Blast L2: The Full Guide, Airdrop Strategy, and More

This guide will get you up to speed on Blast, explaining what this L2 is, how its yields work, and what you need to do to get the airdrop.

Now that the bull market is back, everybody is having a Blast! If you’re late to the party, this blog post will get you up to speed, explaining what Blast is, showing how its yields work, and giving the full airdrop strategy.

What is Blast?

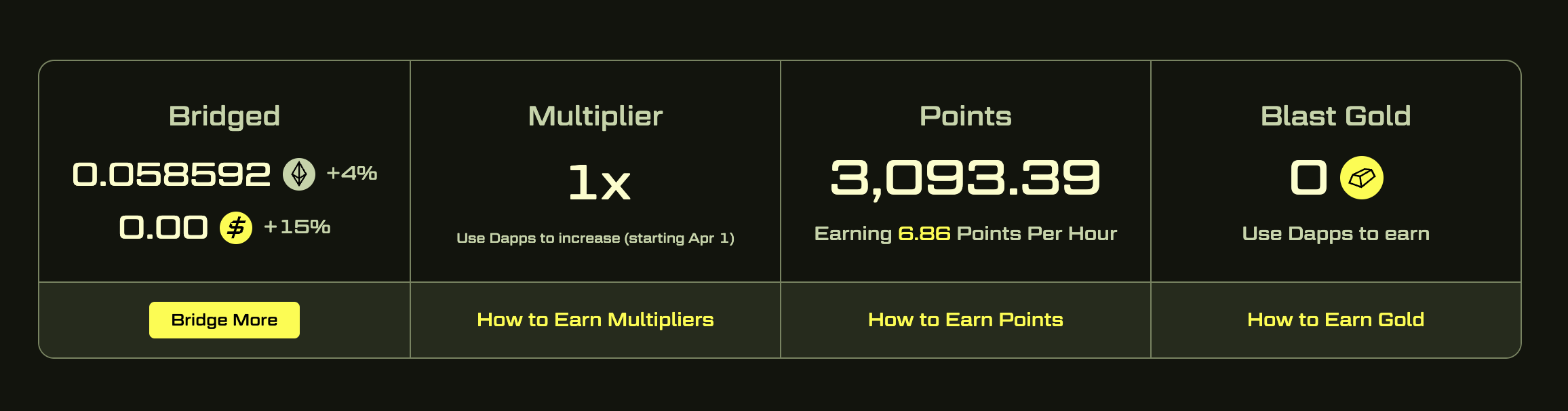

Blast is a Layer-2 (L2) network for scaling Ethereum. Its main innovation is the introduction of native yields for holding crypto on the network. Specifically, by simply storing ETH or USDB, Blast's native stablecoin, on the L2, users earn yields of 4% and 15%, respectively.

