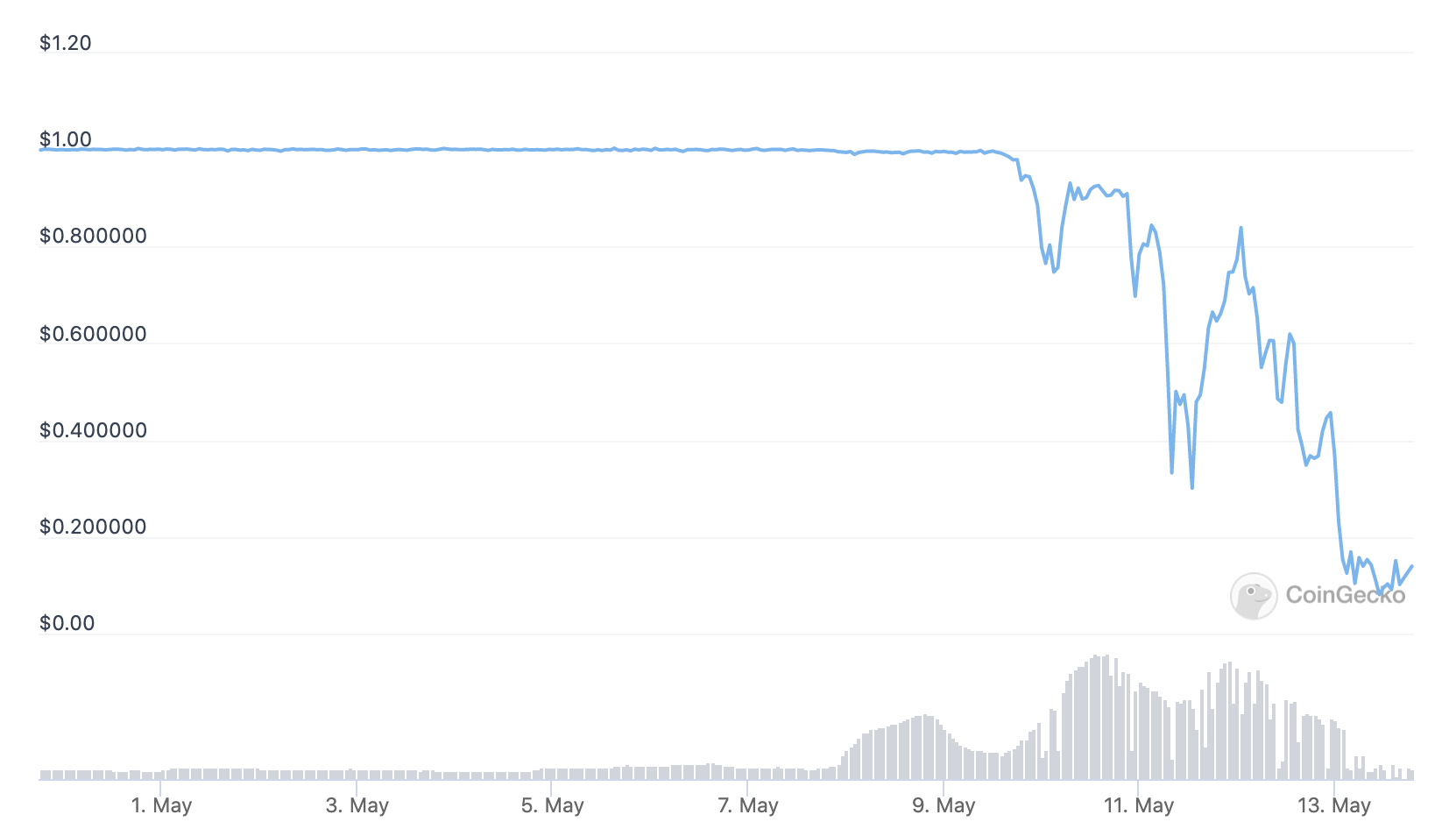

In a matter of days, UST went from $1 to as low as $0.05, dragging otherwise boring stablecoins into the spotlight.

The demise of UST coincided with (or maybe even contributed to) the overall crypto market crash. While usually, traders try to wait out market sell-offs in stablecoins, this time fears spread to USDT and other coins.

In this post, we will explore different types of stable coins, see what happened to UST and LUNA, review other risks, and explore alternatives through hedging with derivatives.

