Wouldn't it be great if your bank account paid more than a grand total of 0% in interest?

That's what attracts a lot of people to staking in decentralized finance: you lock up crypto and gain a nice yield. But staking is more complicated than that and lots of new crypto terms often make it unfriendly to newbies.

This post will explain what staking in DeFi is and how you may use it to your advantage. We'll go through some of the big projects that provide staking, as well as the various sorts of staking. We'll also cover some primary methods for getting the most out of your decentralized finance staking or Defi staking.

What is DeFi staking and how does it work?

The idea of staking crypto is simple: you lock up (stake) your crypto assets and get more assets as a reward.

Staking is often a way to persuade holders to preserve their cryptocurrency. Instead of selling to take profits today, holders can stake and claim staking rewards tomorrow. These rewards can come from special reserves earmarked for staking programs or from issuing new tokens. Because staking rewards can often reach double or even triple-digit annual percentage yields (APY), many crypto enthusiasts view staking as far more appealing than traditional savings accounts.

While the comparison to savings accounts is not exactly correct (as we’ll see, there are more risks with staking), staking is a passive strategy. There is no need to trade or do anything else. Just stake and earn rewards.

So why would protocols and crypto projects pay staking rewards?

Originally, staking crypto emerged as an alternative to mining Proof of Work (PoW) cryptocurrencies. Without going into technical details, cryptocurrency miners secure the blockchain by locking up capital in specialized mining computers and then spending on electricity. As a reward, they get newly minted tokens.

In Proof of Stake (PoS) cryptocurrencies, there are no miners. Instead of spending money on buying and running mining equipment, anyone can run a node by staking a certain amount of cryptocurrencies. Node operators secure the blockchain and get rewards from newly issued crypto — just like miners do. Each PoS blockchain has its own rules on how exactly staking works.

Decentralized finance or DeFi staking put a new spin on staking mechanics.

In decentralized finance protocols, users can stake assets specified by the protocol and get staking rewards. But compared to traditional PoS staking, there are more moving parts. Rewards could be in the same cryptocurrency as the user staked or a new token. The APY could vary depending on the number of participants and so on.

Let’s briefly review the main types of DeFi staking.

DeFi staking types

Staking in Proof of Stake blockchains

Unlike Proof of Work consensus protocols, which require a lot of energy-intensive computing work to ensure transaction validity, PoS relies on validators who have staked crypto assets.

In other words, validators must carry out their responsibilities meticulously or risk losing a portion or possibly all of their stakes.