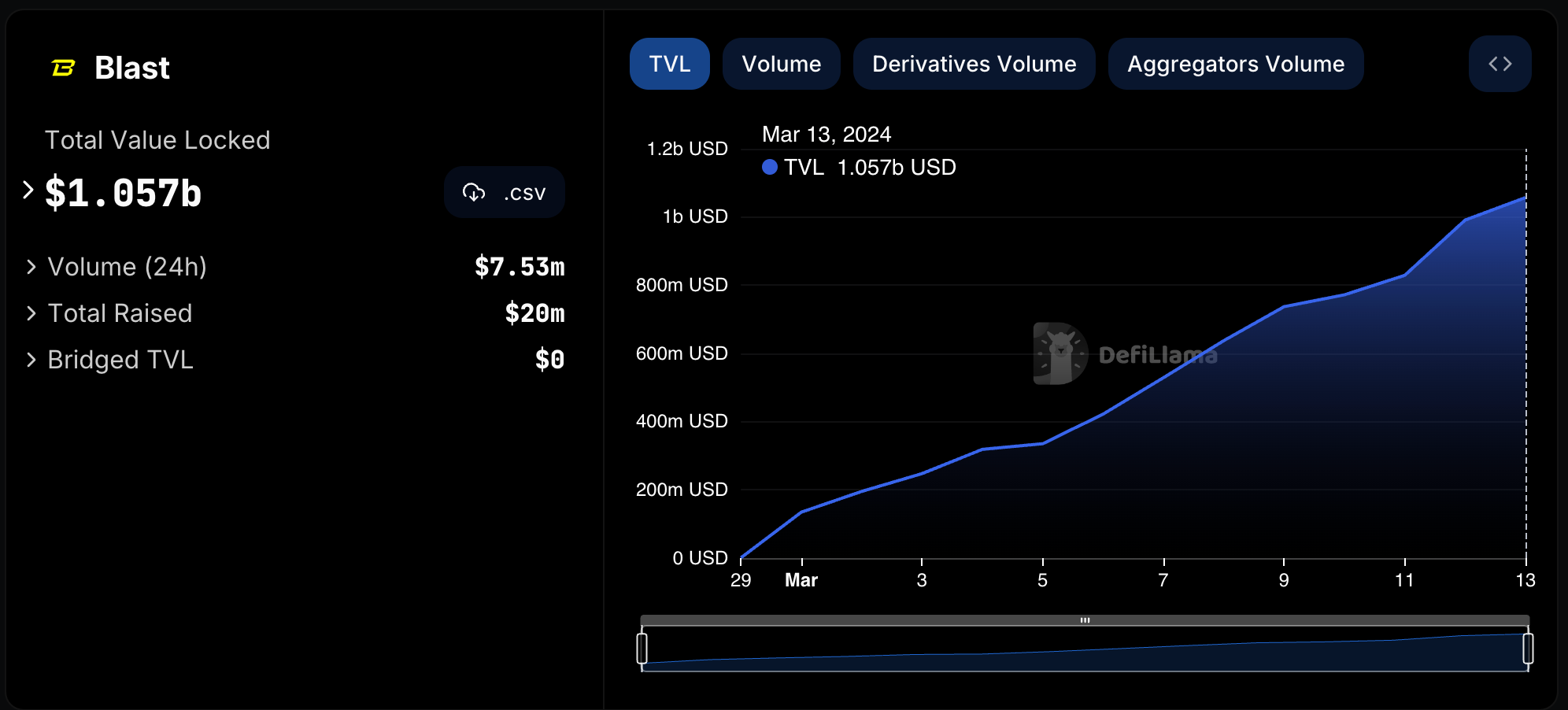

With its mainnet launch in February 2024, Blast has quickly become one of the fastest-growing L2s. Besides earning yields, users are expecting an airdrop (which is already confirmed).

The team

The Blast team clearly knows how to grow new crypto products.

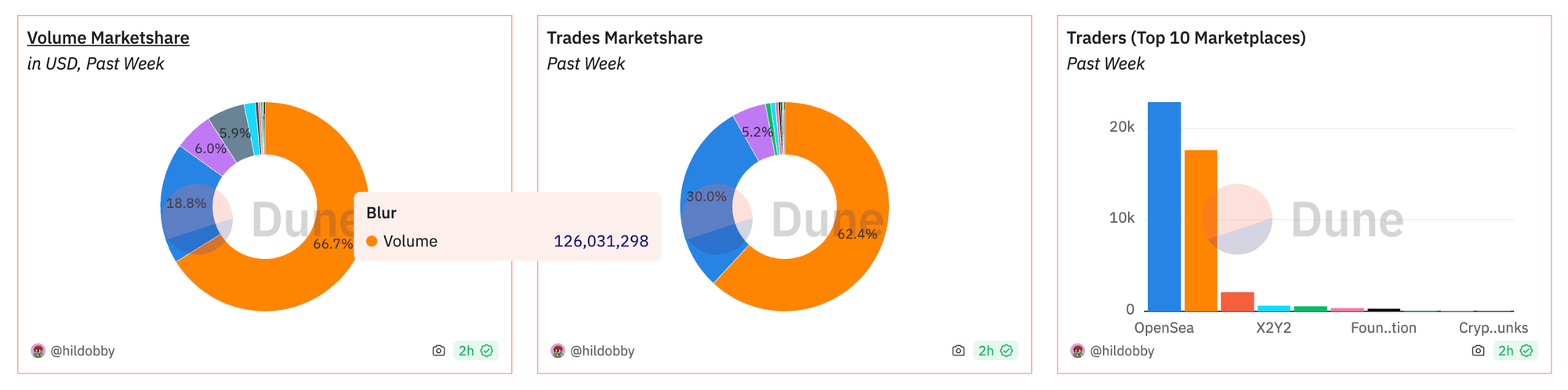

Blast founder Pacman also created the NFT marketplace Blur.