Stablecoins explained

Stable coins are cryptocurrencies that aim to maintain a stable exchange rate. They are pegged to fiat currencies, usually the US Dollar.

In practice, stablecoin prices often slightly deviate from their fiat counterparts. Usually, the price quickly returns to the target value.

However, if the price moves too far away from the peg, this can cause a loss of faith and spark a panic sell-off that would send the price even lower. To avoid that, stablecoins employ various methods of keeping the peg.

Why stablecoins are stable

A stablecoin is stable because people believe that it will maintain its price.

When big traders and market makers see that the price of a USD-linked stable coin is below $1, they can buy it and pocket an easy profit once the price returns to $1. Similarly, when the price is above $1, they can take out a loan to sell the stable coins and buy back when the price drops to $1.

This confidence comes from the way these stable coins are set up.

Centralized vs decentralized stablecoins

A stablecoin could be centralized or decentralized:

- A centralized stable coin is issued by a single issuer, which mints all new coins

- A decentralized stable coin is minted by interacting with a smart contract

This distinction isn’t binary or clear-cut.

A centralized coin can be held by a very wide range of players, who each have different agendas. And founders of decentralized coins can often still have outsized influence even if they can’t control the smart contract.

Both centralized and decentralized stable coins can be either collateralized or algorithmic.

Collateralized vs algorithmic stablecoins

A collateralized stable coin is backed by some assets, known as collateral.

These assets are held either off-chain on the issuer’s balance sheet (centralized coins) or on-chain (usually decentralized).

Almost anything could act as collateral:

- USD on a bank account (for USDC)

- US Treasuries (also for USDC)

- Commercial papers (for USDT)

- ETH and other cryptocurrencies, and even other stable coins (for DAI)

Collateralization is a degree, which means a stable coin can be:

- Overcollateralized (e.g. DAI) — for every stablecoin there is more than $1 in collateral

- Fully collateralized — $1 worth of assets for every stablecoin

- Partially collateralized — under $1 worth of assets for every coin

Unless the collateral is on-chain, it’s hard to know exactly what backs the coin. Even a financial audit by a reputable firm is only a snapshot of the accounts on a particular date.

Meanwhile, overcollateralized stables coins like DAI are capital inefficient. To get $1 you must lock up more than $1 worth of assets, which could earn a yield or do something productive.

That’s why there is a lot of hope for algorithmic stablecoins.

Algorithmic stablecoins aim to maintain the peg through algorithmically modifying the supply.

What is UST and what happened to it?

UST is an algorithmic decentralized stablecoin, which sought to maintain its peg through algorithmically modifying the supply of its arbitrage token LUNA.

Both UST and LUNA tokens run on the Terra blockchain, led by its charismatic founder Do Kwon.

By design, every 1 UST can be exchanged into $1 worth of newly minted LUNA. And when 1 UST is minted, $1 worth of LUNA is burned. This is supposed to stabilize the price of UST.

- So if 1 UST = $1.1, you can buy $1 in LUNA, burn it to mint 1 UST, sell it for USD and instantly make a profit of $0.1.

- And if 1 UST = $0.90, you can exchange UST for $1 worth of LUNA, sell it, and pocket a profit of $0.1.

At first, this worked well.

UST became increasingly popular due to a 20% yield offered on Anchor, a lending and borrowing protocol. To mint new UST, people burned LUNA, decreasing supply and pushing its price up. The token climbed the ranks, attracting even more people into the Terra ecosystem who minted more UST.