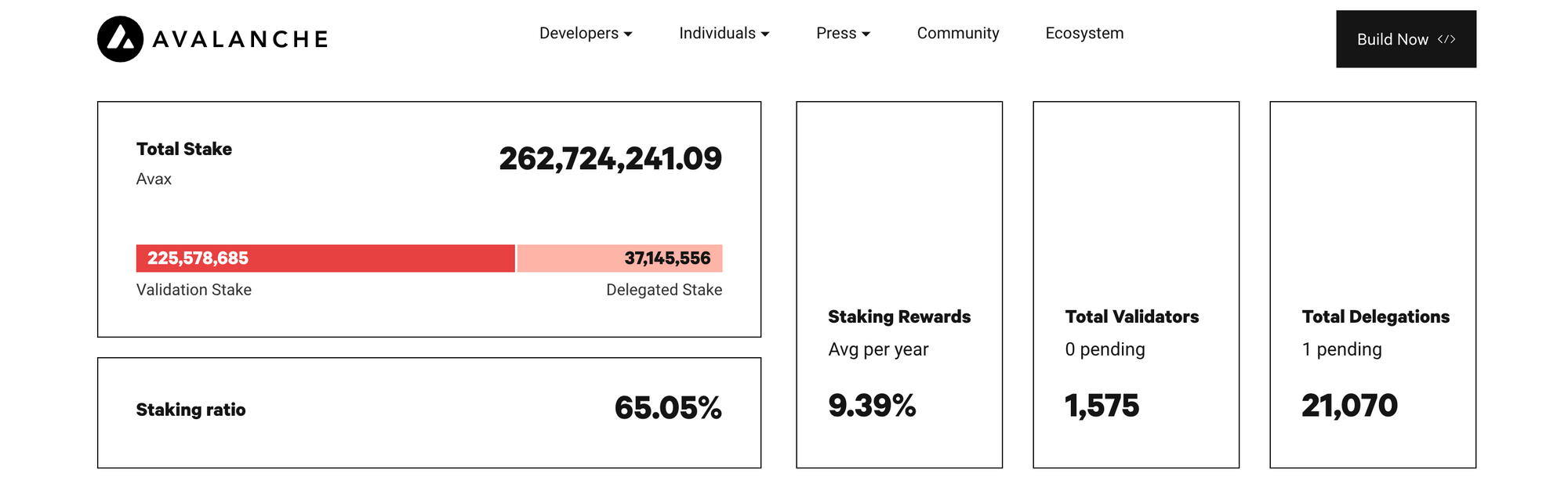

Currently, Ethereum is migrating from Proof of Work to Proof of Stake as part of its Ethereum 2.0 project. Alternative Layer-1 networks such as Avalanche, Fantom, and Solana already have different versions of the Proof of Stake algorithms.

The staking process begins with a participant submitting a stake to become a network validator, making them eligible for staking rewards. For example, to become a validator on ETH2's Beacon Chain, you must deposit 32 ETH. After that, the validator can earn ETH rewards of 5% a year or more (the exact rate depends on the number of participants).

For most small investors, 32 ETH is too much money. And even for larger investors, running a validator is too complicated as it requires specialized technical knowledge and serious time commitment.

Fortunately, decentralized staking service providers help anyone to stake ETH without the prohibitive financial and technical requirements.

With platforms like Lido and RocketPool, ETH holders can deposit any quantity of ETH into a staking pool and begin earning passive income based on the percentage of the pool's total holdings that their contribution accounts for. Specialized participants operate validators on behalf of the pool and get paid from the pool’s rewards. With Zerion, you can simply buy liquid staked tokens and start earning.

The big advantage of decentralized staking is the ability to sell staked assets.

When holders run their own validators on Eth2, they stake their ETH for an indefinite period of time until Ethereum’s Proof of Stake network launches. If holders stake ETH with Lido, they get Lido Staked ETH (STETH), which represents staked ETH and earned rewards. STETH is liquid: holders can sell them, swap on decentralized exchanges, or use in various Defi protocols.

Yield farming or liquidity mining

After reading about high yields in staking, you might be wondering, where does the yield come from?

One source of the yield is a protocol’s rewards for providing assets, also known as liquidity mining.

Liquidity mining is a staking mechanism where holders (liquidity providers) give their crypto assets to liquidity pools and receive rewards. These rewards, which often run upwards of 100% APYs, help new protocols to quickly attract liquidity.

These liquidity pools are required for trading on decentralized crypto exchanges (DEXs). Instead of using intermediaries, DEXes rely on smart contracts with auto market makers (AMM).

A typical liquidity pool consists of two assets that make up a trading pair – for example, ETH/DAI – and uses an algorithm to ensure that the value of one asset is always equal to the value of the other. This means the pool dynamically adjusts asset prices to account for changes in their values generated by trade.

In our ETH/DAI example, buying ETH reduces the amount of ETH in the pool while raising the amount of DAI. So, to compensate, the pool increases the price of ETH in comparison to DAI.

Liquidity providers are at the center of this system, making their assets available to liquidity pools. Providers of liquidity can be compensated in various ways, such as getting a percentage of the pool's trading fees.

Furthermore, many DeFi staking systems include tokens in their reward schemes. DeFi protocols, as we'll see later, need robust reward systems for liquidity providers to view staking as a profitable opportunity.

Advantages and risks of DeFi staking

Pros of DeFi staking

- Passive income: Returns can range from appealing to ridiculous, providing passive income opportunities to people with varying risk appetites.

- Low barriers to entry: Staking is straightforward and can be completed in a few simple clicks. With a tool like Zerion you can simply tokens that represent staked assets, such as Lido Staked ETH (STETH). Users do not require a large sum of money to begin.

- Environmentally friendly: Compared to Proof of Work crypto mining, staking has a smaller, even negligible environmental footprint.

- Supports the network: Staking cryptocurrency on a Proof of Stake network allows people to contribute to the blockchain's security. And staking assets in various Defi protocols increases liquidity and makes it easier to swap or borrow assets.

Cons of DeFi staking

- Hacking/cyber attack risks: Both PoS staking and staking in Defi protocols rely on smart contracts, which might have vulnerabilities that hackers can exploit.

- Price risk: There's a chance the coin's value will drop, especially if the market is turbulent. Unfortunately, when you're stuck in the staking period, you often can't sell your assets if the market falls.

