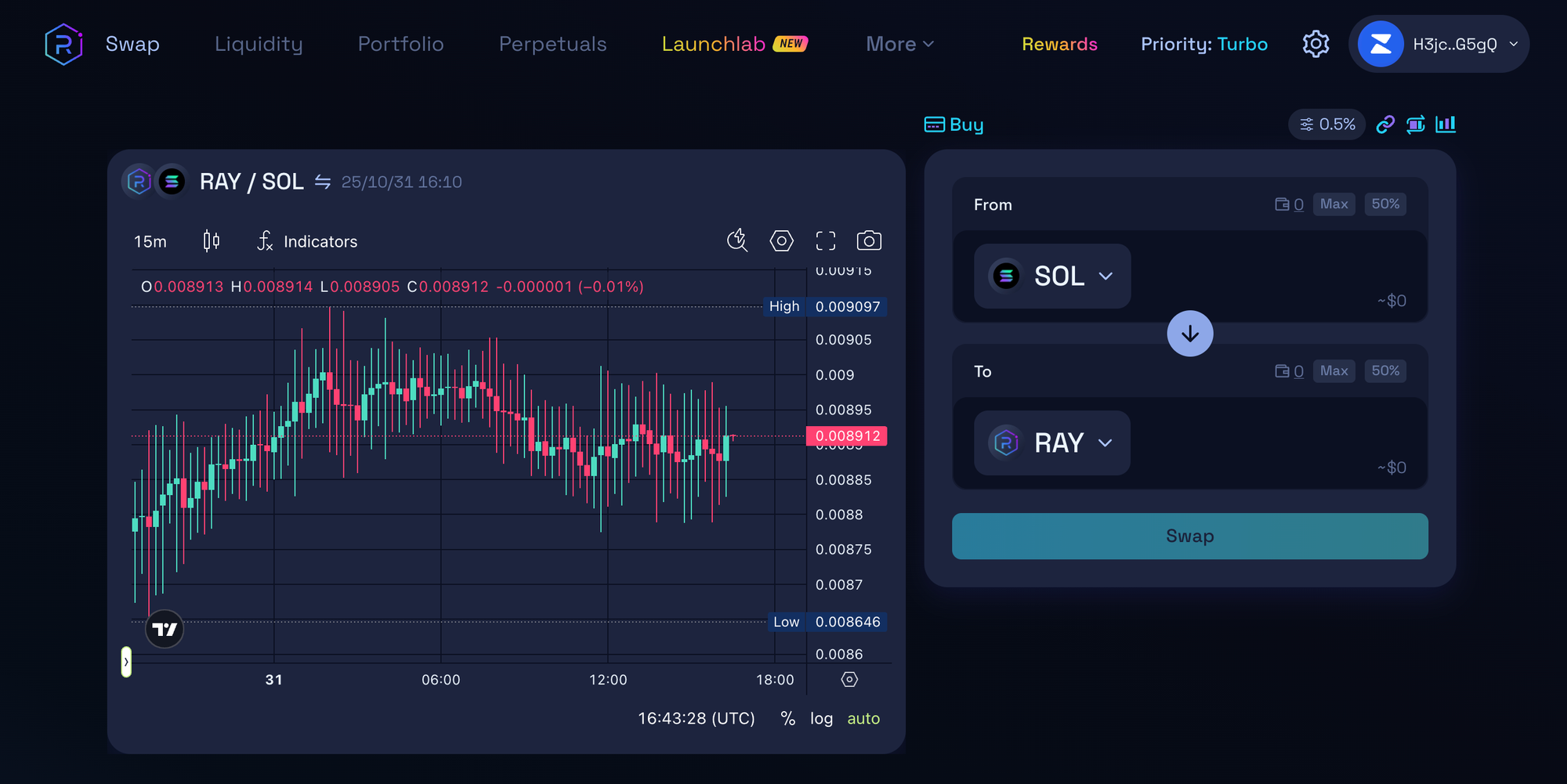

Raydium

Raydium pioneered automated market making on Solana back in 2021. As one of the ecosystem's first AMMs, Raydium established the foundation for Solana DeFi.

The platform offers several pool types. Concentrated Liquidity Market Maker (CLMM) pools allow asymmetric liquidity distribution where LPs can provide liquidity in their preferred price ranges. Constant Product Market Maker (CPMM) pools follow the traditional formula and remain popular for token launches.

Raydium's permissionless pool creation means anyone can launch a trading pair in minutes. Before Pump.fun launched its own DEX, newly created Solana memecoins were launched with Raydium pools.

