Although zkSync is the largest zk Rollup, Uniswap and other DeFi giants are yet to come to the network. This opens up opportunities for zkSync-native DEXes. Given their attractive APYs, these newer platforms are certainly worth exploring. In this article, we dive into Mute.io, one of the largest DeFi platforms on zkSync.

What is Mute.io

Mute.io is a decentralized exchange and DeFi platform native to zkSync Era.

Besides its DEX, Mute offers a yield farming platform and bonding for growing its protocol-owned liquidity. Let’s look at each part one by one.

DEX

Like any other decentralized exchange, Mute lets you swap any tokens and earn fees for providing liquidity to other traders.

Swaps

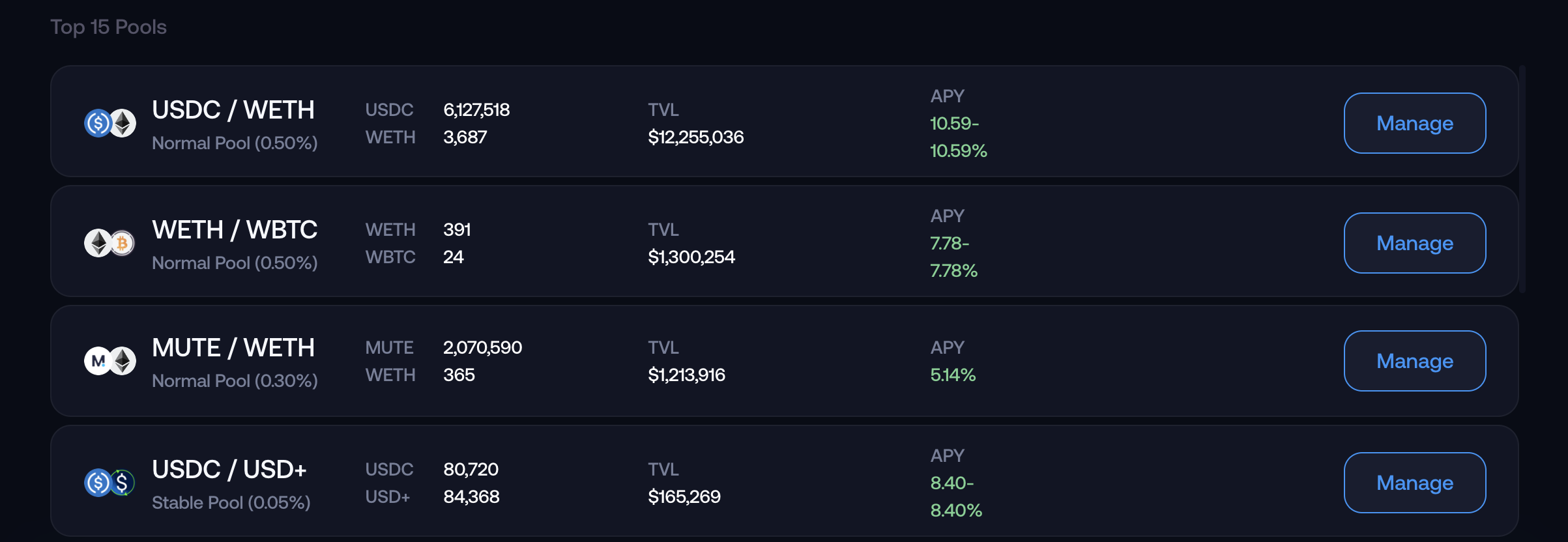

Mute currently supports dozens of trading pairs. Three of them (USDC-ETH, ETH-WBTC, and MUTE-ETH) have liquidity of over $1 million each.