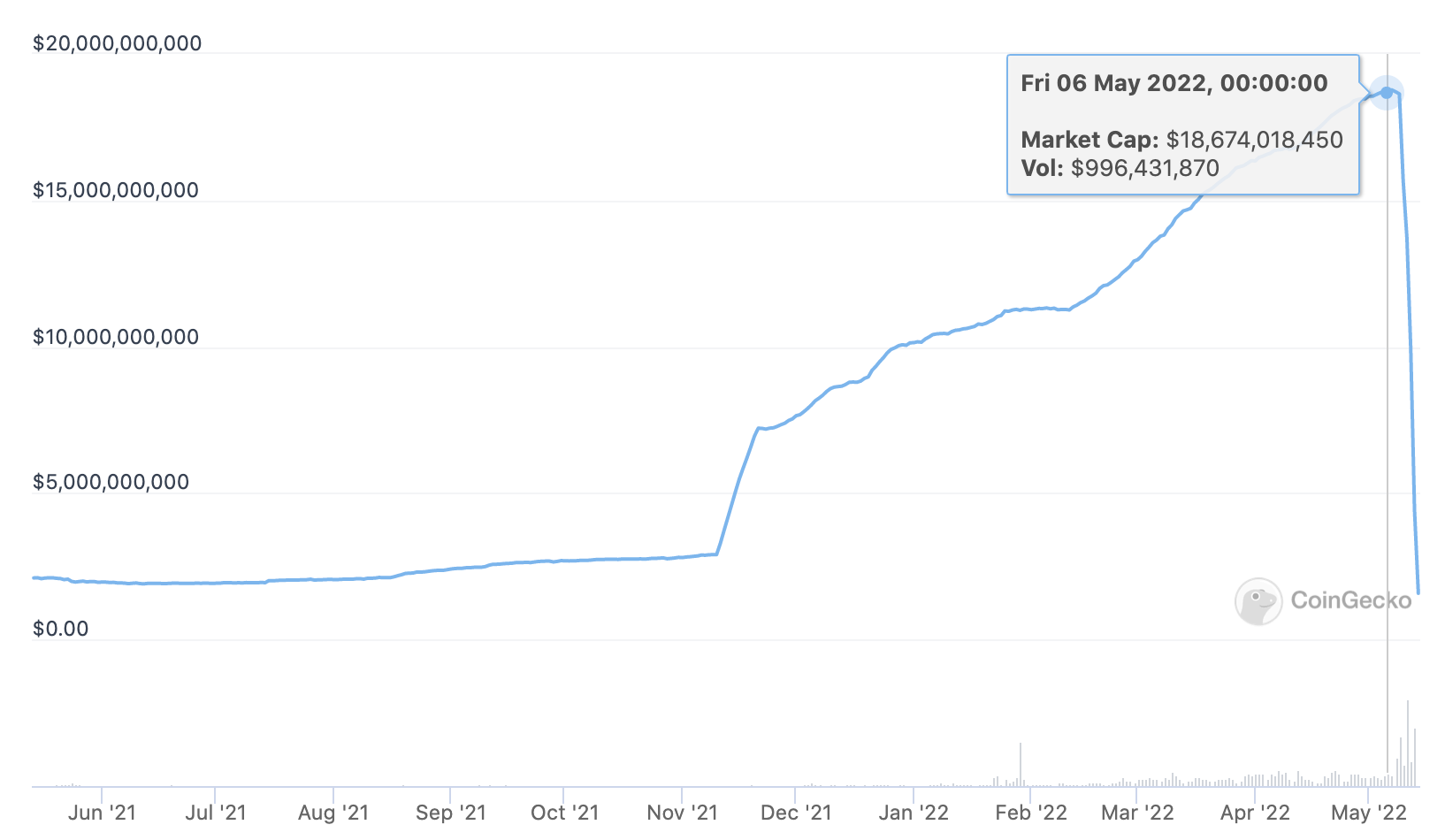

In less than 2 years, the market cap of LUNA rose from $5 billion to $40 billion at its peak in April 2022. During the same period, the market cap of UST went from $1.7 billion to $18 billion.

Then things reversed.

Here’s what happened with UST and LUNA.

- May 7-8. Some whale trader sells $300 million of UST on Curve — exactly when $150 million in liquidity was being moved from 3pool to 4pool (likely not a coincidence). The pool becomes heavily imbalanced and UST’s peg breaks to about $0.98. (Here's a refresher on how liquidity pools work if you need it).

- Investors begin to leave Anchor. Some of them sell UST to redeem it for LUNA. This pushes the price even lower to $0.97.

- May 9. Someone sells $650 million of UST on Binance, pushing the price as low as $0.62.

- May 10. More people flee Anchor, and deposits drop by almost 85%. Because there is no liquidity anywhere, people redeem UST for LUNA, flooding the market and crashing the price of LUNA.

- May 11. Terra founder Do Kwon addresses the community, admitting that “the only path forward will be to absorb the stablecoin supply that wants to exit” (i.e. let people sell at under $1).

- May 12. Terra’s blockchain becomes overloaded and is halted. Anchor’s borrowers get liquidated, and their collateral is sold.