PumpSwap

PumpSwap launched in 2025 as the native DEX for Pump.fun, the dominant Solana meme coin launchpad. Meme coins launched on Pump.fun flow to PumpSwap, creating a complete lifecycle ecosystem.

The platform implements a standard AMM model with dual liquidity pools supporting both SOL and PUMP token pairs. Trading fees have a 0.25% structure with 0.20% going to liquidity providers and 0.05% to the protocol.

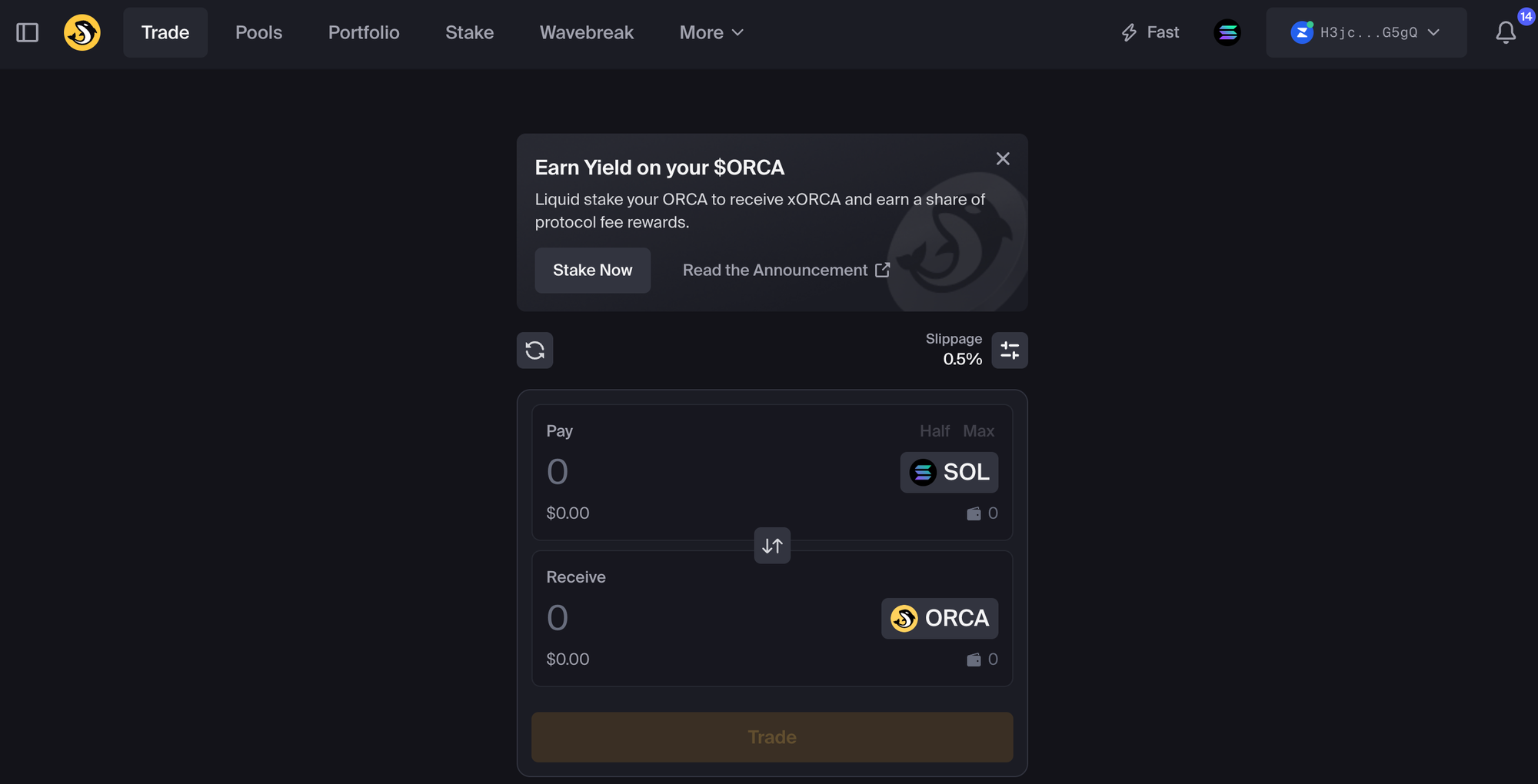

Orca

Orca built its reputation on being the most user-friendly DEX on Solana.

The v2 UI launched in 2024, caters to four user groups:

- traders swapping tokens with price accuracy ensured by built-in Jupiter price comparison,

- liquidity providers managing positions through an intuitive interface,

- token creators launching permissionless pools,

- builders integrating with Orca's double-audited open-source contracts.