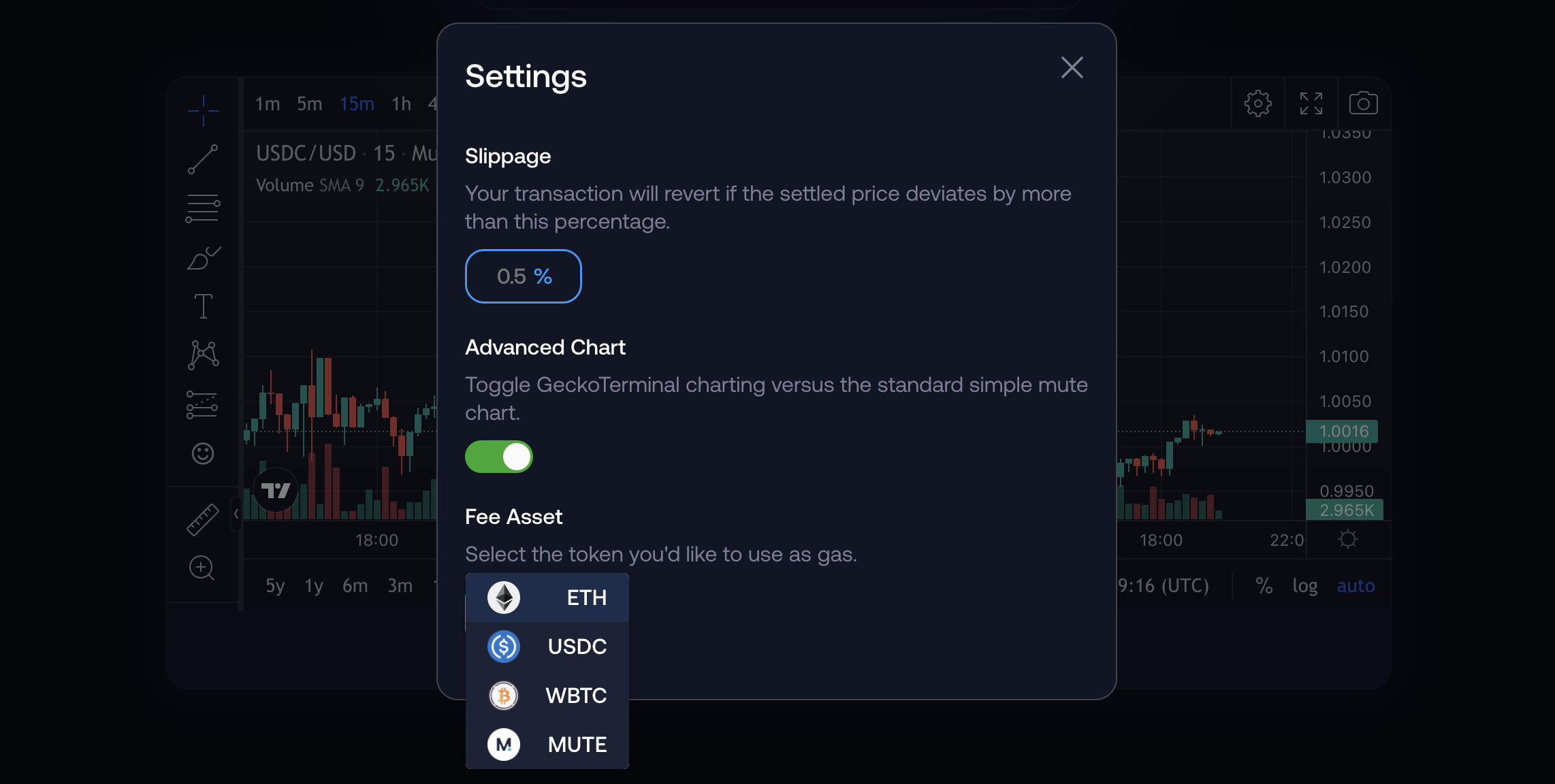

When swapping with Mute, you can select your slippage and the asset to pay the fees. You can also use advanced charts by Coingecko.

Mute is also working on adding limit orders, which would be enabled through a free market of trading bots.

Liquidity pools

You can provide liquidity for all supported trading pairs.

There are two types of LP fee structures: Normal (0.01-10% fees) and Stable (0.01%-2%), which is for assets that usually trade at close to 1:1, such as stablecoins.

Mute is also one of the liquidity sources in 1inch. This means that you can earn fees not only when people trade via Mute.io but also through 1inch and apps that use it, including swap aggregation in Zerion Wallet for zkSync.

Currently, LP yields on Mute range from about 11% for USDC-ETH to triple digits for small pools with memecoins and other degen tokens.

On top of trading fees, you can earn yield farming rewards.

Yield farming on Mute.io with Amplifier

Mute previously offered Amplifier yield farms for 7 trading pairs, yet all programs have now expired.

Amplifier rewards in MUTE tokens came from platform revenues and fees. Initially, the team selected which pools would get the rewards. Eventually, the Mute DAO would vote on those decisions.

Thanks to these rewards and a wide range of trading pairs, Mute became the second largest protocol on zkSync Era by total value locked (TVL) with over $15 million as of September 2023.

