How to Stake AVAX with BENQI and Zerion

Learn what AVAX staking is, how it works, and how to get started.

Staking AVAX can be a great way to earn a yield passively. However, the initial setup can be costly and complicated. Luckily, with BENQI and Zerion Wallet you can stake AVAX in just a few clicks. In this post, you’ll learn AVAX staking, how it works, and how to get started.

What is AVAX Staking?

Avalanche is a proof-of-stake EVM Layer-1 blockchain. By staking AVAX tokens, you can help secure the blockchain and earn more AVAX as staking rewards.

The APY for staking AVAX is usually about 5-7%, fluctuating based on the supply of staked tokens within the network.

Avalanche has two networks:

- The C-Chain, the EVM chain where DeFi and other smart contracts live

- The P-Chain, the non-EVM chain that co-ordinates validators

AVAX staking happens on the P-Chain, where you must use a native Avalanche wallet.

If you have AVAX on C-Chain, you would usually need first to bridge it to P-Chain. Then you can stake. And if you want to withdraw AVAX and use it in DeFi, you would need to bridge back to C-Chain. All that can be costly and slow. Instead, you can use liquid staking.

AVAX Liquid Staking

Liquid staking is when you stake tokens in a protocol and get another transferable token, which represents your staked tokens. These are called liquid staked tokens (LST).

On Avalanche, liquid staking is particularly useful because it bridges the gap between the C-Chain and the P-Chain. You stake AVAX on C-Chain and get LST, which can be traded or used in DeFi. The protocol then stakes your AVAX on P-Chain and pays back the rewards to you on the C-Chain.

The leading liquid staking provider on Avalanche is BENQI.

What is BENQI?

Launched in 2021, BENQI is a suite of DeFi protocols on Avalanche with over $400 million in total value locked (TVL).

BENQI’s Liquid Staking protocol tokenizes staked AVAX as sAVAX, the LST you can move, trade, and use in DeFi.

Here is how liquid staking works at a high level:

- You stake AVAX with BENQI on the C-Chain, i.e. the EVM network with all the DeFi

- BENQI gives you sAVAX and delegates AVAX to validator nodes on P-Chain and gives

- Your sAVAX automatically earns staking rewards

You can always withdraw your staked AVAX and accumulated rewards after a 2-week cooldown period.

If you don’t want to wait, you can use a decentralized exchange like Balancer or Trader Joe to swap your sAVAX to AVAX.