The protocol operates as a DAO with powers delegated to an elected DAO Council. ORCA token holders participate in governance by proposing, discussing, and voting on protocol changes.

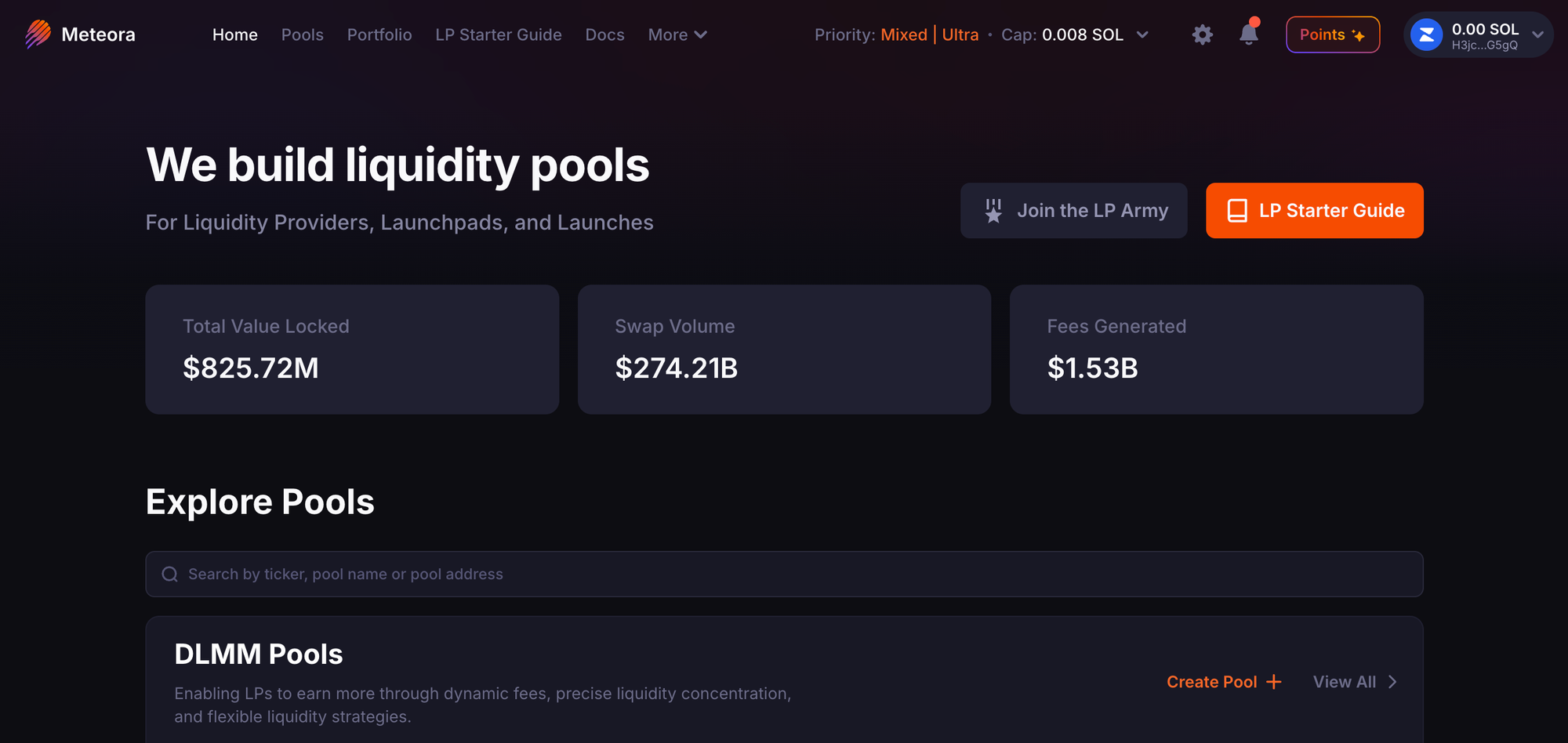

Meteora

Meteora positions itself as a dynamic liquidity protocol designed to boost fee earnings for liquidity providers.

Meteora has multiple pool types and launch mechanisms to either abstract complexities or give full control over how new liquidity pools are created. The TRUMP token launched with a Meteora pool.

Meteora pools appear across major trading terminals, making tokens launched on the platform immediately tradeable ecosystem-wide. The protocol focuses on giving liquidity providers the tools to maximize returns while helping projects launch fairly.

