How to Stake ETH in a Few Clicks

Ethereum’s shift to Proof of Stake aka the Merge promises to turn staking ETH into the most important source of yield in DeFi.

The idea is simple. You stake ETH and get more ETH for validating transactions on the blockchain. In practice, however, this could be complicated for the ‘advanced’ crypto user. Luckily, there are lots of staking platforms that make staking easier.

In this post, we’ll explain to you how to stake ETH, what staking platforms are available, and how to get your staked ETH in a few clicks with Zerion.

How to stake ETH?

You have several options when it comes to staking ETH.

- Staking on your own: You need at least 32 ETH to activate Ethereum validator software. That ETH will be locked up until withdrawals are enabled with Ethereum’s Shanghai update (expected in 2023). You’ll also need a dedicated computer with a 24/7 internet connection and some technical skills.

- Staking as a service: You still need 32 ETH but the staking service will take care of running the validator node. Some of the services even let you use your own keys.

- Pooled liquid staking: You can stake any amount in the staking pool. The pool operator runs validators and distributes staking rewards proportional to everybody’s contribution. Some of the staking pools issue ‘liquid’ tokens that represent your staked ETH.

For any active Web3 user, pooled liquid staking is arguably the most interesting option because it gives the greatest flexibility.

You can sell these tokens and effectively exit staking. Or you can use these liquid tokens in DeFi: to provide liquidity on DEXes, earn with Yearn vaults, deposit on Aave, and more. Alternatively, you can use these liquid tokens as collateral and borrow other tokens.

ETH staking platforms with liquid tokens

There are many different ETH staking platforms and it’s important to do your own research. Below are three different liquid staking platforms based on smart contracts.

Lido staked ETH

Lido is a set of staking protocols on several networks, most importantly on Ethereum.

When you deposit ETH into Lido’s smart contract, you get stETH, an ERC-20 token that represents your staked ETH, rewards, and any penalties. This token is freely transferable and you can use it in any DeFi application. Besides, ETH you can also stake MATIC with Lido.

Lido applies a 10% fee on all rewards. The fee is split between the node operators, the Lido DAO, and a coverage fund for any slashings.

Lido relies on a curated list of node operators, which includes mostly large operators.

Finally, stETH is by far the largest liquid-staked ETH token. It’s widely used in DeFi applications:

- Aave deposits to get interest bearing stETH (those are Aave aTokens)

- Curve pool — or you can buy the pool token via Zerion

- Yearn vault — or just buy the vault token via Zerion

Rocket Pool staking

Unlike Lido, Rocket Pool lets anyone to run a validator.

Instead of providing 32 ETH, a validator with Rocket Pool needs 16 ETH and 16 ETH worth of RPL, the Rocket Pool token. Besides earning a yield on their own ETH, validators also earn commissions and rewards in RPL. This leads to a higher yield than staking solo.

The rest of the required ETH comes from liquid stakers. Like with Lido, you can stake any amount of ETH and get a liquid staked rETH token.

Rocket Pool charges a fee of 5-20%, which is set by the protocol and goes to validators.

StakeWise staking ETH

StakeWise is a pool where anyone can apply to become a node operator.

You can deposit any amount of ETH with StakeWise and get 1:1 sETH2, the protocol’s liquid-staked ETH token.

Unlike in other protocols, the staking rewards accrue in a separate token, rETH2. The two tokens make it easier to calculate your rewards. You can also reinvest the rewards by selling them for more sETH. Both tokens can be supplied in Uniswap pools to farm SWISE, the platform’s governance token.

StakeWise charges a fee of 10%, which is split between the protocol and node operators.

To sum up, StakeWise, Lido, and Rocket Pool all work fairly similarly.

Then why do all these tokens have different prices?

That’s because tokens accrue rewards differently and have different levels of liquidity and demand from using these tokens in various DeFi applications.

As a result, all liquid staked tokens can sometimes trade below spot ETH. That’s ok. This might even be an arbitrage opportunity: once the Proof of Stake Ethereum enables withdrawals, the price difference should disappear.

The table below summarizes the differences.

Lido vs Rocket Pool vs StakeWise

| Lido | Rocket Pool | StakeWise | |

|---|---|---|---|

| Staked ETH ticker | stETH | rETH | sETH2 |

| Volume of staked ETH | ~4,600,000 | ~360,000 | ~83,000 |

| Fees | 10% | 5-20% (now 15%) | 10% |

| Rewards | Accrued in the liquid token | Accrued in the liquid token | Accrued in a separate liquid token, |

The beauty of liquid-staked ETH is that you don’t even need to go through all the steps to stake ETH — you can just buy the tokens in a few clicks.