How to Stake AVAX with BENQI and Zerion

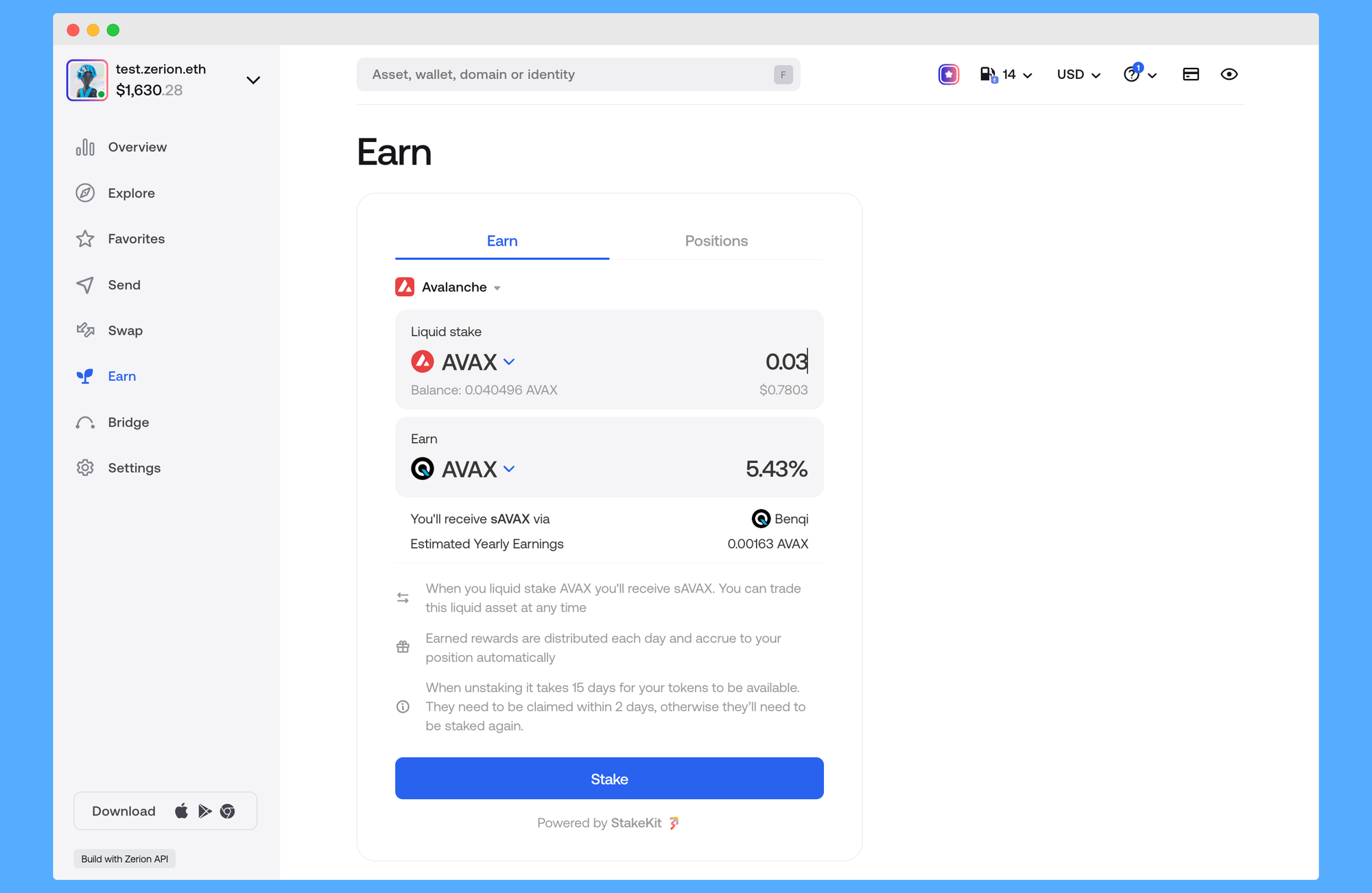

Zerion aggregates staking opportunities from across the most popular chains and tokens using StakeKit.

For any asset, including AVAX, Zerion shows the current APY.

To stake your AVAX, here is what you need to do:

- Go to zerion.io/earn and connect your Zerion Wallet

- Select Avalanche as the network

- AVAX is selected by default as the asset to stake — if you want to buy more AVAX, you can do this with zerion.io/swap, which will find you the best rate