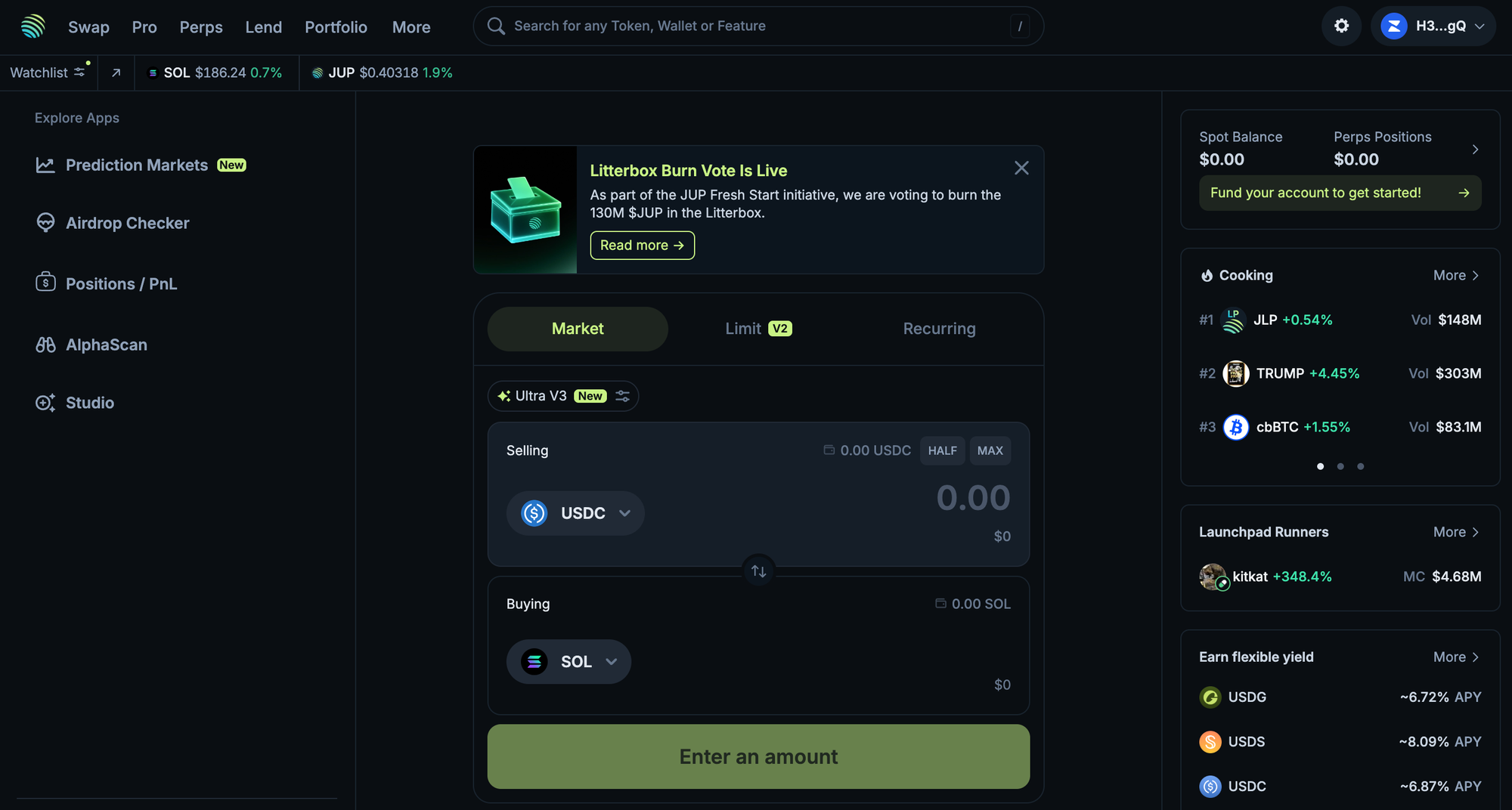

Jupiter

Jupiter dominates Solana trading as the leading DEX aggregator. Rather than providing its own liquidity pools, Jupiter scans multiple DEXes simultaneously to find the optimal trade route for any token pair.

When you swap on Jupiter, the platform analyzes liquidity across Raydium, Orca, Meteora, and other DEXes. It can split your trade across multiple pools or route through intermediate tokens to get you the best price. This aggregation approach means you consistently get better rates than trading on any single DEX.

Jupiter has facilitated over $2.2 trillion in cumulative trading volume. The platform offers advanced features, including limit orders, dollar-cost averaging, and bridge integration.

How to choose a DEX

With so many options, picking the right DEX depends on your trading style and goals.