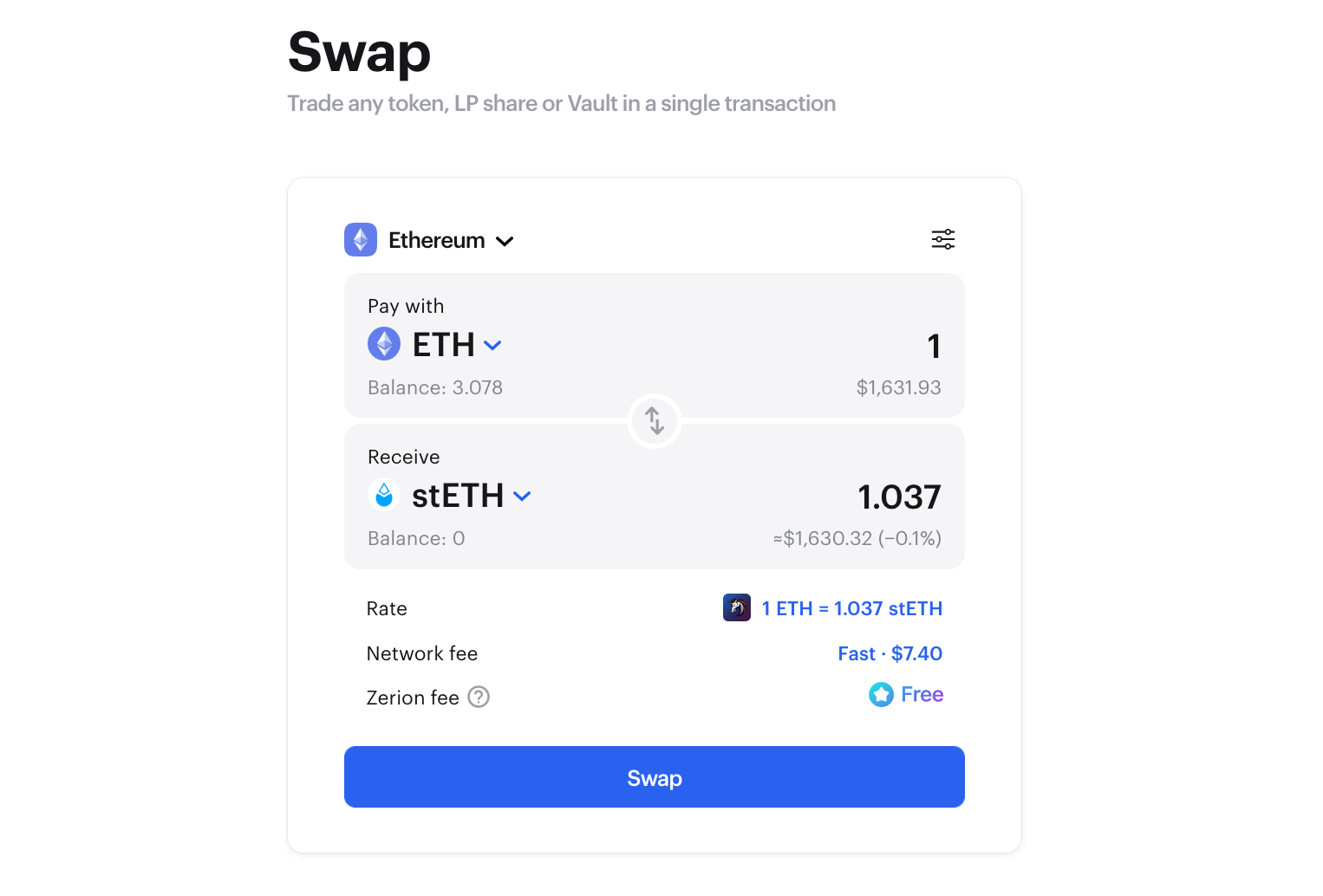

Buy staked ETH on Zerion

Zerion’s trading aggregation can help you find the best rate for any token, including the liquid staked ETH. Zerion scans all DEXes and DEX aggregators and takes into account slippage and gas costs.

- Go to Zerion’s swap tab in the web app or in your Zerion Wallet.

- Select the staked ETH token that you want to buy and the token that you want to pay with

- Zerion will scan all DEXes and DEX aggregators to find you the best rate.

- The network fee (aka gas fees) will likely be lower than staking directly with the protocol.