Web2 me vs Web3 me

— Pacman | Blur + Blast (@PacmanBlur) February 22, 2023

A thread 🧵 pic.twitter.com/9BKyNdan3x

Blur dethroned OpenSea as the top NFT market by executing one of the largest airdrops in history.

The Blast team might potentially replicate Blur’s success on an even bigger scale. To do that, Blast raised $20 million from investors (Paradigm) who previously backed Blur. So Blast's roadmap appears to draw from a proven playbook.

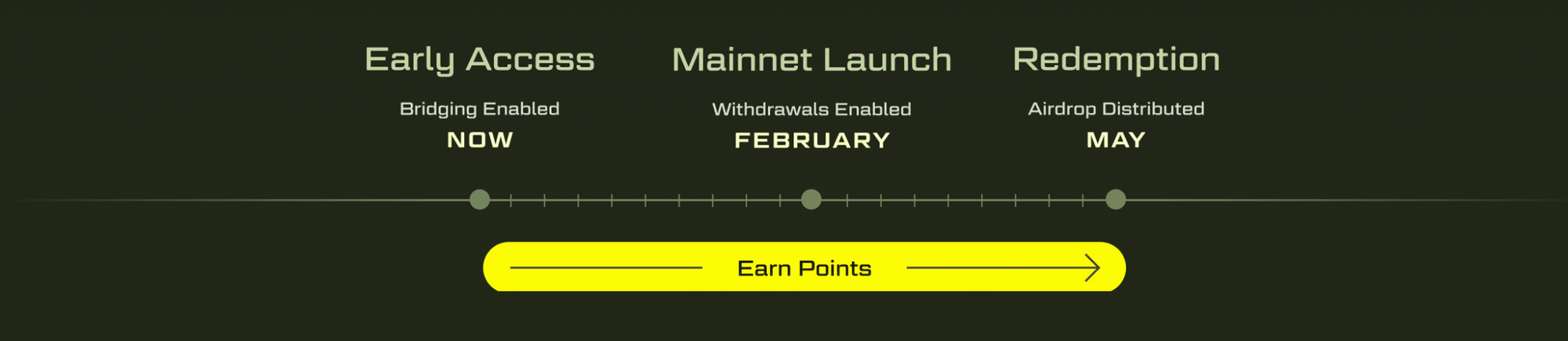

Wen Blast Airdrop

Unlike with other projects where you need to guess, the Blast airdrop already has a date: May 2024.

The airdrop will be split 50/50 between users and developers building on Blast.

For users, future Blast airdrops will be based on points that you can earn now for bridging and doing things onchain.

This rewards system heavily incentivizes moving assets to Blast at scale. The more you bridge, the more points you get. As a result, whales with hundreds of ETH will likely get the lion's share of the airdrop.

Native yields

Aside from the airdrop benefits, Blast also attracts users with its native yield offerings.

ETH deposits earn a 4% yield, sourced from staked ETH managed through Lido (the leading ETH staking protocol). Stablecoins generate a 15% yield, which comes from the MakerDAO protocol. The yield is paid by rebasing tokens — in other words, the number of your tokens goes up.

This setup offers a productive avenue for you to put your spare crypto to work while positioning to get a potential airdrop.