- Best overall experience: Use Jupiter. As an aggregator, it automatically finds the best prices across all DEXes. You get optimal pricing without manually comparing platforms. Jupiter's interface is clean, fast, and reliable. Zerion Wallet integrated Jupiter so you can trade with the best rates right in the wallet.

- For providing liquidity: Consider Orca or Raydium. Both offer concentrated liquidity pools where you can earn trading fees by providing liquidity in specific price ranges. Orca's interface is particularly friendly for newcomers.

- For meme coin trading: PumpSwap specializes in Pump.fun tokens, offering liquidity for newly launched meme coins. Jupiter also works well since it aggregates liquidity to help you trade Solana meme coins at the best price.

- For new token launches: Raydium and Meteora both offer permissionless pool creation with various features. Meteora's anti-sniper tools help projects launch more fairly.

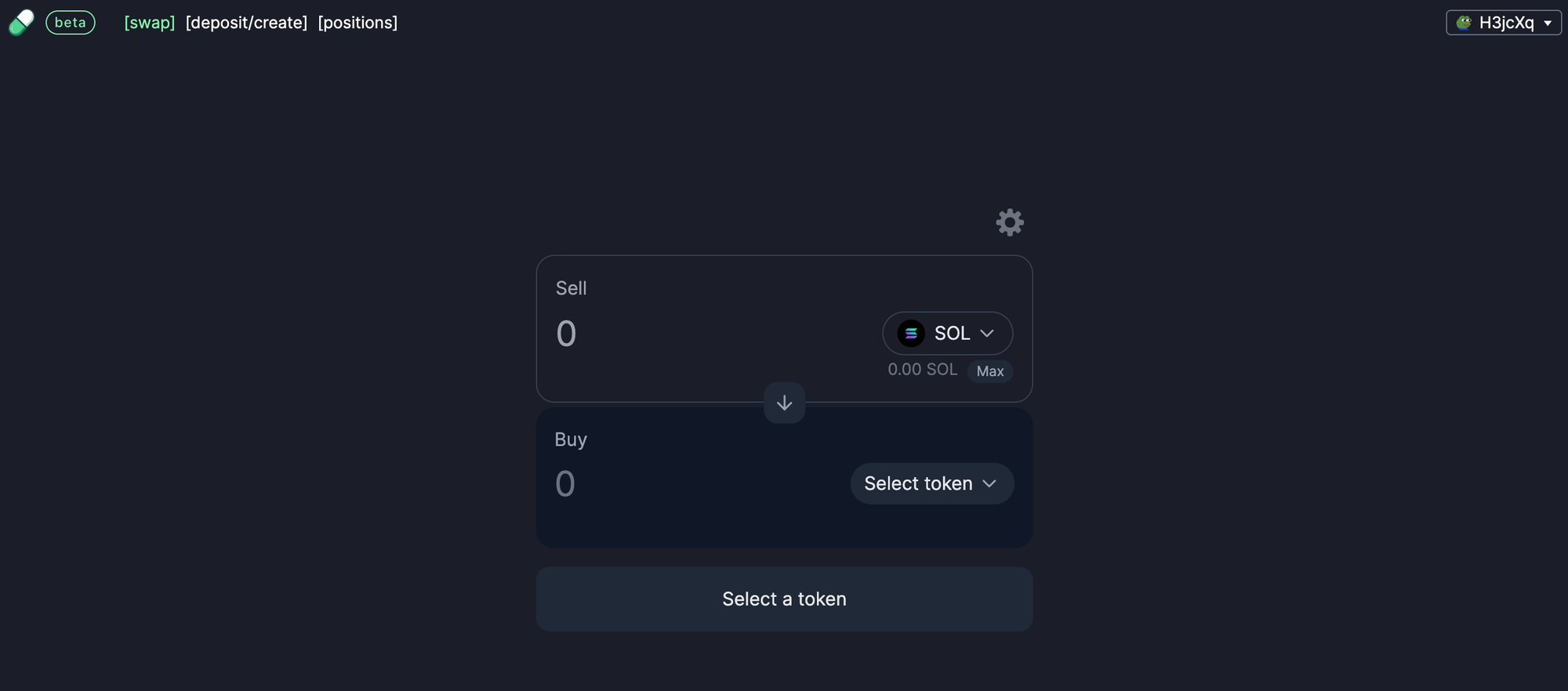

Get the best price in Zerion Wallet

On Solana, Zerion Wallet taps Jupiter under the hood, so your swaps auto-route across all Solana DEXes for the most competitive fill. All without opening a single DEX in your browser.