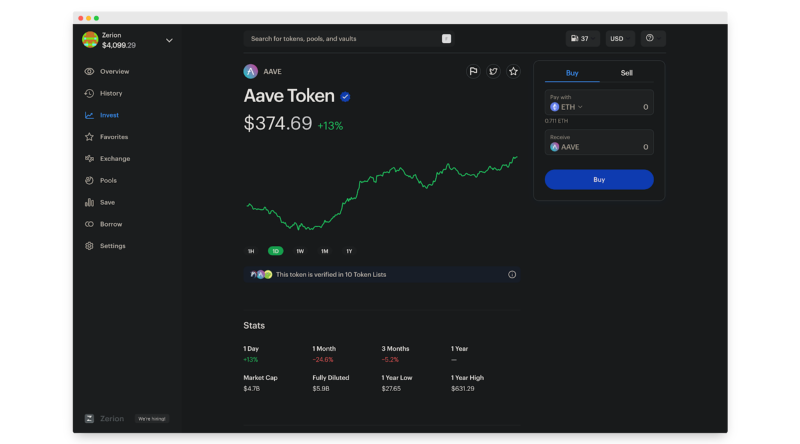

Let’s talk about Aave, DeFi’s biggest liquidity protocol

Aave is a lending and borrowing protocol that dominates 14.8% of the total value locked in DeFi. The protocol is best known for its…

Aave is a lending and borrowing protocol that dominates 14.8% of the total value locked in DeFi. The protocol is best known for its flexible interest rates and undercollateralized flash loans.

But what does “lending and borrowing” really look like in the world of decentralized finance?

It’s time to un-spook DeFi 👻

How Aave works

Suppliers provide liquidity to the market to earn passive income 💰

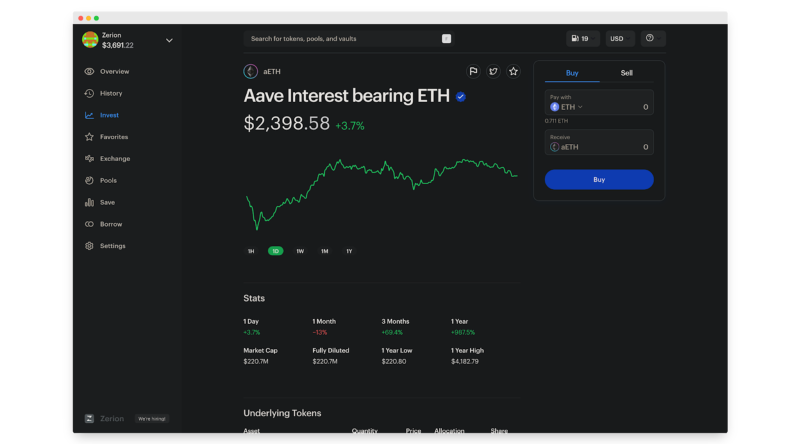

For example, when you buy aETH, the Aave aToken, in Zerion Wallet, you’re really depositing an asset to the Aave protocol and receiving access to a liquidity pool that increases the amount of assets returned to you via interest earned.

Borrowers have the option of borrowing assets in either an over collateralized or undercollateralized fashion:

- Overcollateralized loans require you to deposit assets to the protocol before borrowing different assets.

- Undercollateralized (aka “flash”) loans require zero collateral, provided that you pay back the loan within one transaction block i.e. a very short period of time.

Must-know terms

You’ll come across these when lending and borrowing on Aave:

- Health factor. This is how “safe” your loan is, calculated as the proportion of collateral deposited versus the amount borrowed. A health factor above 1 is recommended to avoid liquidation.

- Loan to Value (LTV) ratio. This is the borrowing power available at a given level of collateral. For example, if a collateral has a LTV of 75%, you can borrow up to 0.75 worth of ETH in the principal currency for every 1 ETH worth of collateral.

- Liquidation threshold. This is the threshold at which a borrow position will be considered undercollateralized and subject to liquidation. For example, if a collateral has a liquidation threshold of 80%, it means the loan will be liquidated when the debt value is worth 80% of the collateral value.

- Liquidation penalty. When a liquidation occurs, liquidators repay part or all of the outstanding borrowed amount on behalf of the borrower. In return, they can buy the collateral at a discount and keep the difference as a bonus.

Digging deeper into Aave flash loans

⚠️ Flash loans are high risk and should only be used if you know what you’re doing. You can read more about Aave flash loans here.

Flash loans enable you to borrow instantly with no collateral required, provided that the liquidity is returned to the pool within one transaction block. When this doesn’t happen, the entire transaction is reversed, guaranteeing the safety of the funds in Aave’s reserve pool.

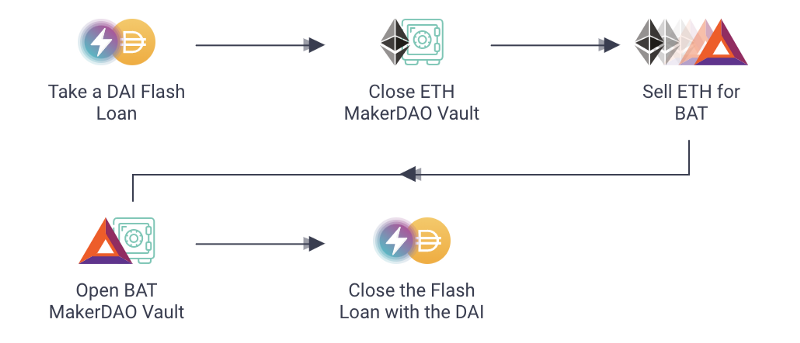

People typically use flash loans for arbitrage opportunities, collateral swapping, self-liquidation, and more.

The Aave governance token

Like many DeFi protocols, Aave has a decentralized governance structure powered by the $AAVE token. If you hold $AAVE, you can vote on the outcome of Aave Improvement Proposals (AIPs) or stake to earn rewards.

Ready to get started? Head over to app.zerion.io or visit or chat to us on Discord!

Try Zerion Wallet

And mint Zerion DNA, a free evolving NFT!