Bridge to Blast L2

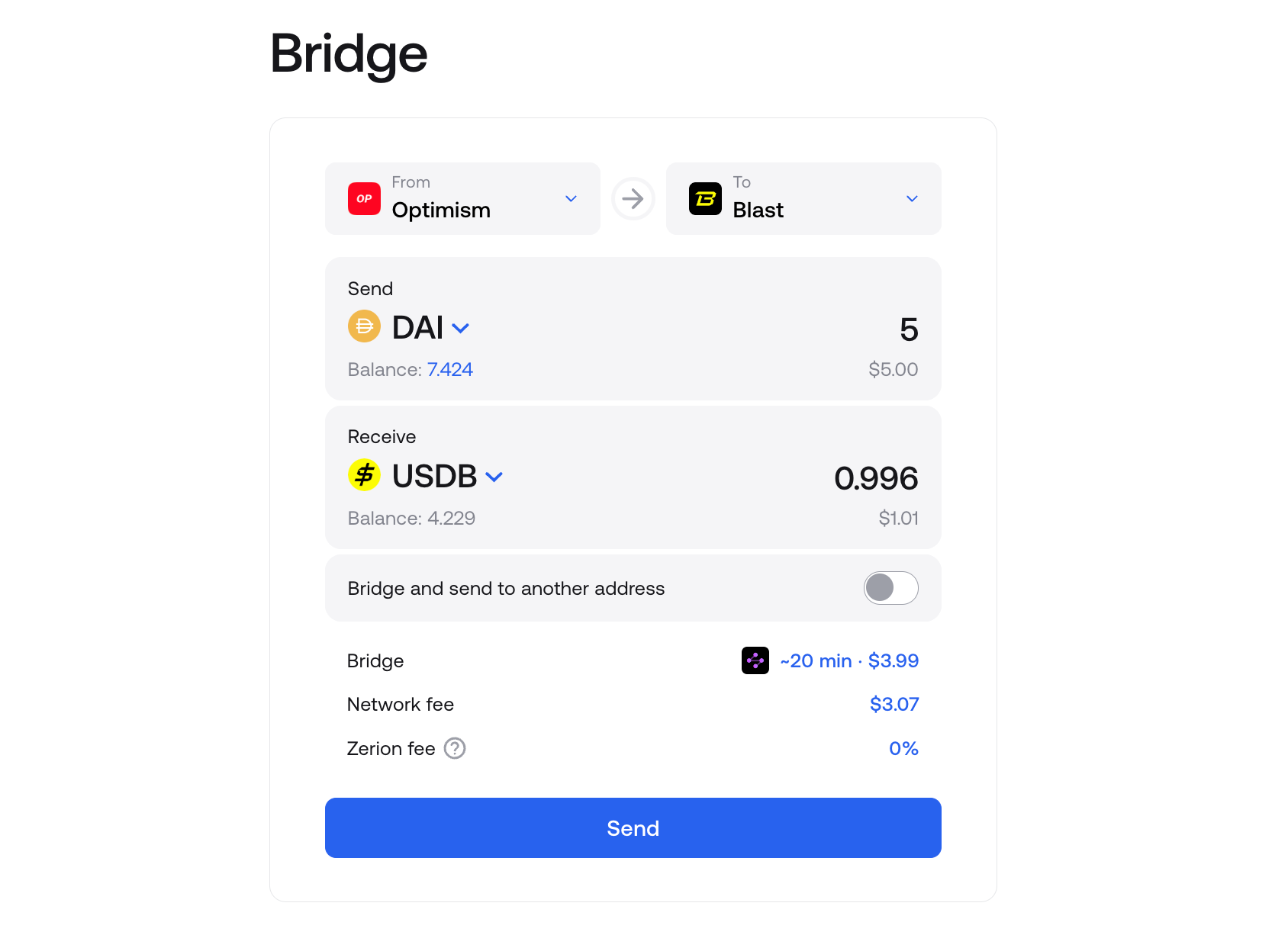

The first step to using Blast is to bridge some assets.

You can do this with Zerion’s bridge aggregator in the web app or in the mobile app. Zerion is also the best wallet for Blast with NFT tracking, human-readable transaction history, and more.

All you need to do to bridge to Blast:

- Select Blast as the ‘to’ network

- Select your ‘from’ network — it’s cheaper to use an L2 like Optimism

- Select the assets — besides ETH, you can bridge stablecoins and swap them for USDB

- Sign the transaction to Approve the asset that you’ll bridge

- Sign the transaction to bridge

Your deposit will show on the Blast dashboard. If you need an invite code: 7R7O8.

Now that you have some ETH on Blast, it’s time to use dapps.

The Blast airdrop strategy: use dapps!

Just passively holding ETH or USDB on Blast will likely not work if you are not a whale.