Tracking and managing your Mute portfolio

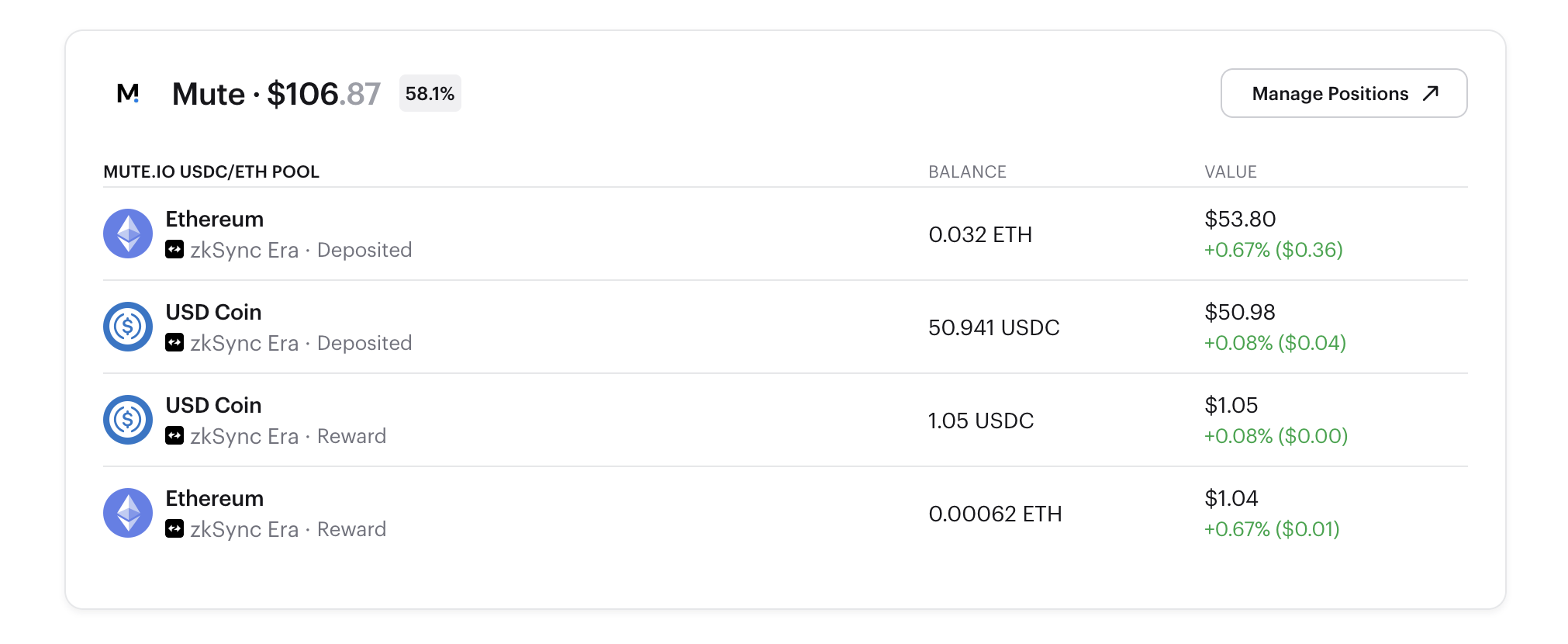

With Zerion Wallet, you can track all your zkSync assets, including Mute LP tokens and rewards.

- Track all your LPs and rewards

- Review transaction history

- Manage your positions by going to the verified dapp URL

Zerion is available as a mobile app, a browser extension (currently in early access), and a web app.

Zerion web app is a great way to see how your zkSync address would look in a Zerion Wallet after you import your seed phrase or private key. To test Zerion, just connect your wallet to the web app.

Besides best-in-class portfolio tracking, Zerion Wallet has a swap and bridge aggregator, advanced security features, Perks, and more.

Now, let’s get back to Mute.

MUTE token and DAO

Mute.io has its own native token MUTE.

The MUTE token can be locked to get dMUTE, the soul-bound version used for voting in the Mute DAO. How much dMUTE you get depends on the length of the lockup period, which can be between 7 and 365 days. At the end of the lockup, dMUTE can be exchanged back to MUTE.

Holders can use dMUTE to get Amplifier rewards for their LP tokens. They can also vote on the creation of new Amplifier Pools and other important DAO decisions.

Bonding

Besides buying tokens MUTE tokens on the market, it’s also possible to get them at a discount through bonding.

Bonding in DeFi is a process of exchanging tokens at a discount by paying with LP tokens. The tokens for sale come from the DAO, which in return grows its protocol-owned liquidity (which can generate fees). Buyers usually get their tokens after a vetting period.

In Mute’s case, you can buy MUTE for MUTE-ETH LP. The discounts start at 0% and increase gradually until all tokens are sold out. Currently, all bonding is sold out and will likely be available once the market improves.

Conclusion

In this post, we reviewed what Mute.io is, how its DEX and farming work, and explored how you can track your portfolio with Zerion Wallet. After that, we went over the Mute DAO and its native governance token MUTE.

If you’re exploring the zkSync Era ecosystem, Mute is certainly a platform you should try.