How to Find the Best Place to Stake ETH

In this post, we’ll explain how staking Ethereum works, what APY you can earn, and how to find the best place to stake ETH and start earning.

If you have ETH in a non-custodial wallet, you can easily and safely use it to earn a passive yield. In this post, we’ll explain how staking Ethereum works, what APY you can earn, and how to find the best place to stake ETH and start earning.

What is staking Ethereum

Staking on Ethereum is a process where you lock up your ETH to secure the blockchain and earn more ETH as the reward.

With the Merge, Ethereum has fully shifted to the Proof of Stake algorithm. This means that instead of miners (like in Bitcoin), validators add transactions to the blockchain, earning block rewards and transaction fees.

Anyone can become a validator by staking 32 ETH, which serves as a security guarantee. If a validator tries to cheat or otherwise breaks the rules, this ETH can be slashed.

Running a validator requires some hardware and tech skills in addition to staking 32 ETH. You must also ensure that the validator can run 24/7.

It’s easier to stake with dedicated protocols like Lido or Rocket Pool.

We’ll show you how to find the best place for staking ETH but first, let’s explore how much you can earn.

ETH staking APY

The APY or annual percentage yield for staking ETH is between 2% and 5%.

The yield is paid in ETH, and it can fluctuate depending on several factors:

- How much competition there is between validators — the more ETH is staked, the lower is the yield everyone earns

- How many transactions there are — when the blockchain is busy (and gas is expensive), the yield is higher

How much you earn also depends on how you stake ETH. Unless you stake ETH on your own, you will need to pay some fees to the staking protocol.

How to stake ETH

There are several ways to stake ETH:

- Solo staking — you need 32 ETH and technical expertise to run your own validator

- Staking with a centralized exchange — you trust that the exchange or other provider will keep it safe and will not run into problems with regulators

- Staking with an onchain pool — you supply any amount of ETH, and it will be routed to a validator using smart contracts

The easiest and safest way to stake ETH is using an onchain staking pool. That way, you do not have to trust anybody. Your ETH is securely locked in a smart contract. Only you can withdraw it. And you can do that whenever you want without anyone’s permission.

With most onchain staking protocols like Lido or Rocket Pool, you will also get liquid staking tokens (LSTs). You can use this token in DeFi or can instantly sell for ETH.

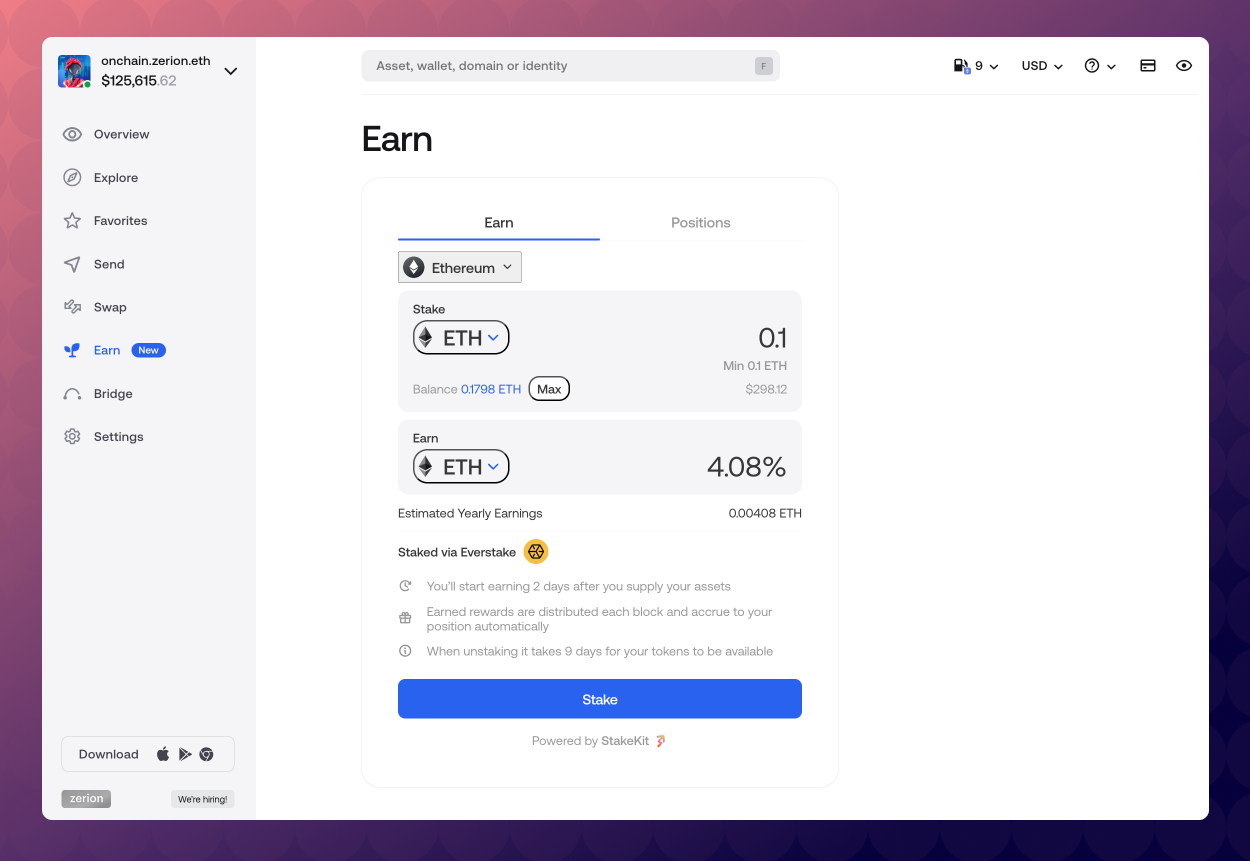

The rates among these providers fluctuate, and Zerion can help you find the best place.

- Go to Zerion Earn

- Connect your wallet

- Click on ETH under ‘Earn’ to see the available options and yields

- Click stake and sign the messages.

That’s it. Your staked ETH position will appear in your Zerion Wallet or the Zerion web app.

The yield will accrue automatically, and you can withdraw your ETH at any time (you’ll need to wait a few days).

Summary

This post examined how staking Ethereum works, what APY you can earn, and how to do it. We’ve then examined how to find the best yields with Zerion.

The next step is to stake some ETH and see how it works. To fully appreciate it, you need to experience the true freedom of earning a yield onchain.