Instead, you need to do transactions, use dapps, and be a good citizen.

This can pay off in 3 ways:

- More points on Blast

- Points or Blast tokens from dapps (remember, devs get 50% of the Blast airdrop)

- Potential airdrops of dapps’ own tokens

So which dapps to use and where can you find them?

Featured dapps

First, Blast lists many dapps on their website. Some of them will let you get more points.

- Multipliers — Starting from April 1, use the featured dapps to get 2x points. Using these dapps is your chance to catch up with whales who might skip this.

- Gold — this will represent future airdropped Blast tokens, that dapps will likely give to users. Gold will be manually assigned by the Blast team

These dapps don’t require you to stake or LP and are cheap to use:

- DistrictOne — a socialfi app with group chats. For being active in chats and taking part in daily Rallies, you can win Gems, which are then converted into Blast Gold.

- Cambria — a PvP fighting game (surprisingly fun) where you can duel with other players for ETH or points. Invite codes for you: da-tn2oqkfpsb, da-ldy2f2ze2c, da-tn2oqkfpsb, da-o6eckzweq3, da-km0r2i3itl.

- YOLO games — degen gaming where you can bet big or small. Or you can just watch people lose and win dozens of ETH.

- Decentral Games — a straight-up onchain casino with poker, slots, black jack, you know. You even get a free bonus and a matching bonus for the first deposits. Asks for your email and address thou.

- Spacebar — an onchain game where you can mint a spaceship and earn daily points. Immediately get 1,000 points by setting Zerion DNA as your PFP and using this referral code: cV07eh.

The Big Bang winners

Earlier in February, Blast also announced the results of the Big Bang competition for developers building on top of the network. The winners are already among the top dapps featured by Blast.

Meanwhile, in the ‘runner ups’ and ‘honorable mentions’ you can find some exciting dapps that won’t cost you a lot of money, including:

- BladeSwap — a DEX with a daily free loot box;

- BlasterSwap — a DEX with its own upcoming airdrop and extra rewards for providing liquidity for featured projects. Swap daily to get up to a 50% boost.

Established protocols with top TVL

Finally, you can check out which DeFi protocols are gaining TVL by checking DeFiLama. If other degens are using those protocols, there is probably a reason: yields, airdrop expectations, or points (the worst). Of course, you’ll need some assets to earn those yields.