- Slashing risks in PoS: Validator nodes that hold your staked tokens in Proof of Stake networks may be penalized if they do not process transactions with a 100% uptime.

- Impermanent loss: When you provide assets in a liquidity pool, you contribute with a fixed ratio. But if the price of one of the assets surges, when you withdraw assets from the liquidity pool, you’ll get fewer units of that asset. Unless trading fees and rewards cover this loss, it would have been more profitable to passively hold these two assets. This is known as impermanent loss because there is a chance that asset prices would return to the same level as when you entered the pool.

- Gas fees: On Ethereum, gas fees for interacting with Defi staking might end up being higher than the rewards you get from staking. That’s why many Defi protocols are also launching versions of their apps on Layer 2 scaling solutions. For example, Uniswap, one of the most common DeFi protocols, has recently launched on two of the most popular rollups on the market: Optimism and Arbitrum.

Where Can I stake DeFi tokens?

This depends on what DeFi tokens you want to stake.

Centralized crypto exchanges like Binance let you stake a wide range of tokens. They take care of all the complexities of interacting with smart contracts but also take hefty fees.

You can usually also stake any DeFi token on its protocol's website. For example, on the Synthetix platform, you can stake SNX and earn rewards.

Some staked DeFi tokens are also freely tradable. This means you can buy their staked versions (which earn fees or grant other benefits) right on an exchange.

That's where Zerion's trading aggregation can help. On Zerion, you can buy xSUSHI, the staked version of Sushiswap's token, as well as various versions of staked ETH. Holding these staked tokens in your non-custodial wallet like Zerion Wallet could be a nice way to generate some passive income.

How to stake DeFi

- Research cryptocurrencies that can be staked. You'll need a Proof-of-Stake coin or a DeFi token that has staking.

- Create the right crypto wallet. Some Proof-of-Stake cryptocurrencies require their own wallets. DeFi tokens on Ethereum or other EVM networks — Zerion Wallet would be the perfect fit.

- Purchase the coin you choose. You can buy your crypto on one of the centralized or decentralized exchanges (DEXs). If you prefer decentralized exchanges, then Zerion can help you find the best price across DEXs.

- Use an exchange or a pool to stake your cryptocurrency.

Bottom line

DeFi staking is gaining popularity all over the world.

As a result, more platforms and protocols now offer this feature, resulting in healthy competition and innovation. Some companies choose a multi-tiered compensation system, while others focus on cross-chain support. Both ideas are sound, but merging the best of both worlds will be a game-changer.

Choosing decentralized finance staking over a savings account often makes sense. It has greater rewards and support for assets like stablecoins, which do not fluctuate in value.

Soon, there will be more compelling offerings to choose from as cross-chain support becomes more ingrained in these solutions. Putting your money to work in a low-risk manner is what the mainstream needs to start paying attention to cryptocurrencies.

If you're ready to stake DeFi tokens, the best way to do that is with a Zerion Wallet, which will help you track all your positions.

Try Zerion Wallet

FAQ

What is DeFi in the crypto world?

Decentralized finance, also known as DeFi, is an alternative financial system that reimagines financial transactions by eliminating intermediaries using decentralized ledger technology, particularly Ethereum. DeFi's smart contracts, which carry out financial transactions under certain conditions, enable a wide range of financial operations.

What is DeFi staking?

It is the technique of locking crypto assets into a smart contract in exchange for becoming a validator in a DeFi protocol or a Layer 1 blockchain and collecting rewards.

Is DeFi staking worth it?

Staking is could as rewarding as crypto mining or trading, but it also comes with risks.

How much do you earn from DeFi staking?

The main benefit of staking is that it allows you to earn additional crypto with a reasonably high yield. In some cases, you may be able to make more than 10% or 20% per year. Some DeFi protocols can offer even higher yields although there are always higher risks as well.

Is DeFi staking safe?

There's a chance you'll lose your money and pledged assets. It might happen due to smart contract bugs, exploits, or fraud. Only invest what you are prepared to lose.

How is DeFi staking calculated?

Staking calculators are used to compute staking rewards. Typically, the estimate is based on the interest accrued over some time. However, the staking yield is usually not fixed and can fluctuate with supply and demand.

Can you lose money staking in DeFi?

When you stake crypto, you can lose money. There are no risk-free investments and staking is not an exception.