- May 13. LUNA and UST enter a death spiral, where depreciating UST is constantly redeemed for freefalling LUNA, which is down from the all-time high of $119 to $0.0000009 (-99.999%).

Overall, UST’s algorithm worked as intended. However, it was not enough to restore the peg once confidence was lost and the downward spiral started.

This doesn’t mean that the same fate awaits other stablecoins, but it’s important to understand what risks exist in these seemingly safe tokens.

Stablecoins risks

Stablecoins are not risk-free. Nothing is, especially in crypto. Let’s review some of the key risks.

📉 Market risks

Big market movements, even if they are not directly related to the particular stable coin, can put too much pressure on the peg.

If everybody is swapping into a particular stable coin, the price could exceed $1 (that’s what happened with USDC this week).

And if everybody is dumping a stablecoin to join the bull run, the price could be pushed to under $1.

💰 Quality of collateral

If assets that back the stablecoin deteriorate, people could start selling the stablecoin.

FUD (fears, doubts, uncertainties) alone could have a significant price impact. For off-chain assets, it’s hard to know the true quality of what's on the issuer's balance. The USDT’s collateral (or the lack of it) has long been the subject of heated debates.

🤖 Algorithm risks

Any algorithmic coin depends on a number of assumptions.

Most importantly, these coins assume that people would behave in a certain way. And that can only be tested in extreme conditions of the real market.

🏛️ Regulatory risks

Today, stablecoins are largely unregulated. But that is likely to change.

The regulators in the US killed Diem, Facebook’s ambitious stablecoin project. Existing stablecoins are much smaller in scale than what Facebook envisioned but if and when they get bigger, regulators will likely start paying attention.

💧 Liquidity risk

This risk materializes when everybody tries to sell and there are not enough buyers.

Issuers and their backers of centralized coins can pick up excessive sell pressure. Decentralized coins, however, must rely on holders’ self-interest.

A list of major stablecoins

Now that we explored different types of stablecoins and various risks, we can look at how major coins performed. Below is a list of stablecoins with above $1 billion market capitalization, ranked from the largest to the smallest cap.

Because all the major stablecoins are different, they all have different risk profiles. Holding a mix of various coins could help diversify risks: when one coin goes down, others might go up or at least keep steady.

By connecting your wallets to Zerion you can get a full overview of all your coins. Zerion will list not only what you have on Ethereum, but also on BSC, Solana, Polygon, and major Layer 2 networks.