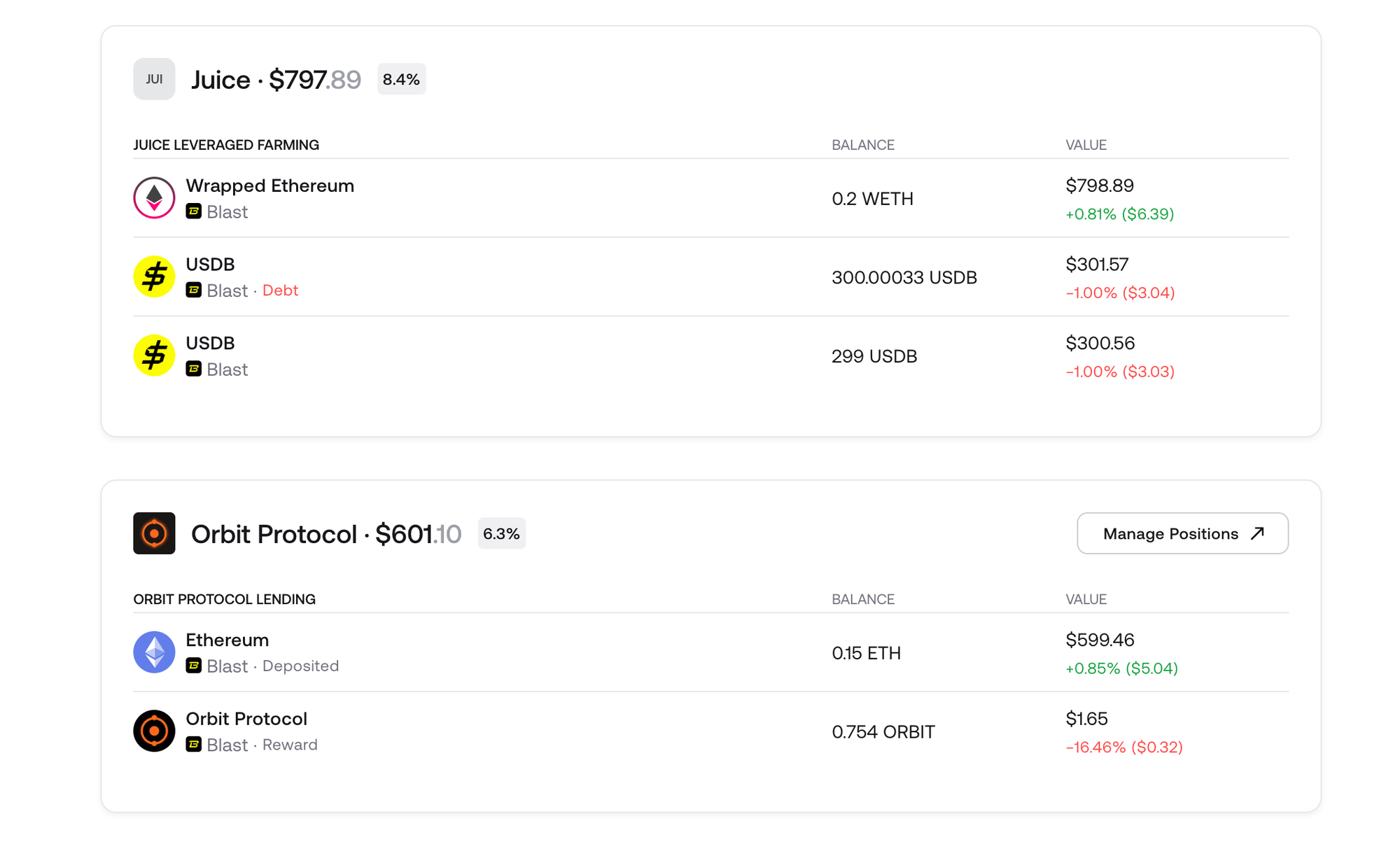

If you have some assets, using established protocols could be the safest way to benefit from the Blast growth with less risks:

- ZeroLend — deposit ETH for ~14%, made up of the ETH yield, Blast points, and earlyZERO. Plus farm ZeroLend’s own points for their future airdrop.

- Synapse — one of the largest bridges, you can provide USDB or ETH, both yield >60% APY. Half of your LPs will be in the protocol’s own versions of the tokens.

- Symbiosis — a well-established bridge where you can provide liquidity on Blast to let people transfer. While the pool is small, you can get 20% APY on ETH. It’s one sided, you don’t need to hold another token.

- Abracadabra — deposit ETH on Blast (earning 6%) and borrow MIM, the stablecoin, which you can swap for more ETH.

You can also track many of the top protocols with the Zerion web app (connect any wallet) and Zerion Wallet for Blast (import your private keys).

With Zerion, you can also see not only your Blast moves but your whole multichain transaction history in a human-readable format. This helps to stay sane and remember where you’ve been.

What’s next

Blast is growing fast, and you should not fade it.

Even if you are late to the party, there is still time to catch up by being active on the network. The airdrop is coming in May, and it’s time to grind, Zer.

To remember where you’ve been and what positions you have on Blast, get Zerion Wallet.

FAQ

How does Blast compare to other L2s?

Blast stands out from other L2s by offering native yield on ETH and stablecoins, meaning assets earn interest automatically. It also uses an optimistic rollup design like Arbitrum and Optimism but prioritizes passive yield and user incentives. However, it has fewer live dApps and less liquidity compared to some other more established L2s.

Will Blast do another airdrop?

Future airdrops are possible, especially for active users, early adopters, or those who provide liquidity. Staying engaged with the ecosystem increases your chances of qualifying if more rewards are distributed.

How to discover upcoming airdrops on L2 networks?

You can discover upcoming airdrops on L2 networks by following official project announcements on X (Twitter), Discord, and Telegram. Platforms like Zerion can help track activity and eligibility. Additionally, engaging with testnets, using bridges, and interacting with new protocols early can increase your chances of qualifying.