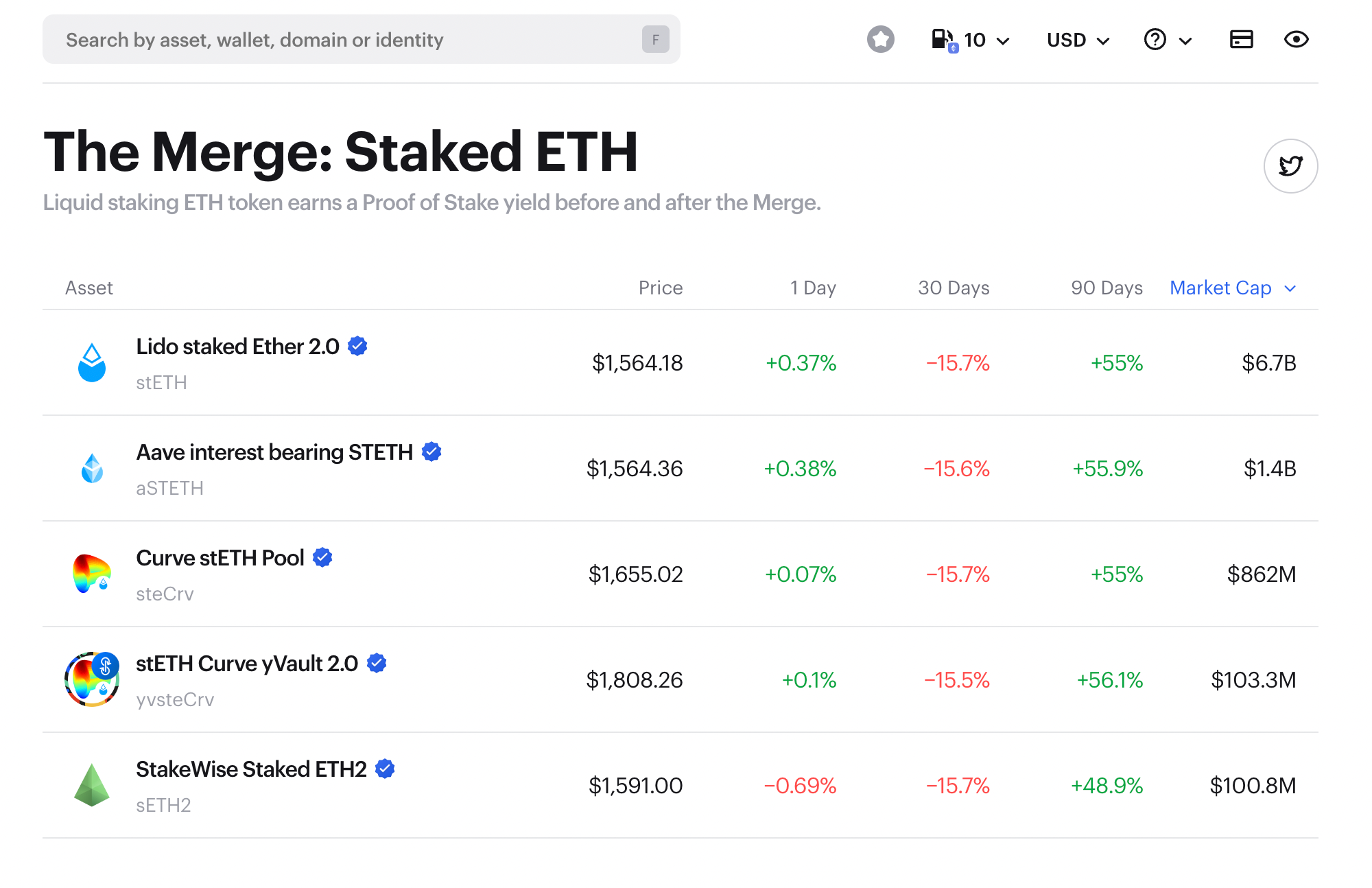

The Merge: Staked ETH Tokens

Zerion also provides a curated list of liquid-staked ETH tokens on the web and mobile app.

Simply click on this link or go to the Explore tab on the app and look for “The Merge: Staked ETH” section.

Remember, this article is intended to be used for informational and educational purposes only. It's important to always do your own research before making any investment.

FAQ

What does it mean to stake Ethereum?

To stake means to lock up 32 ETH to run a validator, earning rewards from new blocks and transactions. With liquid staking, you can stake any amount of ETH.

Is staking ETH worth it?

Staking ETH earns a varied yield of at least 4% a year. The yield is paid in ETH so if you’re calculating profits in USD or other fiat currencies, the actual yield would depend on the price of ETH. However, staking ETH is arguably the least risky source of yield in Web3.

What is the best place to stake ETH?

The best place to stake ETH depends on how much ETH you have, your skills, and your investment horizon. If you have 32 ETH, have some technical skills, and don’t plan on using that ETH for at least a year, then staking on your own would be the best option.

However, for most people, liquid staking is a better option as has lower entry requirements and gives you great flexibility.

Can staked ETH depeg?

None of the liquid-staked ETH are truly pegged to ETH. Instead, they naturally trade closely to ETH as traders understand that eventually, these tokens will be redeemable for ETH.

However, in short term, the price of liquid staked ETH tokens can move away by 20% or even more from the spot price of ETH. That could happen for example if many people want to buy or sell that token at the same time.

Can you lose money staking ETH?

When you stake ETH via your own validator (even if it’s run by a third-party service), your main risks are penalties for going offline and slashing for fraudulent transactions.

With liquid staked ETH the main risks are liquidity and smart contract exploits. Liquidity risk simply means that you might not be always able to sell the token for the price you want. Of course, there is also a risk of some undiscovered smart contract exploits or hacks.

Can I unstake ETH after the Merge?

You will not be immediately able to unstake your ETH after the Merge. Withdrawals will be enabled with Ethereum’s Shanghai update, which is expected sometime in 2023.