- Click ‘Stake’ and sign the transaction

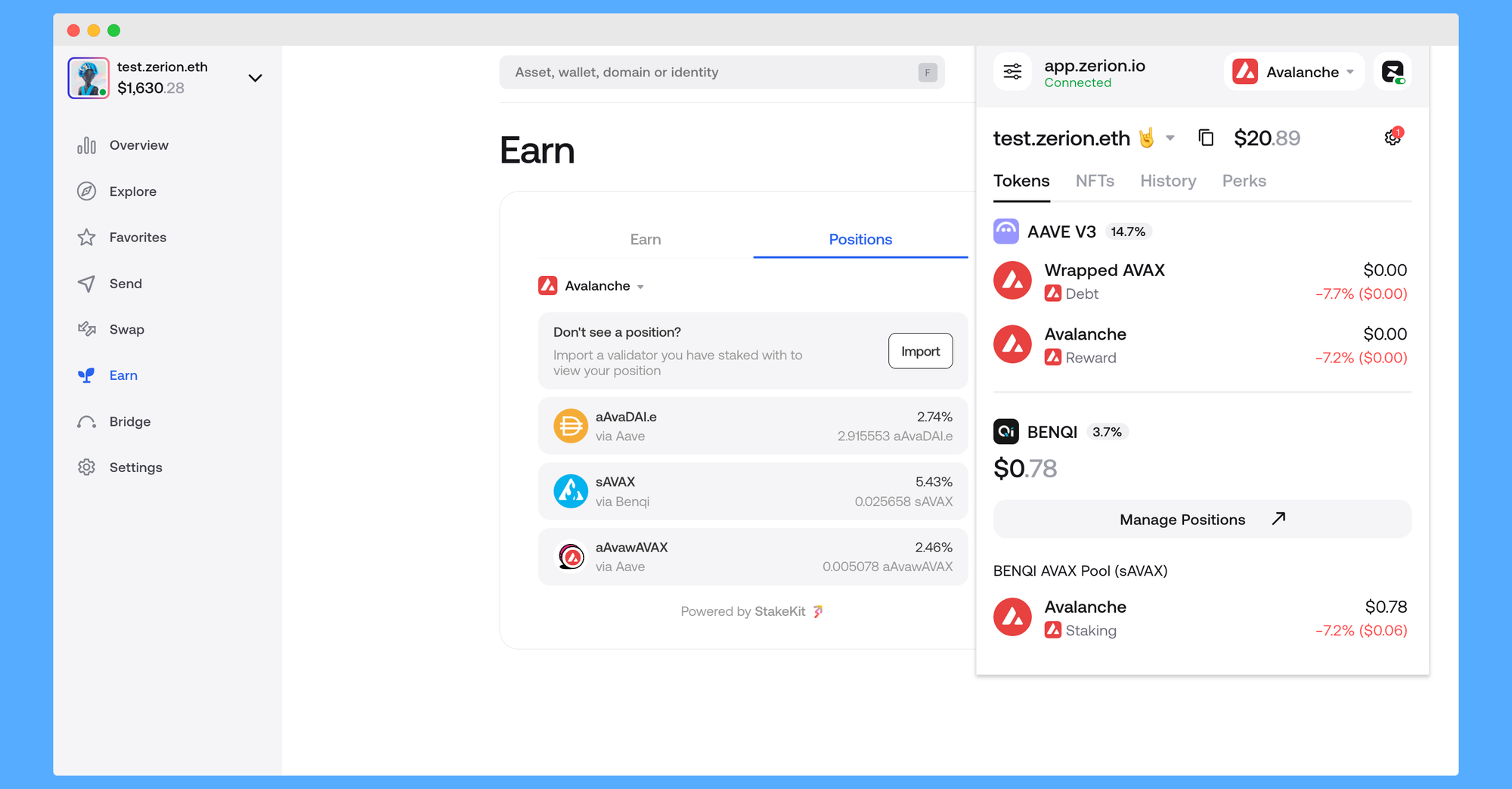

After staking AVAX, you will receive sAVAX in your wallet. You can see those tokens in the portfolio Overview, transaction history, and also in the list of your positions in the /earn tab.

To get back your AVAX, you can simply swap sAVAX. This way you don’t have to wait 15 days for a withdrawal period.

You can also use your sAVAX in DeFi, for example, to provide liquidity for sAVAX/AVAX pool.

Finally, you can also stake AVAX in Zerion Wallet on mobile. Tap the Storm icon, select ‘Earn’ and follow the same steps.

To Sum Up

In this post, you’ve learned how AVAX staking works and how Benqi makes it easy and fast. After that, you’ve seen the exact steps to start staking right in Zerion. Now, it’s time to put this knowledge into practice!

FAQ

How do I stake my AVAX?

You can stake AVAX using BENQI liquid staking directly in Zerion. Simply go to zerion.io/earn and select Avalanche as the network.

Is it worth staking AVAX?

Staking AVAX can be a great way to earn a passive yield while maintaining the full custody of your tokens.

How does BENQI liquid staking work?

BENQI takes deposits in AVAX on the EVM chain. It then stakes tokens with delegators and gives you sAVAX, the liquid staking token that you can freely transfer, trade, or use in DeFi.

What are the fees for staking AVAX with BENQI and Zerion?

BENQI currently has no fees, and Zerion charges a 10% fee for earned rewards.