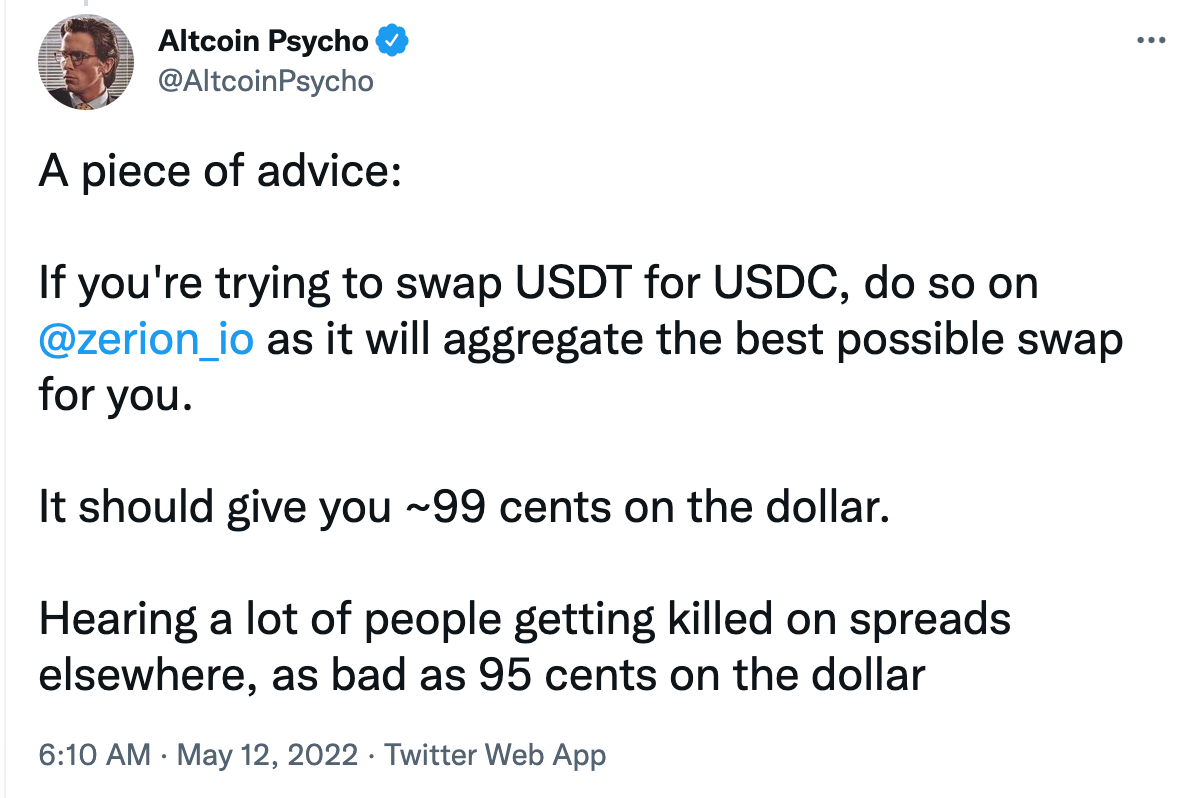

If you realize that you have too much of any particular stablecoin, Zerion’s trading aggregator can help you find the best rate for swapping — again, not only on mainnet Ethereum but also on Layer 1 and Layer 2 networks.

Stablecoin alternative with crypto derivatives

Many crypto investors buy stablecoins to wait out bearish trends and preserve wealth.

This can also be achieved through buying derivatives to hedge the risk of crypto prices going down. You can hedge the downside by either buying put options or by shorting perpetual.

Short perpetual with DYDX, Kwenta, or MCDEX

A perpetual is a type of futures contract without an expiration date.

If you hold ETH and have a short perpetual for the same amount, you have a market-neutral position. This means that if the price of ETH goes down, the value of your short perpetual will go up and compensate for the losses.

Furthermore, when you hold a short perpetual you can even get income from the funding rate. This is the rate that traders pay for a long perpetual, essentially placing leveraged bets that the price will go up.

The main risk of a short perpetual contract is that a big upward price surge can get your position liquidated: your collateral will be sold to cover the loss. To avoid that you can monitor the price and swap contracts for ones with higher liquidation prices.

Here are the top on-chain perpetual platforms:

- DYDX — on Starkware

- Kwenta — on Optimism (maybe you could qualify for the next OP airdrop)

- MCDEX — on Optimism

Put options with Dopex or Lyra

If you don’t want to worry about the risk of getting liquidated, you can instead buy put options.

You can pick the option’s strike price so that it covers your whole or part of your crypto holding. For example, if you have 1 ETH worth $2000 and worry that it might go down to $1500, you can buy a put option that would pay $500 if the price would drop to $1500.

Unlike with a perpetual, you pay the premium when you buy the option. Also, options eventually expire, so to keep the hedge you need to buy new options with longer expiration.

Here are two on-chain options platforms:

Review your stablecoins risks

To sum up: all stablecoins are risky, just like anything else in crypto. You can hedge some of the price risks with short perpetual or put options.

But in general, if you worry about the price it’s likely that you have too much money in the market.

Connect your wallets to Zerion to see exactly what you hold across different DeFi protocols and all Layer 1 and Layer 2 networks.

P.S. Crashes and bear markets are tough. If you or someone you know is deeply affected by what happened in the crypto market this week, please reach us on Discord — don't keep it to yourself, you're not alone.

FAQ

Are stablecoins safe?

Stablecoins are risky. They offer protection from price volatility but can’t guarantee that the peg to the underlying fiat currency or liquidity can be maintained in any conditions.

Which stablecoin is most stable?

All existing stablecoins lost their peg at some point, usually during extreme market conditions. In normal circumstances, all large-cap stablecoins maintain their peg.

Can you short stablecoins?

You can get short exposure to stablecoins by borrowing them against some other crypto asset. For example, you can deposit ETH as collateral in Aave, borrow USDT, and then sell it.

Why are stablecoin yields so high?

Higher rewards (yields) also have higher risks. Yields are usually higher for riskier stablecoins that have smaller capitalizations or shorter track records.

Are stablecoins a good investment?

This depends on your goals. Over the long term, stablecoins lose their purchasing power due to inflation, just like the regular fiat currencies. But in the short term stablecoins can protect you from the volatility of cryptocurrencies.